Monero: Is a shorting opportunity presenting itself?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XMR bulls secured a range-low of $161.

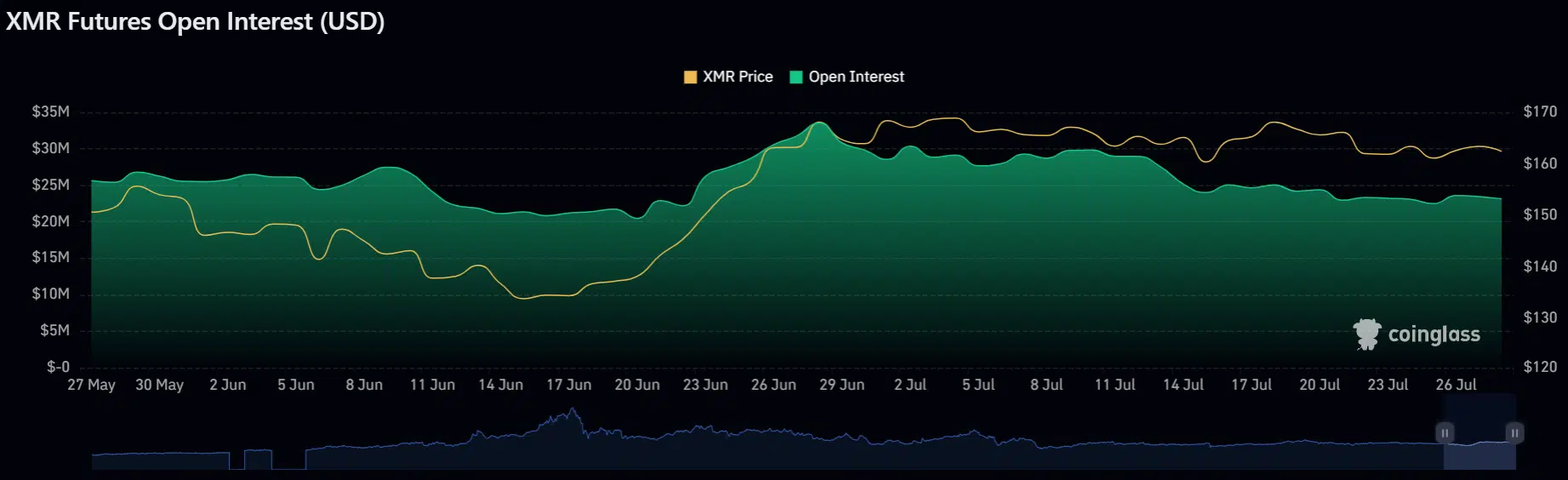

- Demand in the futures market has dropped since late June.

Since 25 July, Bitcoin [BTC] has struggled to make a candlestick session close above $29.5k on the daily chart. Altcoins picked up on this muted price performance as some retraced further, while others, like Monero [XMR], extended their price consolidation.

Read Monero’s [XMR] Price Prediction 2023-24

Monero has been consolidating between $161 and $171 since the beginning of July. But price action has been firmly restricted in the lower range, below $165 in the past seven days.

So, bears had the upper hand at press time, based on weak BTC and recent XMR price action.

Will XMR falter at mid-range?

In the last seven days, price rejections at the mid-range level of $166 saw XMR drop to a range-low of $161. A similar price rejection in mid-July saw it drop below the range-low and form a deviation before reclaiming the range-low, mid-range, and retesting the range-high.

But with the weak BTC below the range-low, XMR could falter at the mid-range. If that’s the case, another price rejection could set the altcoin to retest the range-low ($161), offering a shorting opportunity with a modest RR (Risk to Reward).

But a close above $166 (mid-range) will invalidate the above bearish thesis. Such an upswing, especially if BTC reclaims $29.5k, could set XMR to target a range-high of $171.

Meanwhile, the CMF (Chaikin Money Flow) was above the zero mark, indicating improved capital inflows for XMR. However, the RSI (Relative Strength Index) was slightly above the neutral level – emphasizing mild buying pressure at the time of writing.

Open Interest rates declined in July

How much are 1,10,100 XMRs worth today?

According to Coinglass, XMR’s Open Interest (OI) rates have declined since late June. The metric, which tracks opened contracts and overall sentiment, peaked at >$30 million in late June. After that, the OI moved southwards, reinforcing the bearish bias in July.

If the bearish bias persists and BTC remains below $29.5k, shorting opportunities could likely be at mid-range.