More Ethereum whales exit the market – Are they giving up?

- One of Ethereum’s top whales has dumped seven thousand tokens, making over $16 million in profits.

- Ethereum’s price has seen very minute increases; Analysts expect bulls to take control back.

Ethereum [ETH], the second-largest cryptocurrency in the world, continues struggling to regain its footing after a dramatic free-fall that sees investors holding on for dear life.

But now, it would seem that the largest holders of the token are starting to give up.

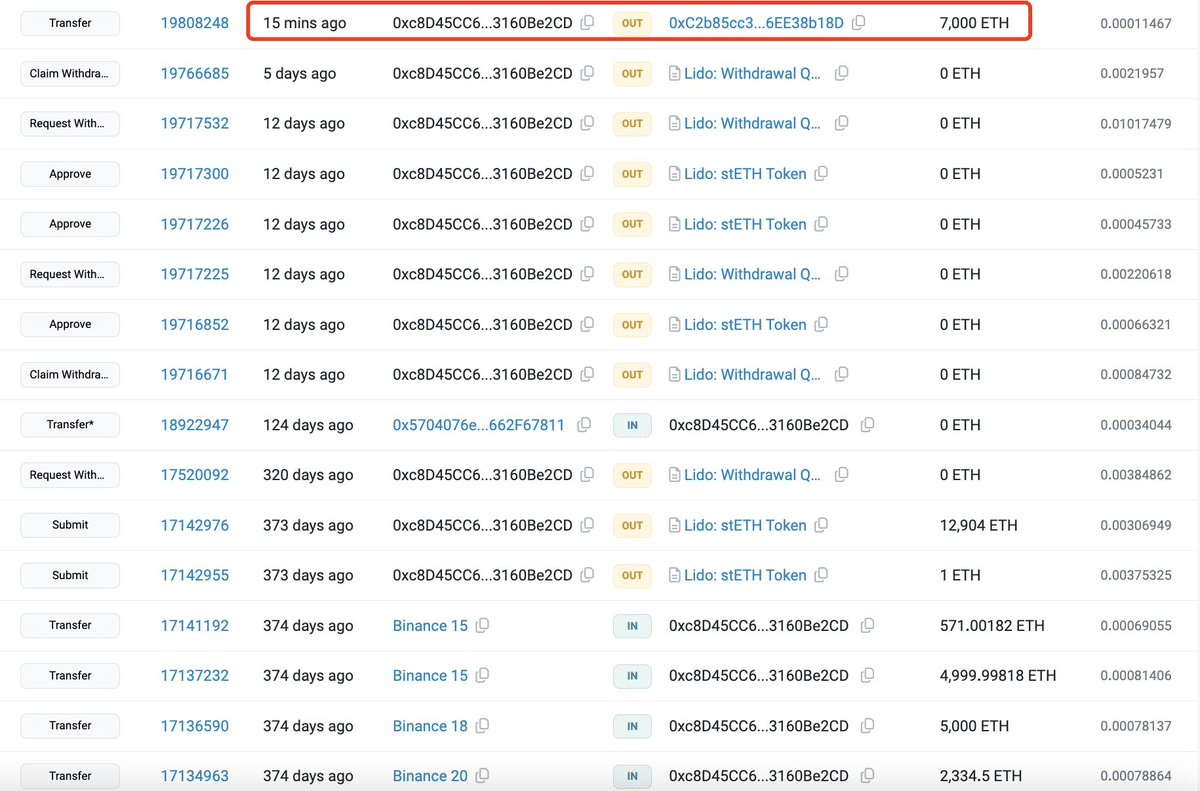

Recent data from Lookonchain showed that an Ethereum whale who bought the coin around a year ago is now selling it for profits.

The whale withdrew 12,906 ETH (which is $24 million on price levels at press time) from Binance [BNB] at $1,890 last year and deposited it into Lido [LDO].

They then withdrew 7,000 of those coins from Lido when the market crashed a little on the 30th of April and deposited it into Binance. The profit made by the whale was over $16 million.

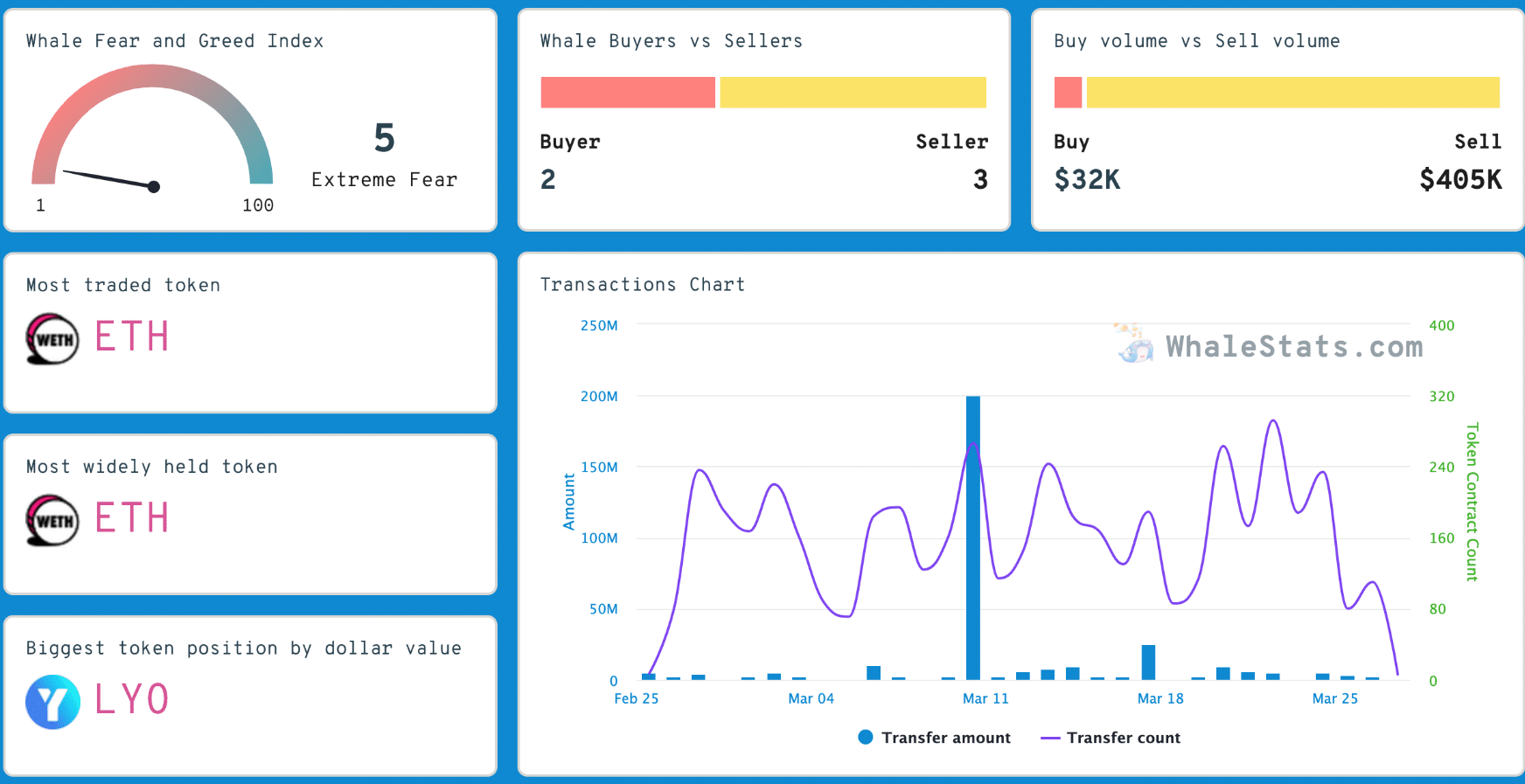

Data from WhaleStats revealed that BSC Chain Ethereum whales’ Fear and Greed Index was at extreme fear at press time.

Ether remains the most traded and held token by the whales, but they are clearly on edge, awaiting further market movements.

Ethereum’s performance in a gloomy market

Crypto markets are still in the red, reeling from the correction that came after Bitcoin hit new all-time highs, suggesting an onset of a bull run.

However, currently, the bears have the upper hand. At press time, Ethereum was worth $3,208. That is an increase of 0.02 percent over the past day and 0.8% in the past seven days.

Prominent crypto analyst Ashcrypto updated his outlook for Ether’s price.

According to him, the historical pattern from 2020 and 2021 shows that Ethereum is going to break out again in the third quarter of this year. Going by his chart, he expects Ether to hit $4,000.

Meanwhile, KEN Crypto, another popular analyst, believes that there has been a slight change in investor sentiment.

Although it is largely bearish, he asserts that there is a tiny little bullish sentiment emerging too, thanks to the coin staying above 100 Simple Moving Average (SMA).

However, despite that, Ethereum bulls are encountering major resistance, struggling to breach key higher levels.

Is your portfolio green? Check out the ETH Profit Calculator

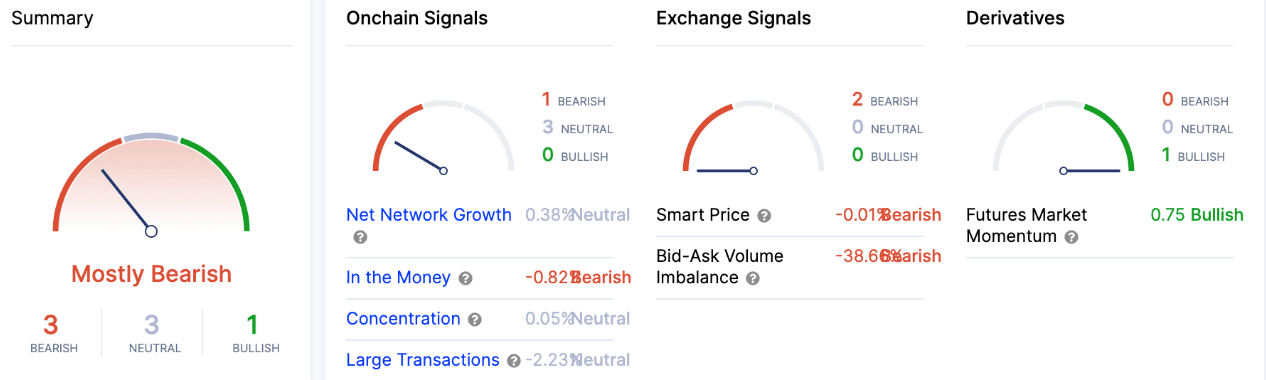

Further insights from IntoTheBlock reveal a strong link between Ethereum’s price and the volume of large transactions, showing that they greatly affect Ethereum’s price movements.

Notably, a decrease in these transactions in April corresponded with a drop in Ethereum’s price. Clearly, whales are influencing the market by increasing selling pressure.