Bitcoin miners ‘punishing’ BTC? Analysts point fingers as crypto slides below $66K

- Analysts reveal divergent views on the current miner profitability crisis.

- One camp deems the crisis as a ‘market top’ while others time it as a ‘buy signal’

After last week’s Fed decision, Bitcoin [BTC] seems to be facing another troubling factor influencing its price—miners.

The largest digital asset dropped below $70K after the Fed failed to cut interest rates in June, contrary to what the market initially expected.

Fast-forward to the new week. As of press time, BTC struggled to hold above $65K due to what market analysts claimed could be headwinds from Bitcoin miners.

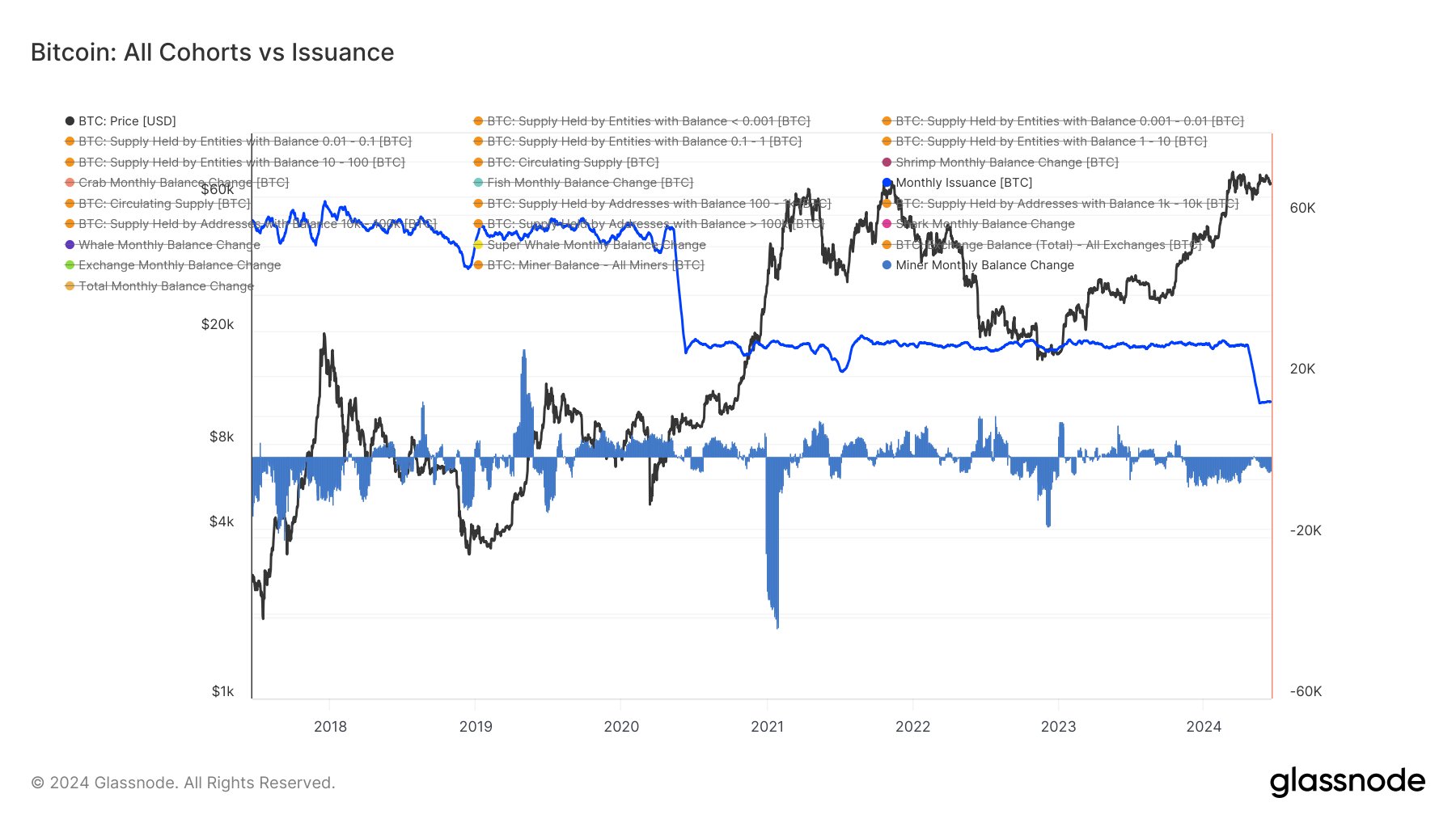

According to James Van Straten, a renowned on-chain analyst, BTC miners have sold over 30,000 BTC of their reserves since last October.

‘Miner addresses collectively hold a substantial treasury of 700,000 BTC, but their balance has decreased by 30,000 BTC since October. This period marks the longest distribution phase for miners since 2017, adding to headwinds’

Put differently, miners, especially ineffective ones after the April halving event, are selling their holdings to cover expenses and possibly exit the sector due to profitability issues.

Should you sell or buy BTC?

The profitability crisis of miners, known as miner capitulation, has been ongoing for the past 33 days. Thus, the selling pressure from miners could be one of the factors weighing on the BTC price at the moment.

Some miners have diversified into AI computing to remain profitable after the halving event in April.

However, Quinn Thompson, CIO of crypto hedge fund Lekker Capital, viewed the ongoing miner crisis as a ‘top indicator for crypto’ and worse than the miner crisis in the 2022 crypto winter.

“What is a better top indicator for crypto than all BTC miners getting indiscriminately bid up on the coattails of AI and $NVDA?”

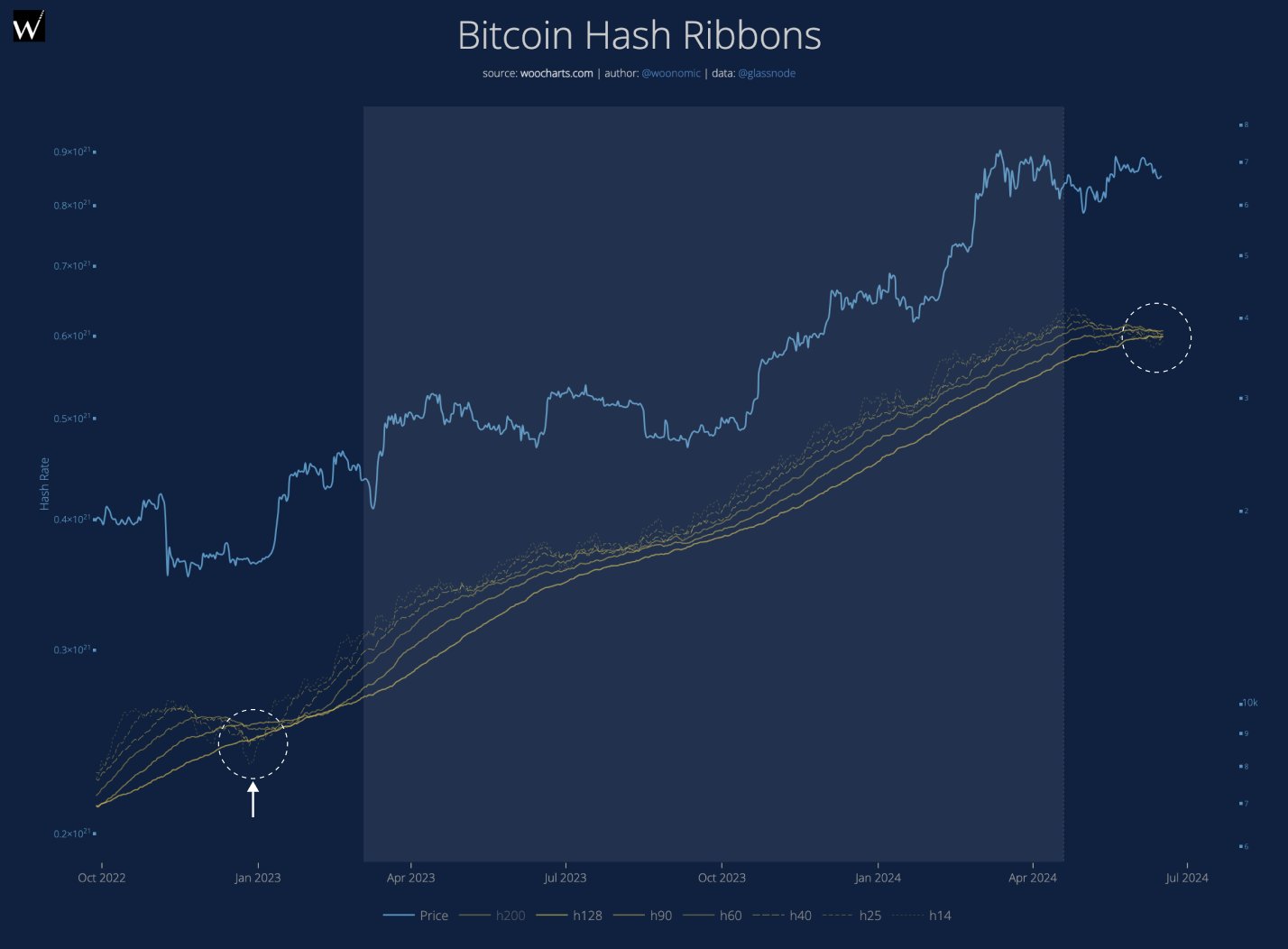

Another user and analyst, Willy Woo, stated that the BTC price would be “punished” until the hashrate improves.

“Bitcoin price will continue to be punished until the hash market picks up some volume. This is why bankers used to call it drug money.”

Hashrate, the computing power to mine a BTC, declined significantly after halving in April and later in May, per Blockchain data.

Like Woo, another analyst, Cole Garner, stated that a BTC buy signal was imminent if the hashrate recovered.

“When hashrate reverts, Hash Ribbons will print one of the most historically reliable #bitcoin buy signals ever seen. And we’re close to that signal.”

Hash Ribbons are moving averages that track hashrate downtrends and typically signal buy signals.

That said, while Thompson deemed the miner crisis a “market top indicator,” others timed it as a potential buy signal.

Besides, BTC’s value has typically stayed near its average mining cost, which hit $86K, and could push the king coin to hit the target soon enough.