Michael Saylor sells $216M in MicroStrategy shares for more Bitcoin

- Michael Saylor sold $216 million in MSTR shares.

- MicroStrategy’s commitment to Bitcoin remained unwavering.

MicroStrategy’s CEO and Bitcoin [BTC] advocate, Michael Saylor, recently undertook a surprising move that caught the attention of the cryptocurrency community.

Saylor, who has been one of the largest proponents of Bitcoin and has led MicroStrategy’s aggressive strategy of accumulating BTC, sold a significant amount of company shares.

The biggest bull wants to acquire more BTC

According to a regulatory filing with the U.S. Securities and Exchange Commission, Saylor initiated the sale of $216 million worth of MicroStrategy (MSTR) shares.

The disclosed plan indicated that Saylor intended to sell 310,000 shares, which were originally awarded as stock options in 2014 and were set to expire in April 2024.

The sales plan was not a sudden decision. Notably, a couple of months ago, Saylor explained during MicroStrategy’s third-quarter earnings call that he planned to sell 5,000 shares per trading day.

This would commence on the 2nd of January and continue over four months, subject to a minimum price condition. The quarterly filing specified that he could sell up to 400,000 shares of his vested options through 26th April, 2024.

The reasoning behind the sell-off

In his statement during the earnings call, Saylor mentioned that exercising this option would allow him to address personal obligations and acquire additional Bitcoin for his personal account.

He remained optimistic about MicroStrategy’s prospects, emphasizing that his equity stake in the company would remain significant even after these sales.

The market reaction to this move was notable, with MicroStrategy’s share price experiencing a substantial decline. At the time of writing, MSTR was trading at $631.06 on the NASDAQ, marking a significant drop of 7.89% in the last 24 hours.

However, despite the short-term market reaction and possible bearish sentiment, the bigger picture highlights MicroStrategy’s unwavering commitment to Bitcoin.

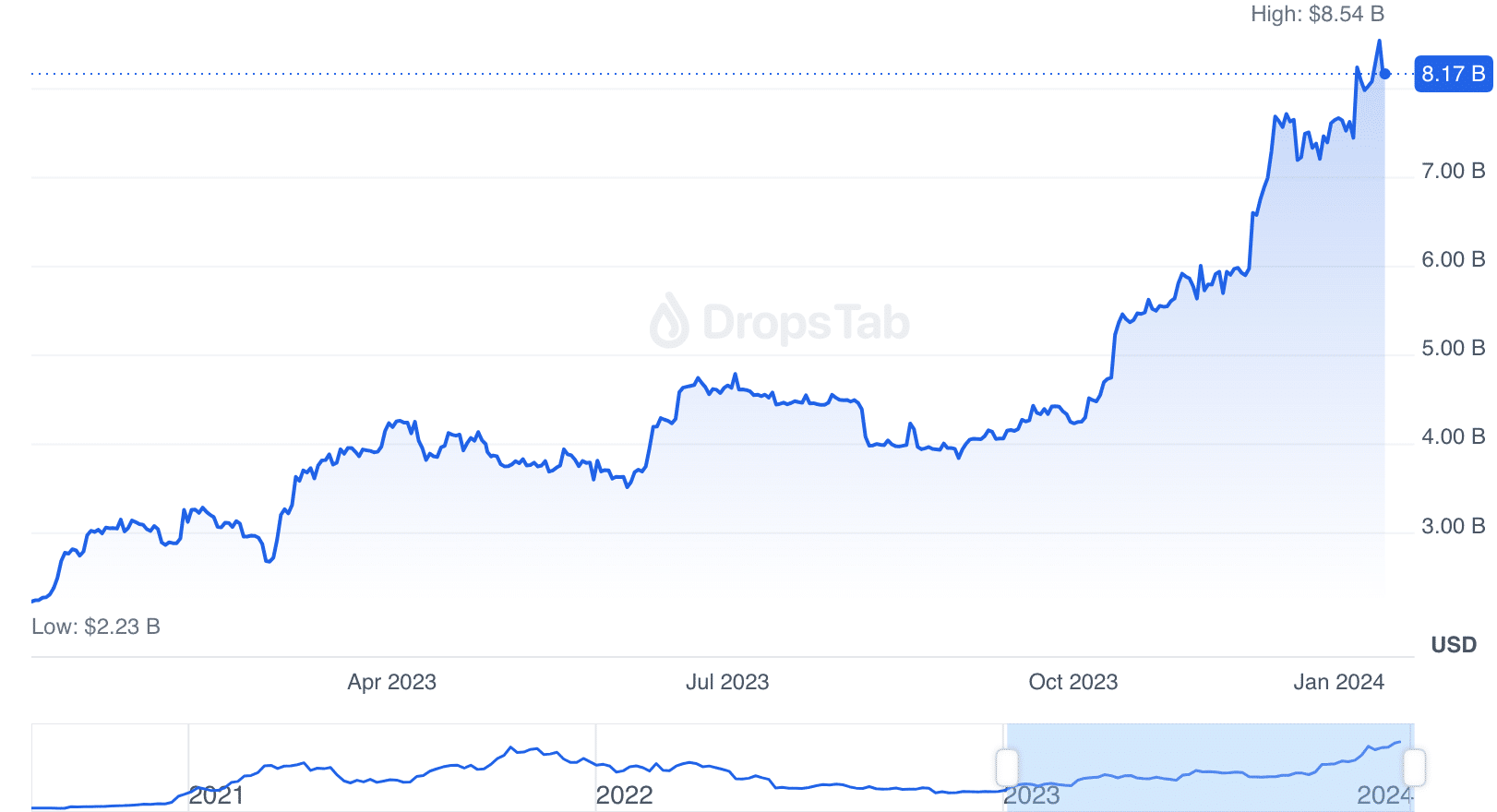

The company held 189,150 BTC, valued at over $8.14 billion, at press time. Notably, despite market fluctuations, MicroStrategy’s Bitcoin holdings remained profitable by $5,334,968.00.

Is your portfolio green? Check out the BTC Profit Calculator

The strategic approach of MicroStrategy to accumulate and hold substantial amounts of Bitcoin reflected a bullish long-term perspective on the cryptocurrency.

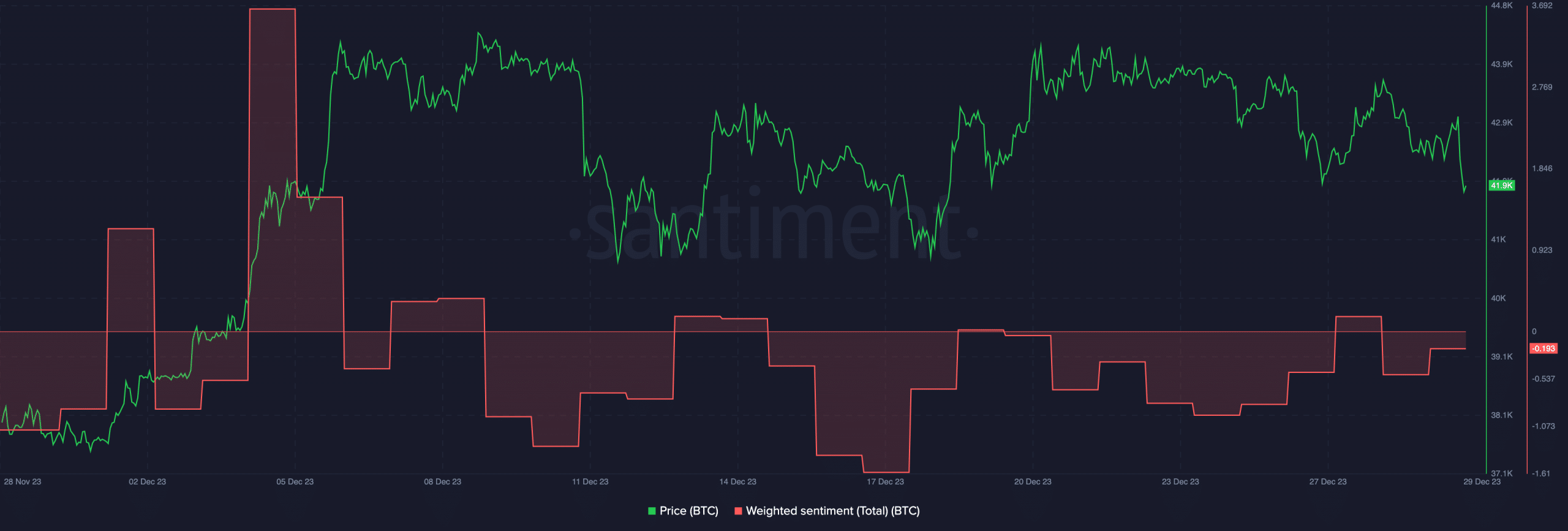

At press time, BTC was trading at $42,544.09, and sentiment around it had slightly taken a hit.

EDIT: The headline previously read “Michael Saylor sells holdings: Should BTC holders be worried?”