MicroStrategy’s Q2 earnings: Will its Bitcoin bet finally pay off?

- MicroStrategy to release Q2 earnings report.

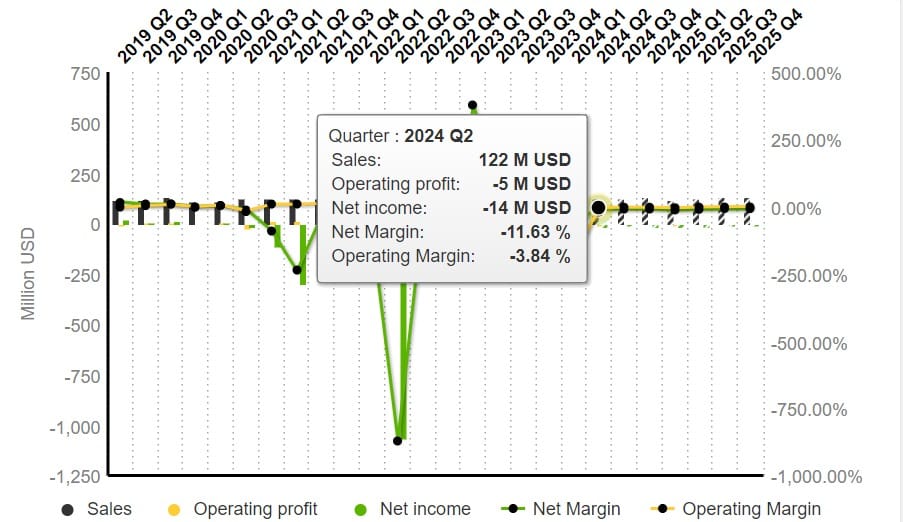

- Preview shows uncertainty and decline in net profit.

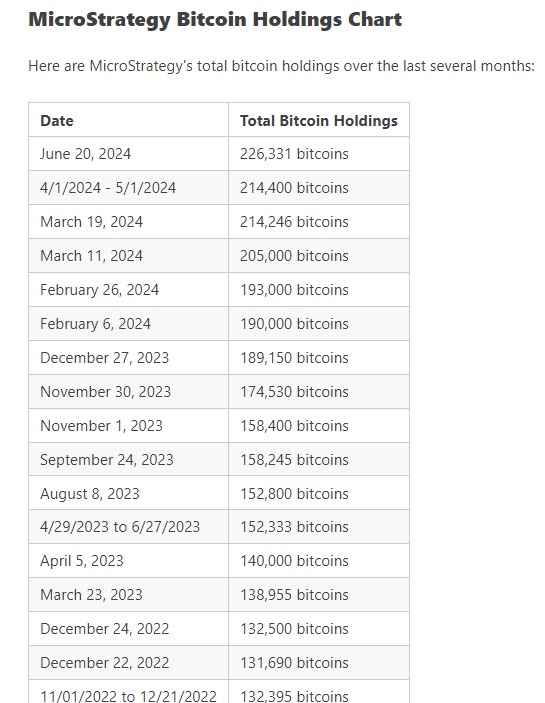

Over the past four years, MicroStrategy has been actively accumulating to increase it holdings and subsequent stock value.

Over the past, MicroStrategy has made Bitcoin [BTC] purchases every month except in July, 2024 and September, 2020. This accumulation has pushed the company to become the largest corporate BTC holder in the world.

After BTC experienced an extremely volatile few months, MicroStrategy is expected to report its earnings on 1st August 2024 for Q2. With the awaited Q2 earnings report, there’s heightened speculation over the true financial status of MicroStrategy and its future.

MicroStrategy is all about Macrostrategy

The amount of Bitcoin it holds makes MSTR a valuable and attractive company for investors. In all its operations, MSTR has acquired 226,331 BTC tokens accumulated over the past four years.

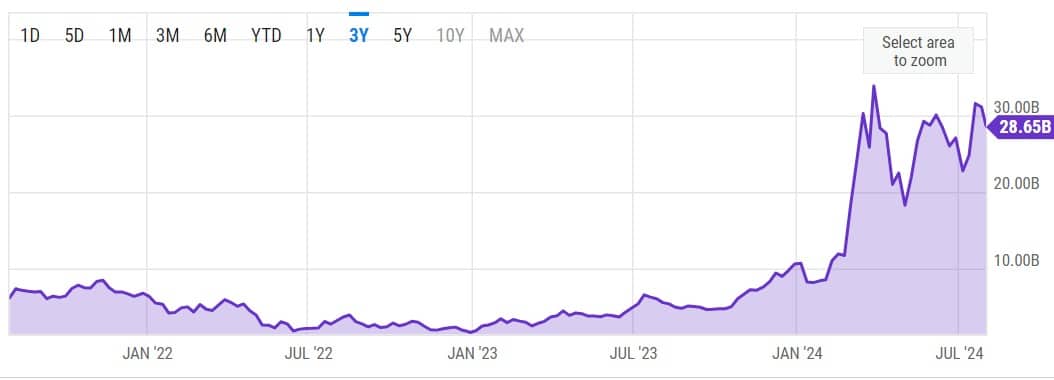

This BTC holding makes a compelling case for MSTR to drive its market cap to $28.65 billion, a significant rise from $9 billion a year ago.

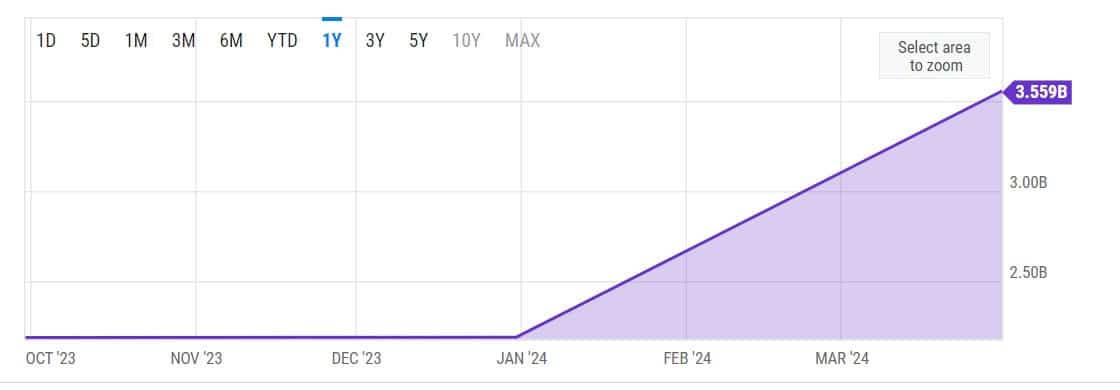

However, MicroStrategy accumulates its holdings through long-term, low interest and share insurance. According to the Q1 2024 earning reports, the company has long-term liabilities of $3.5 billion.

The liabilities are a bet on BTC that earns value against fiat that loses value over time. Although investors prefer MSTR, especially over the crypto approach, its subsidiary Macrostrategy owns most of the BTC holdings.

Therefore, MicroStrategy purchases BTC but transfers most of the holdings to Macrostrategy. According to a previous report, Macrostrategy holds the most BTC with 175,721 BTC tokens, while MicroStrategy holds only 38,679 BTC tokens.

This approach gives investors an illusion that MicroStrategy holds most BTC while it doesn’t. This is a huge risk to creditors, especially if the company goes bankrupt. Such may happen because Macrostrategy is shielded from recourse if its parent firm, MicroStrategy, goes bankrupt.

This implies that equity holders only have assets held by the parent firm. In case of bankruptcy, creditors cannot claim BTC held by Macrostrategy, although it holds most of MicroStrategy’s BTC holdings.

This shows how little BTC is held by MicroStrategy, and in the event of liquidation, creditors would suffer massive losses.

Q2 earnings: What to expect

As of this writing, BTC was trading at $64,462 after a 2.8% decline over the past 24 hours. Thus, based on data from bitcoin treasuries, MSR holds 226331 BTC, an investment of $8.37 billion at an average of $36,990.

Therefore, based on the current rates, MSR investment has gained over $6 billion with over 70% in gains.

With these gains, the firm is expected to report a higher revenue this fiscal year than the previous year with $122 million against $115 million.

MicroStrategy’s case for BTC

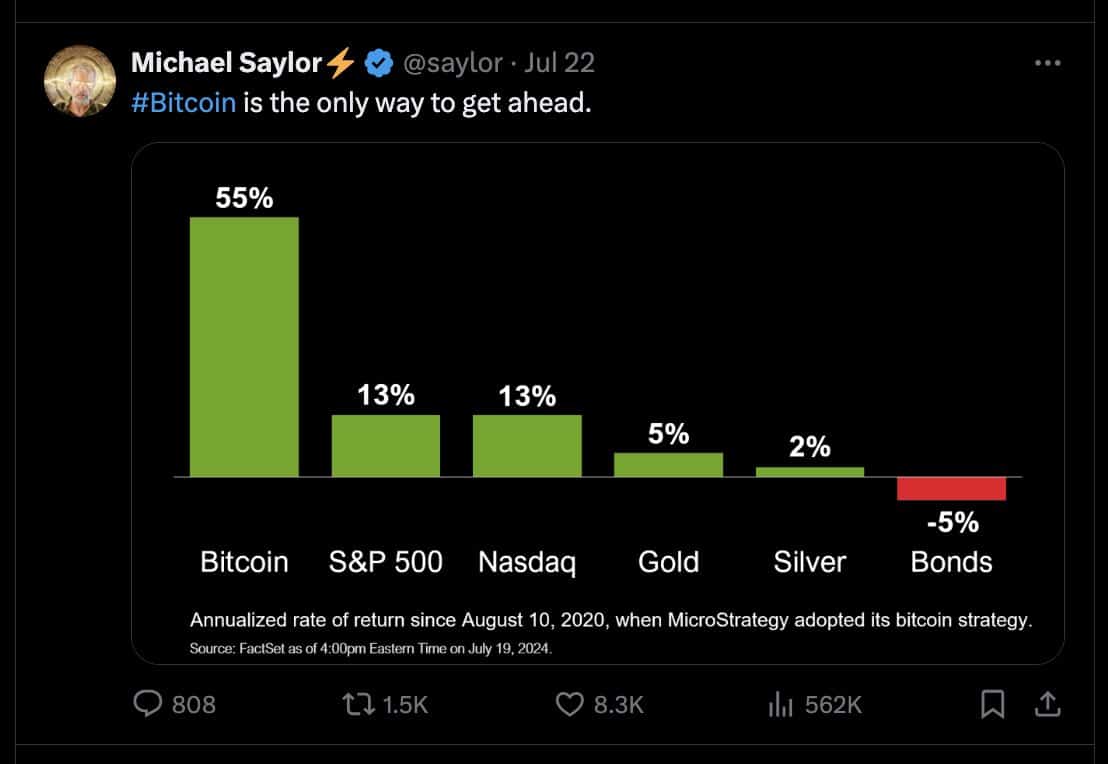

Despite the prevailing concerns, MicroStrategy has big expectations for BTC. Michael Saylor, the Chairman, predicts BTC will hit $13 million in 2045.

According to the firm’s projection, the BTC market cap will surge to $273 trillion, surpassing Gold and all major companies. In such a scenario, Microstrategy’s portfolio would hit $3 trillion from $8 billion initial investments.