Michael Saylor buys Bitcoin again: How will this help BTC?

- Michael Saylor has invested in BTC yet again.

- Bullish sentiment around Bitcoin remained high at press time.

Even while Bitcoin [BTC] was trading below $30,000, Michael Saylor was one of BTC’s loudest and largest proponents.

As time passed, BTC’s price rallied way past the $30,000 mark. However, Saylor’s stance remained the same.

Bullish sentiment persists

According to data from Lookonchain, from the 26th of February to the 10th of March, Michael Saylor’s company, MicroStrategy acquired 12K BTC, totaling $821.72 million, at an average price of $68,477.

At the time of writing, MicroStrategy’s total Bitcoin holdings stood at 205,000 BTC, equivalent to $9.9 billion, with an average acquisition cost of $33,706.

Based on current market prices, the accrued profit from these investments could amount to an impressive $7.9 billion.

The funding for this acquisition came from the $782 million generated through its recent convertible debt offering.

For context, convertible notes are a form of debt that can be converted into equity at a later stage, commonly used by companies to raise capital without immediately determining their valuation.

At press time, MicroStrategy had outpaced the financial giant BlackRock in terms of Bitcoin holdings on its balance sheet with its recent acquisition.

At the time of writing, BlackRock possessed 195,985.31 Bitcoins through its IBIT iShares Bitcoin Trust, which was lower than MicroStrategy’s holdings.

Examining the status of Bitcoin ETFs, the Assets Under Management (AUM) for GBTC has returned to around $28 billion, reaching pre-ETF levels, driven by the appreciation in Bitcoin’s price.

Significant outflows persisted from GBTC, suggesting that investors may be hesitating on the sidelines, anticipating a resolution or a decline in BTC prices before re-engaging.

How is Bitcoin doing?

At press time, BTC was trading at $$71,899.41, with its price having grown by 2.69% in the last 24 hours. Traders remained positive around BTC as its put-to-call ratio declined significantly from 0.50 to 0.46.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated that the number of bullish bets taken in favor of Bitcoin had outnumbered the bearish ones over the last few weeks.

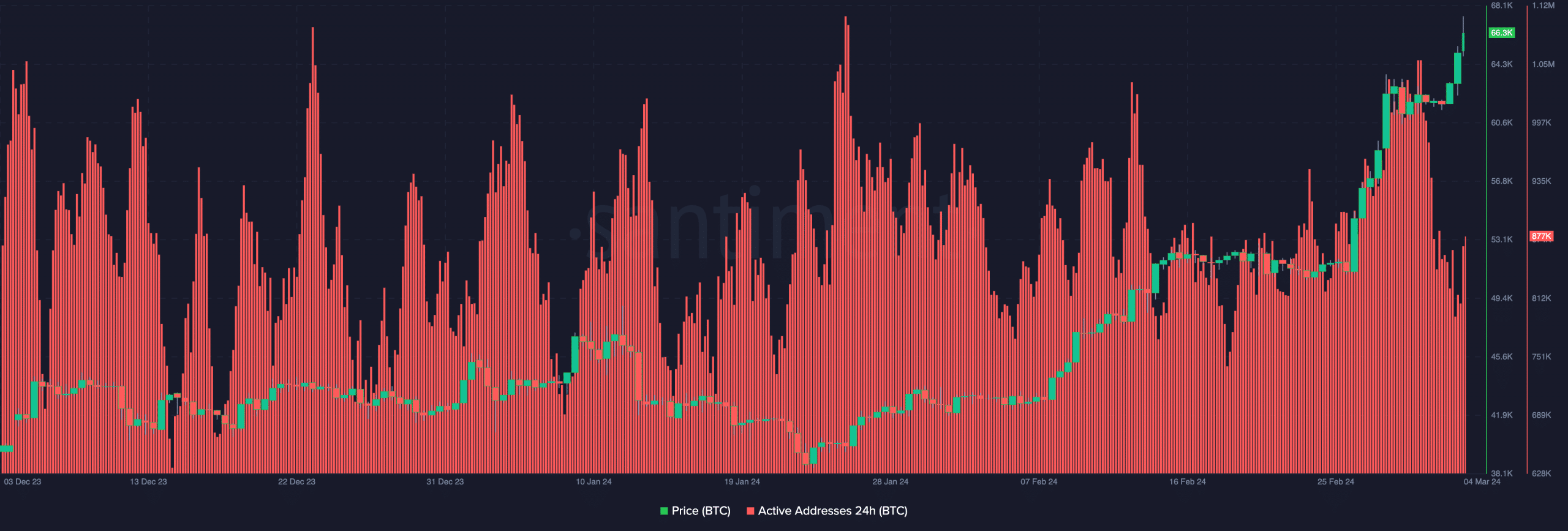

Despite all the bullish sentiment around Bitcoin, there was a dip in activity observed on the Bitcoin network over the last few days. This decline in activity could hinder the potential for BTC’s growth, moving forward.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)