MKR, COMP lead DeFi revival against rough patch

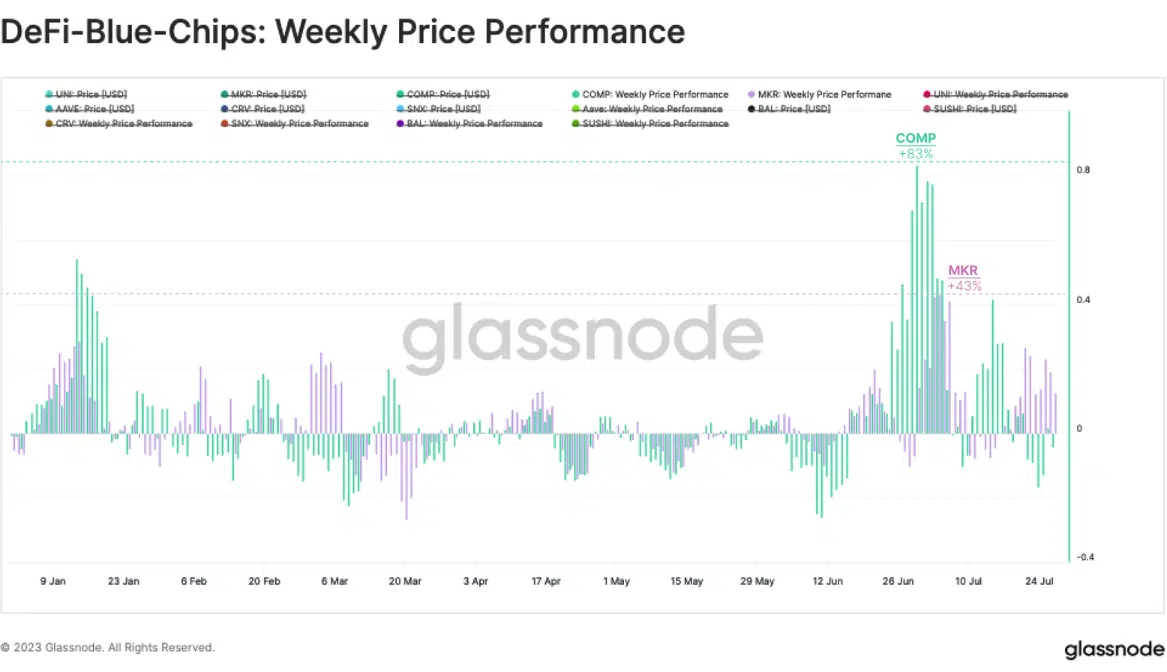

- MKR increased by 43% while COMP surged by 83%.

- Bot trades on Uniswap increased but token prices have now tanked.

The Decentralized Finance (DeFi) market experienced a rollercoaster journey since June with several projects facing tough times amid regulatory heat and challenges. However, this turbulence seems to have taken a back seat with altcoins, led by MakerDAO [MKR] and Compound Finance [COMP], emerging as key players leading the recovery.

Realistic or not, here’s COMP’s market cap in MKR terms

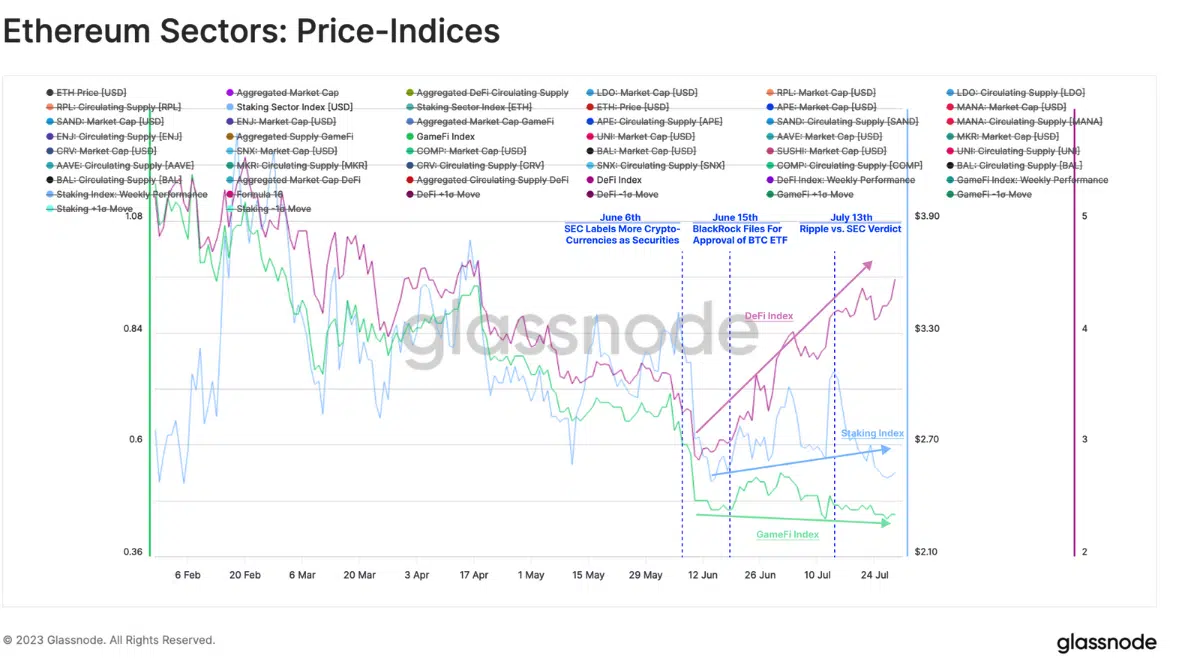

According to Galssnode weekly insight, interest in DeFi tokens spiked after a number of them put up tremendously poor performances. An undeniable reason for the previous decline in DeFi token prices was the SEC memo where about 68 tokens were called unregistered securities.

Also, Ripple’s [XRP] partial win over the U.S. SEC shifted focus and dominance from Bitcoin [BTC]. This triggered an interest in altcoin, DeFi tokens inclusive.

New developments trigger the rise

Between 12 June and 24 July, Glassnode revealed that the DeFi price index rallied by 56%. For context, the DeFi price index considers the performance of the top eight tokens by market capitalization.

Following the uptick registered, Glassnote noted that,

“This is the first outperformance since September 2022, and with very similar performance thus far.”

But as was mentioned above, the overall hike in value would have been impossible without the input of MKR and COMP. And the rise in the value of these tokens was not just random rallies.

For MKR, the introduction of its Smart Burn Engine was the catalyst needed for an uptick. In June, MakerDAO deployed the MKR Smart Burn Engine contracts on-chain. The engine is a smart contract system designed to allocate excess of its stablecoin DAI while increasing the on-chain liquidity of MKR over time.

Due to the prospect of removing $7 million worth of MKR while increasing demand, the token surged by 43% in one week.

COMP, on the other hand, had the launch of the Superstate project to thank for its 83% hike. On 28 June, Compound’s founder Robert Leshner revealed that it was launching Superstate to bridge the gap between traditional finance and crypto-native assets.

DEX volume dominates, but now…

Well, apart from the strides of MKR and COMP, other positive developments appeared in the ecosystem. One of which was the Decentralized Exchange (DEX) flow. According to the on-chain analytic platform, DEX volume dominance rose from 3.75% to 29.25% between early June and late July.

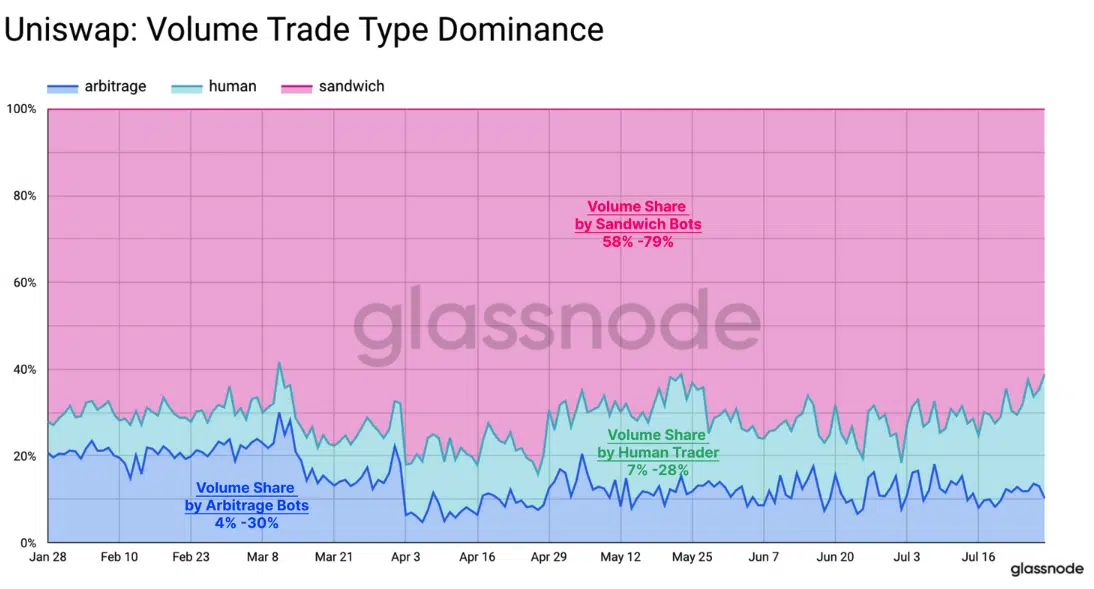

Furthermore, the rise in DEX volume could be linked to trading activity on Uniswap [UNI]. But it wasn’t primary because of the top altcoins. Instead, the presence of both human traders and Sandwich bots increased on the platform.

Is your portfolio green? Check the Compound Finance Profit Calculator

Sandwich bots are MEV-extracted bots that help in trading large buy orders and follow-up sell orders. Glassnode revealed,

“We observe that Sandwich bots generally account for more than 60% of daily volume. The volume share of Arbitrage bots has decreased from roughly 20% to 10% since the beginning of the year. Meanwhile, the share of volume created by human traders has increased up to 30% since the beginning of July, aligning with the period of increased interest in DeFi tokens”

However, the positive developments initially recorded have been subject to a downtrend following Curve Finance’s [CRV] challenges. At press time, tokens including COMP and MKR decreased by 18.19% and 3.02% in the last 24 hours.