Near Protocol: A look at why recovery isn’t as ‘NEAR’ as it may seem

Founded by Alex Skidanov and Illia Polosukhin, NEAR Protocol prides itself as a development platform, with the concepts of sharding, proof-of-stake, and a layer-one blockchain designed for usability central to its operations.

In the last few weeks, the Protocol recorded significant strides. Amidst other developments that were recorded, Phemex, a leading cryptocurrency exchange, announced on 8 May that investors could trade $NEAR, the Protocol’s native token on its platform.

Similarly, DecentralBank announced the availability of the $USN <> $NEAR swapping page on the platform.

All of these developments led to an increased activity on the NEAR Protocol. On 13 May, the protocol also announced that the total number of accounts created on the network surpassed 10 million.

Now, you might be wondering about the performance of the NEAR token given the news of the Protocol housing over 10 million accounts.

Let’s take a look.

There seems to be some growth

Following the announcement of the total number of accounts, the network’s native token, NEAR made some moves in an uptrend direction. The token recorded a 16% growth on 13 May. However, this was followed by a retracement which pushed the price of the token downwards. At $6.69 at the time of writing, the token recorded a 9% spike in the last three days.

Although in an oversold positions at the time of writing, the announcement did manage to create some waves for the token. The bulls attempted to push the RSI and MFI into the 50 neutral region, which was met with stiff opposition from the bears who forced it back downwards.

Additionally, a look at the market capitalization of the token revealed some progress within the period under review. Recording a high of $5.13 billion on 13 May, the market capitalization for the NEAR token grew by 5% in the last three days. The market capitalization stood at $4.6 billion at the time of writing.

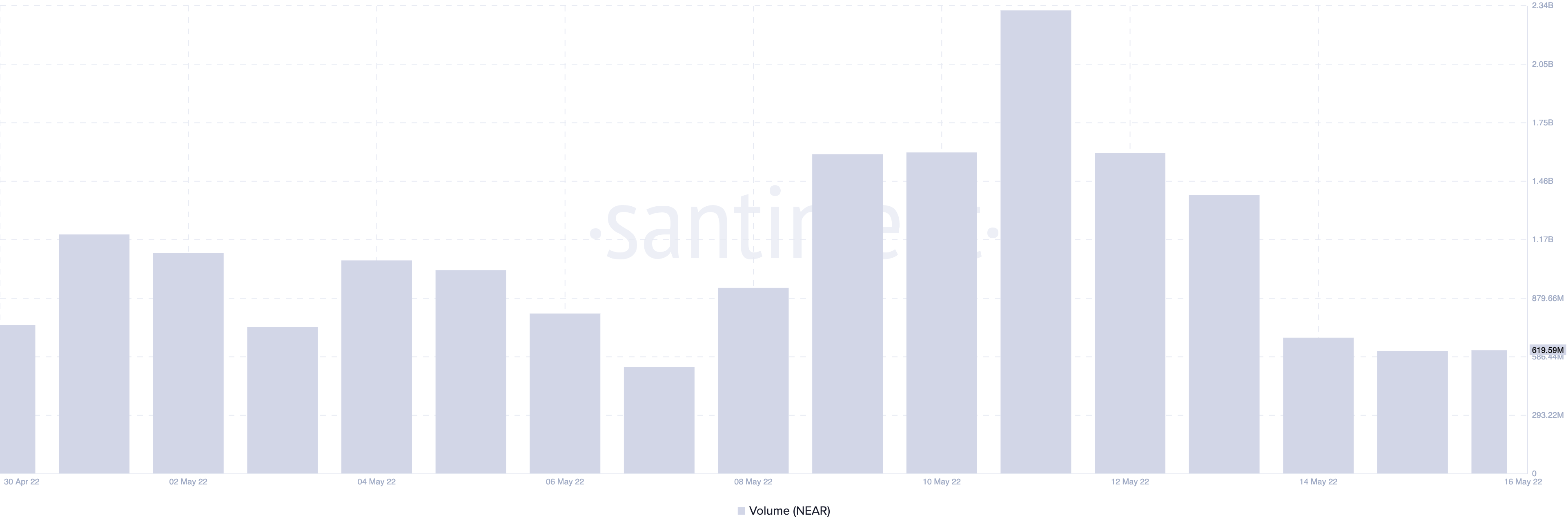

However, despite the growth in price and market capitalization, the noteworthy metric is the transaction volume for the NEAR token within the same period. A steady decline was spotted within the time under review. Interestingly, it is also to be noted that less people continued to trade the coin despite a spike in its price.

Err…Did we mention the positive too soon?

While some growth was recorded on a price front, the on-chain analysis data did not reveal an all round impact on the NEAR token after the announcement of 13 May.

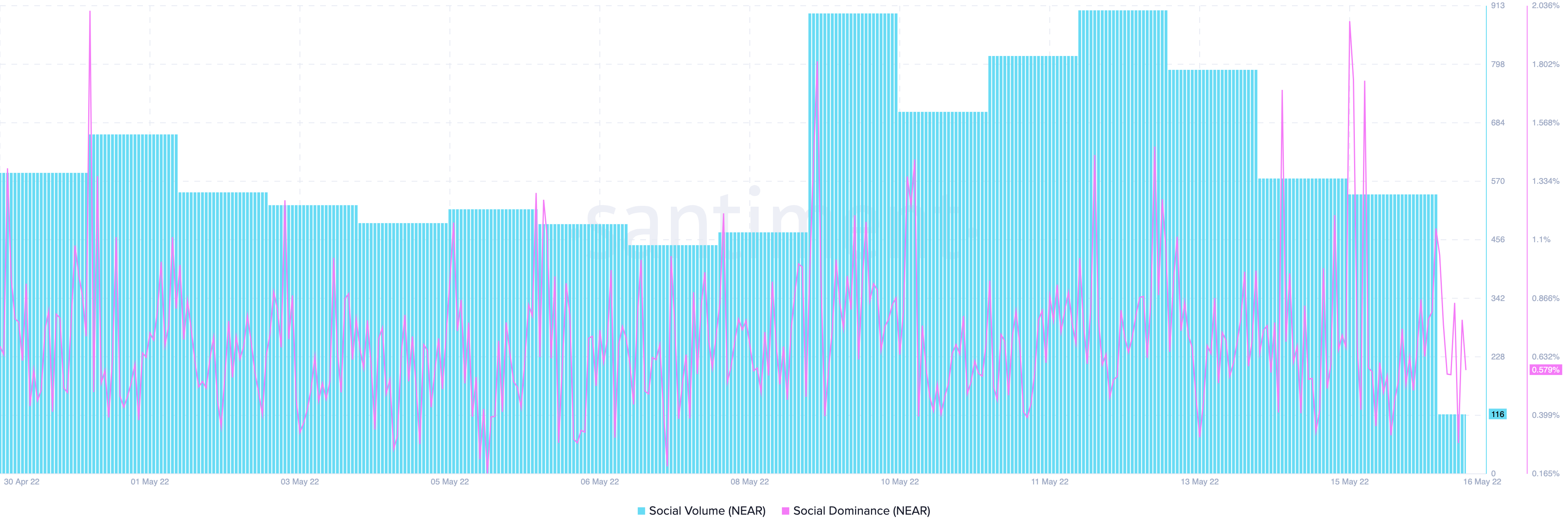

A consideration of the social impact showed that the social dominance of the token attempted an uptrend on 14 May. This was, however, followed by a reversal on 15 May due to the pegging of this metric at 0.684% at the time of writing. Trading at $116 at the time of writing, the social volume witnessed a decline since 13 May. This indicated that the announcement created very little social buzz in the past three days.

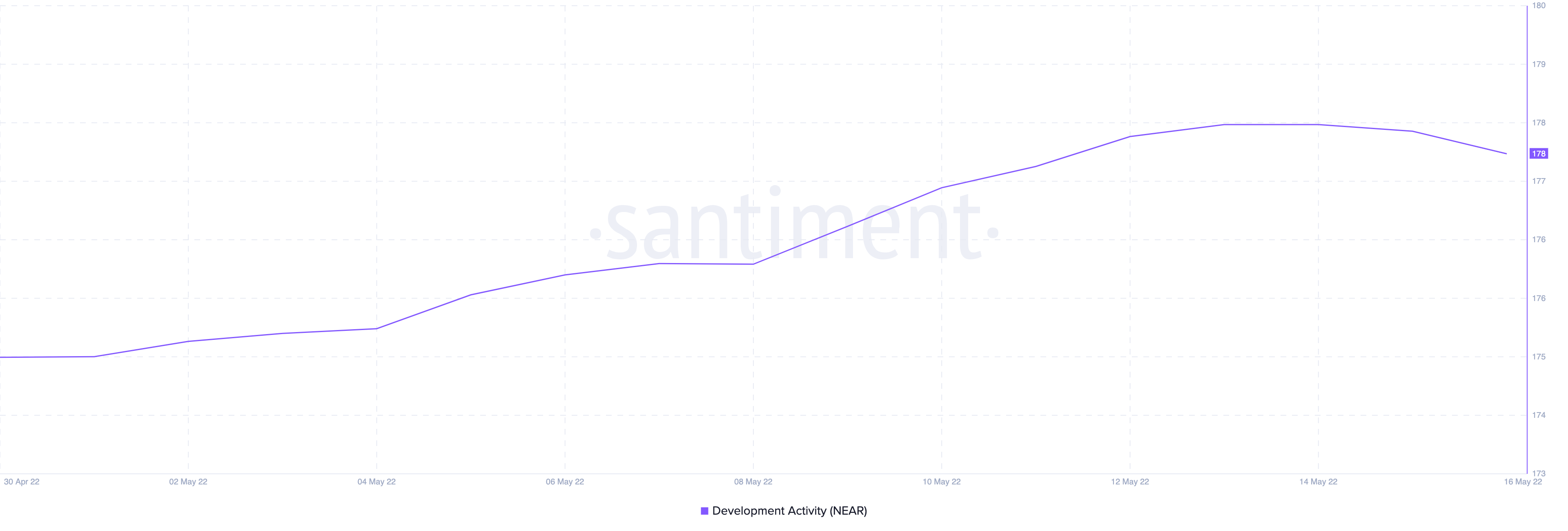

Similarly, on a developmental front, the last three days were not marked with any significant impact. The overall development activity on the token maintained a flat line of 178. In retrospect, as updates continue to hit the Protocol, an uptrend movement here is not entirely impossible.