Memecoins’ rise and fall over the years – Why the hype has faded

- Memecoins have experienced multiple peaks and corrections from mid-2022 to 2025, but their overall trend has been downward.

- The Coin Performance chart reinforces the decline of memecoin dominance, highlighting steep corrections.

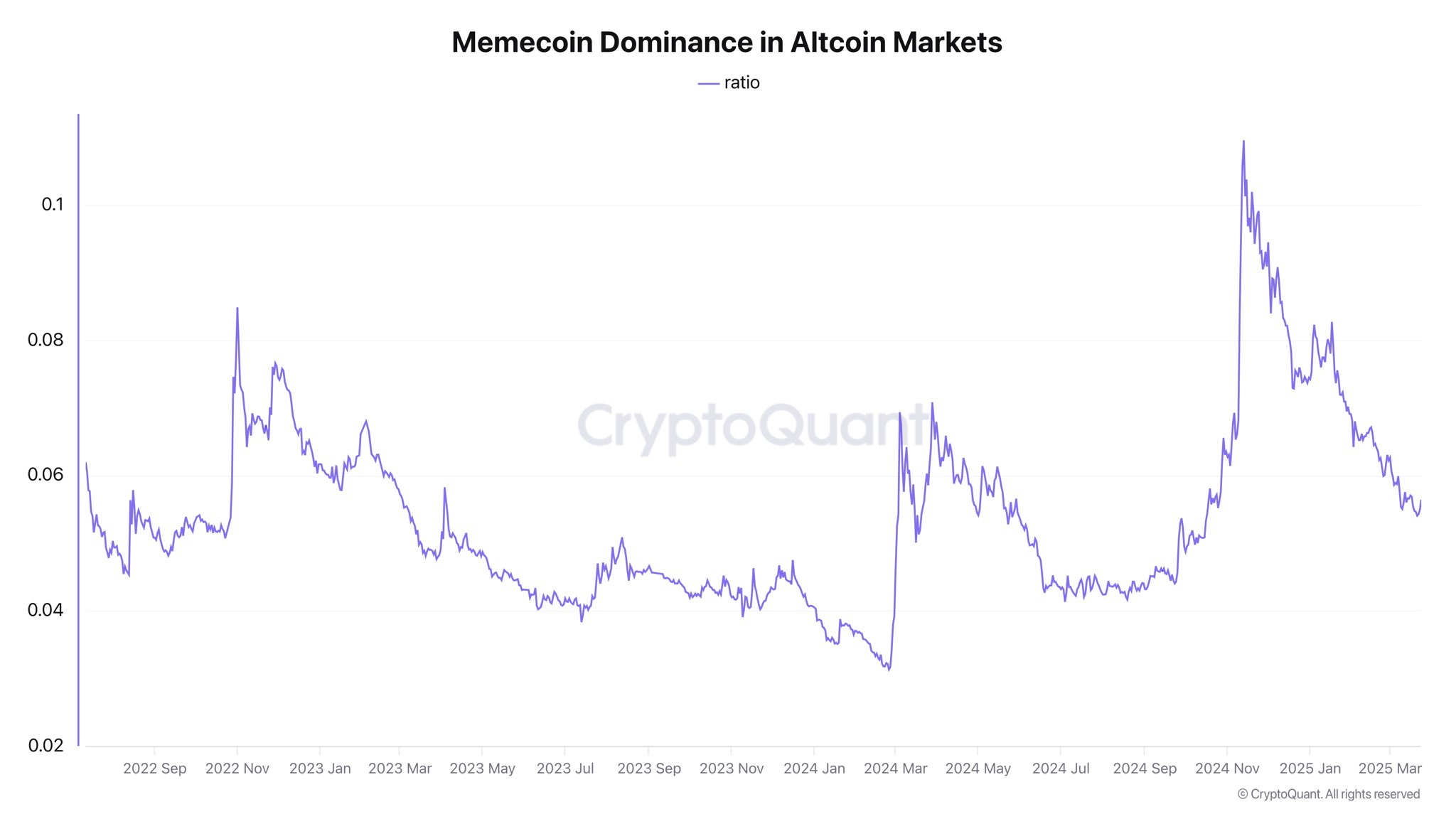

Memecoins have experienced multiple peaks and corrections from mid-2022 to 2025, but their overall trend has been downward.

In mid-2022, memecoin dominance hovered around 0.02 before spiking briefly to 0.08 in late 2022, likely due to a short-lived speculative frenzy.

This surge, however, was unsustainable, and by early 2023, dominance corrected to 0.04. Throughout 2023, the market remained volatile but trended downward, stabilizing between 0.03 and 0.04.

A notable drop in late 2023 pushed dominance back to 0.02, signaling growing investor disinterest.

Early 2024 saw a temporary resurgence, with dominance rising to 0.06 by mid-year. However, this rally quickly lost momentum.

From December 2024 onward, a sharp decline became evident, with memecoin dominance plummeting to 0.02 and remaining stagnant into March 2025.

This persistent downtrend confirms that memecoins are underperforming relative to the broader altcoin market.

The absence of a reversal pattern indicates that memecoins have continued to lose traction, with no signs of a renewed bullish cycle.

Memecoins performance breakdown

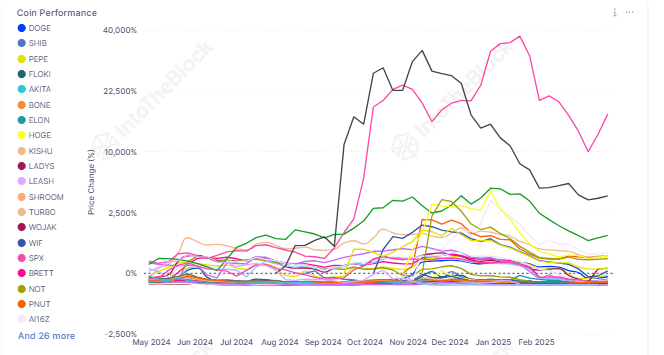

The Coin Performance chart reinforces the decline of memecoin dominance, highlighting steep corrections in major tokens like Dogecoin [DOGE] and Shiba Inu [SHIB].

DOGE peaked with a staggering 40,000% price increase in late 2024, while SHIB surged to around 22,500%. However, the euphoria faded quickly.

By February 2025, DOGE retraced to 10,000%, and SHIB dropped to just 5,000%.

Other memecoins, such as PEPE and FLOKI, mirrored this trend, erasing previous gains and hovering near 0% or even negative returns.

Further data confirms the end of the memecoin season, as none of these assets have shown recovery signals. Unlike past cycles, where speculative hype fueled rebounds, memecoins now face an increasingly skeptical market.

The sector’s poor performance against the broader altcoin space underscores the fading relevance of meme-driven tokens in a maturing crypto market.

Key drivers behind the decline

Finally, several factors have contributed to the decline of memecoins, making a resurgence unlikely. The “Coin Performance” chart reveals the sharp downturn in leading memecoins, aligning with a broader shift in market sentiment.

Web discussions highlight oversaturation, with an influx of new memecoins flooding the market, diluting interest in individual projects.

Meanwhile, trading volume on platforms like Pump.fun has plummeted by 94% since January 2025, confirming waning speculative interest.

Furthermore, regulatory scrutiny has further dampened enthusiasm for memecoins. Unlike utility-driven assets such as AI and DeFi tokens, which offer tangible use cases, memecoins rely heavily on market hype.

Also, institutional and retail investors are shifting toward projects with strong fundamentals, leaving memecoinsbehind.

Additionally, memecoin market capitalization has fallen by 30% in 2025 alone, reinforcing the sector’s decline.