Bitcoin

More Bitcoin leaves exchanges as network growth continues

Bitcoin owners clutch their assets while exchanges see an exodus. New addresses flood in, hinting at patient anticipation and a bullish symphony ahead.

- BTC supply on exchanges was at an all-time low.

- The number of new addresses has, however, remained above 500,000.

Lately, it seems that individuals who own Bitcoin [BTC] are opting to retain their holdings, as there has been a rise in the withdrawal of assets from cryptocurrency exchanges. Nevertheless, the Bitcoin network has witnessed a notable influx of new addresses daily. This shift in data patterns could potentially suggest a gradual accumulation phase in preparation for the upcoming bullish market surge.

Read Bitcoin (BTC) Price Prediction 2023-24

Bitcoin outflow steps up

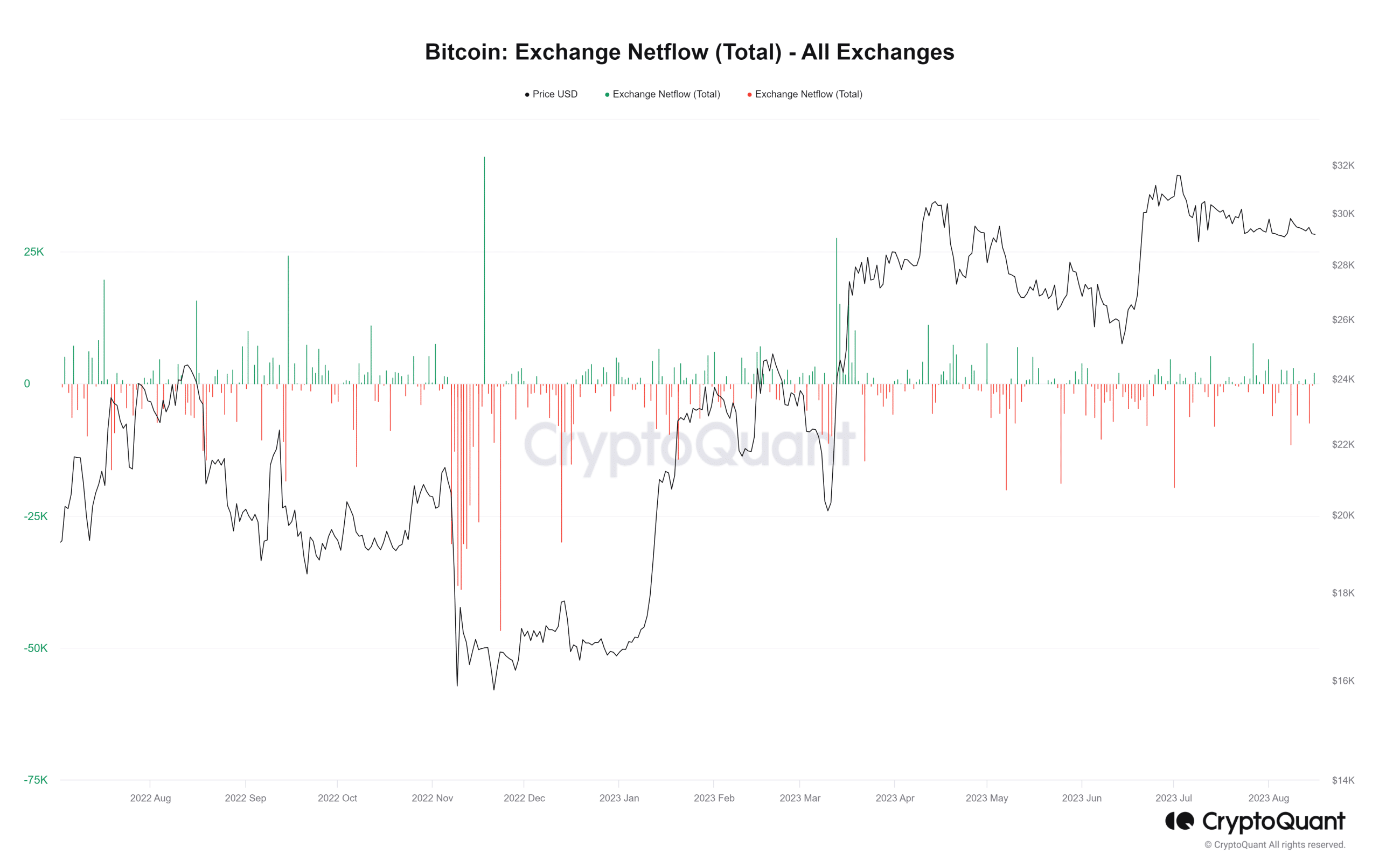

An examination of the movement of Bitcoin on various exchanges revealed a recent trend of increased BTC leaving these platforms. Based on data from the exchange netflow chart provided by CryptoQuant

, nearly 8,000 BTC were withdrawn from these exchanges between 14 and 15 August.This phenomenon suggested that holders of BTC were actively claiming ownership of their holdings, potentially reducing BTC’s availability over time. If this trend continues, it could result in a scarcity of BTC.

Consequently, the scarcity might contribute to a rise in the asset’s price due to heightened demand coupled with a limited supply of BTC to fulfill these increasing demands.

Analyzing the total Bitcoin supply on exchanges

Roughly three months ago, the aggregate amount of Bitcoin held on exchanges accounted for approximately 1.9 million units. However, an examination of the supply on exchange chart by Santiment revealed a significant downturn in this figure.

As of this writing, the quantity of BTC available on exchanges was approximately 1.2 million, signifying a reduction of about 700,000 units within this period. Additionally, this current volume represented the lowest level of BTC supply on exchanges recorded throughout the year.

This situation suggested that outflows from exchanges have influenced the amount of BTC held on these platforms. This phenomenon further reinforced the notion of a potential scarcity scenario and an associated uptick in prices for the asset.

BTC new addresses continue to trend upward

Among the various price thresholds, Bitcoin holders eagerly hope for the cryptocurrency to surpass, the $30,000 mark stands out as particularly significant. Over the past few months, BTC has faced considerable difficulty breaking through this range, encountering robust resistance.

Despite this prolonged struggle, the emergence of numerous new addresses within the network signified that enthusiasm remained undeterred.

According to data from a Glassnode chart, the count of these new addresses has exceeded 500,000 at the time of this writing. This observation highlighted that the network’s expansion has maintained its momentum even as BTC’s price has remained stagnant.

How much are 1,10,100 BTCs worth today

From these metrics, it can be deduced that many Bitcoin holders were exercising patience, anticipating an increase in BTC’s price.

Concurrently, the influx of new addresses likely indicates a desire to partake in the current price range, intending to maximize profits during the forthcoming bullish phase.