Moving past these divergences will put Bitcoin’s ‘resilience’ to test

Bitcoin registered its largest weekly close during the middle of October, and last week, it was topped again by closing at $62,500. Over the current week, Bitcoin reached as high at $69,000 but at press time, it is currently consolidating under $64,000 yet again.

While the long-term narrative is strongly bullish right now, signs of concerns are surfacing all over on-chain fundamentals and the tide may turn in the opposite direction.

Divergences in Profit Taking and Activity?

One of the strongest sell signs is currently being illustrated by Price-Daily Active Addresses Divergences or Price-DAA. As observed, rising price action is not matched with higher active addresses. But it is important to note that it has been a trend for the better part of 2021. Regardless, it is a sign of concern that is mildly amplified when the Network Profit/Loss chart is analyzed.

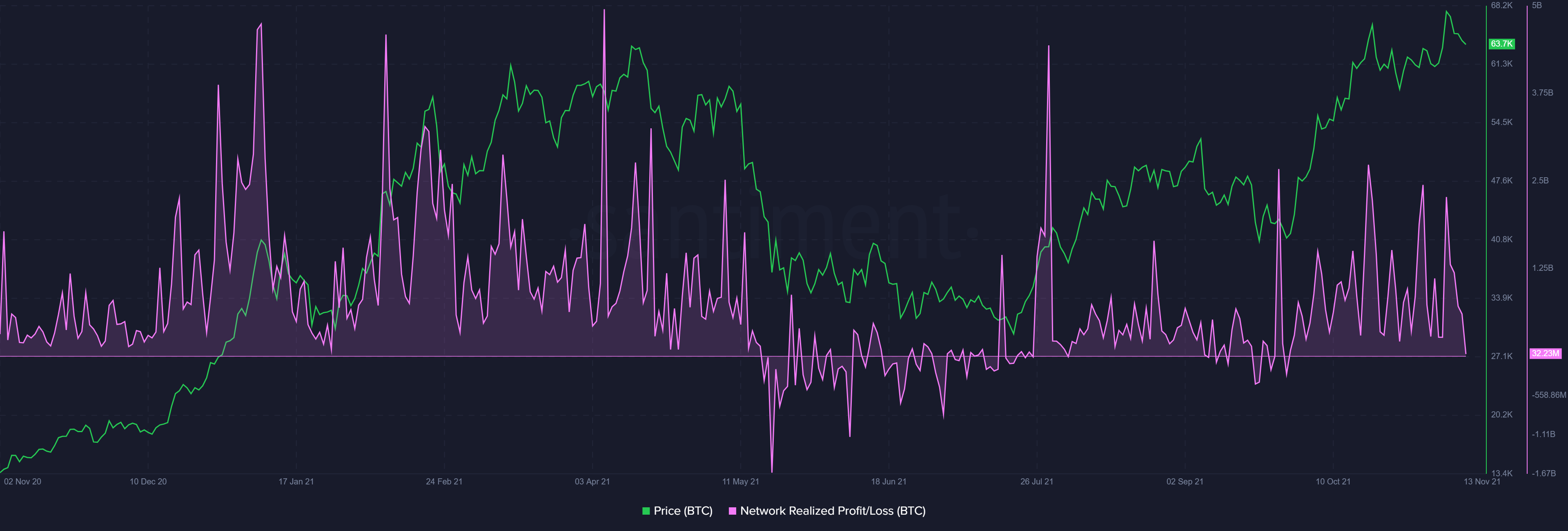

According to Santiment, the Network Profit/Loss for Bitcoin is drastically dropping as fewer addresses are moving BTC at a profit now. The divergence can be witnessed between the rising price and dropping supply moved in profit. Such a trend at the top of a market indicates correction possibilities.

However, keeping every narrative in mind, BTC futures basis suggested the market is particularly healthy.

Bitcoin Futures yet to reach January-April Euphoria?

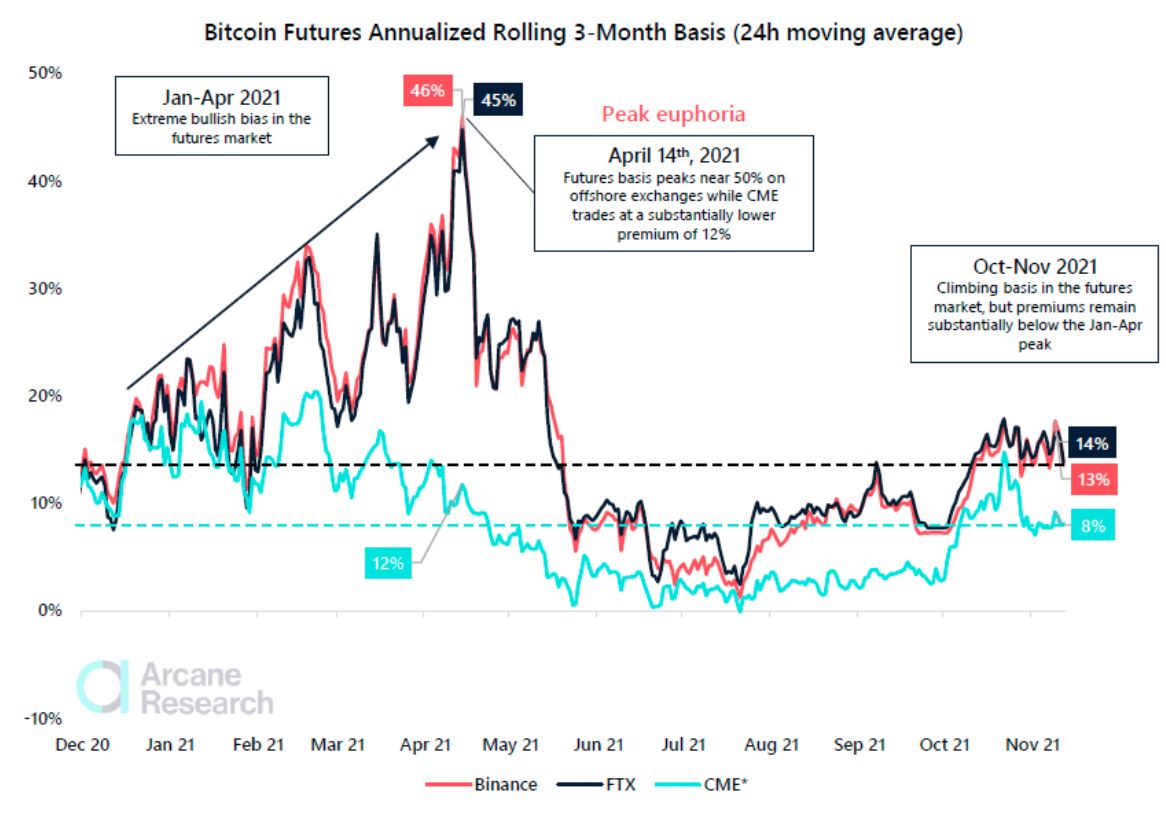

Now, while on-chain fundamentals are important to understand activity, the futures market is essential to under trader sentiment. And right now, it remains pretty neutral. According to Arcane Research, Bitcoin Futures Annualized Rolling 3-month basis on multiple exchanges remain palatable. The extreme bullish bias and high premiums on off-exchanges were observed during Q1 2021. But right now, the futures market is not completely in a state of Euphoria.

Indecisive? Practice Patience

At the moment of time, patience remains the key virtue for any investors if they are already holding Bitcoin. Using leverage traders is extremely during this volatile period, and a better direction is needed to evaluate the next step in the industry.