Microsoft outage: How Bitcoin thrived during the global IT shutdown

- Bitcoin saw a rally as the Microsoft outage hit.

- Millions of systems are still offline globally.

A few days ago, a significant global Microsoft outage disrupted numerous sectors, including traditional finance, causing widespread challenges for businesses and services reliant on Microsoft technologies.

Interestingly, during this tumultuous period, the cryptocurrency market, including Bitcoin [BTC], operated without interruption.

Microsoft outage pauses global services

The recent Microsoft outage, triggered by a CrowdStrike software update, had widespread repercussions, notably affecting the airline and financial sectors by causing flight cancellations and service disruptions.

This incident effectively incapacitated millions of PCs globally, exposing the vulnerabilities inherent in centralized technological frameworks.

Reports indicate that the malfunction was due to a problematic update from CrowdStrike that impacted devices running the Microsoft Windows operating system.

Despite the chaos, CrowdStrike has recently announced that a significant number of affected PCs have been restored and are back online.

Crypto in good light

However, this episode also underscored the resilience and independence of decentralized technologies, such as Bitcoin and other cryptocurrencies, which continued to operate smoothly without interruption.

The stark contrast in the impact of the outage on centralized versus decentralized systems provided a real-world demonstration of the potential benefits of blockchain and similar technologies.

This has reinforced the argument for decentralized systems as a reliable alternative, especially in critical situations where traditional systems falter.

How Bitcoin reacted to the outage

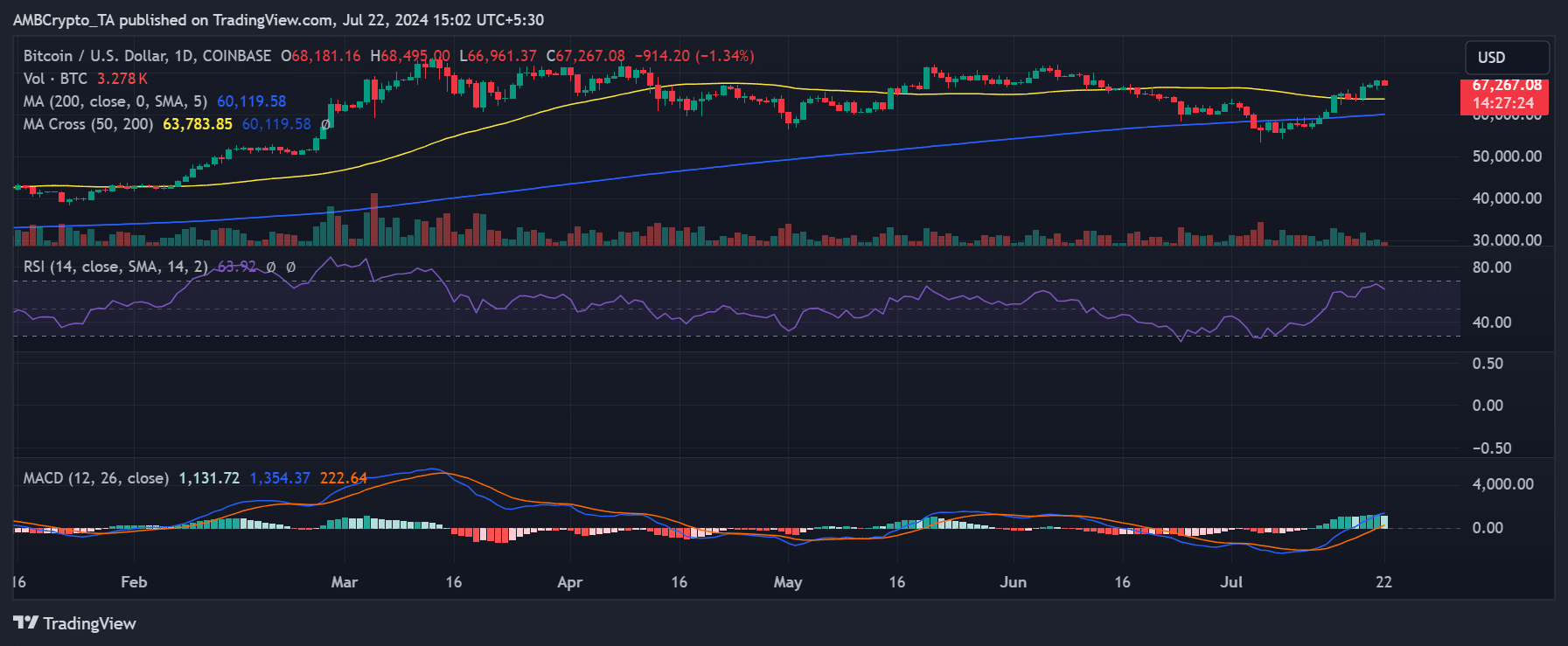

The Microsoft outage on the 19th of July coincided with a notable increase in Bitcoin’s price, as analyzed by AMBCrypto. On that day, Bitcoin surged by over 4%, reaching around $66,700, a level it had not tested in several weeks.

This timing is interesting, as it suggests that during times of uncertainty or failure in traditional, centralized tech infrastructures, investors might turn to decentralized alternatives like Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The positive momentum didn’t stop on the day of the outage; Bitcoin continued its upward trajectory. By the 21st of July, the price had climbed further, exceeding $68,000—an increase of over 1% from the earlier spike.

This continued rise may reflect a growing perception of Bitcoin as a ‘safe haven’ or a more reliable alternative during tech disruptions that affect traditional financial systems and services.