Altcoin

NEAR Protocol’s daily active addresses hit 3M – Bullish sign?

As the AI crypto sector continues to grow, will NEAR form a bullish leg?

- NEAR saw 3M daily active addresses in Q3 2024.

- Addresses show interest in NEAR as AI tokens outperform the broader market.

Artificial Intelligence (AI) cryptocurrencies have witnessed significant growth, with most of them, such as Bittensor [TAO] outperforming the broader cryptocurrency market.

Besides TAO, the other AI-related crypto that has seen significant growth is NEAR Protocol [NEAR].

In the last 30 days, NEAR has gained by 25%. These gains were spurred by the growth of the network, rising usage, and interest.

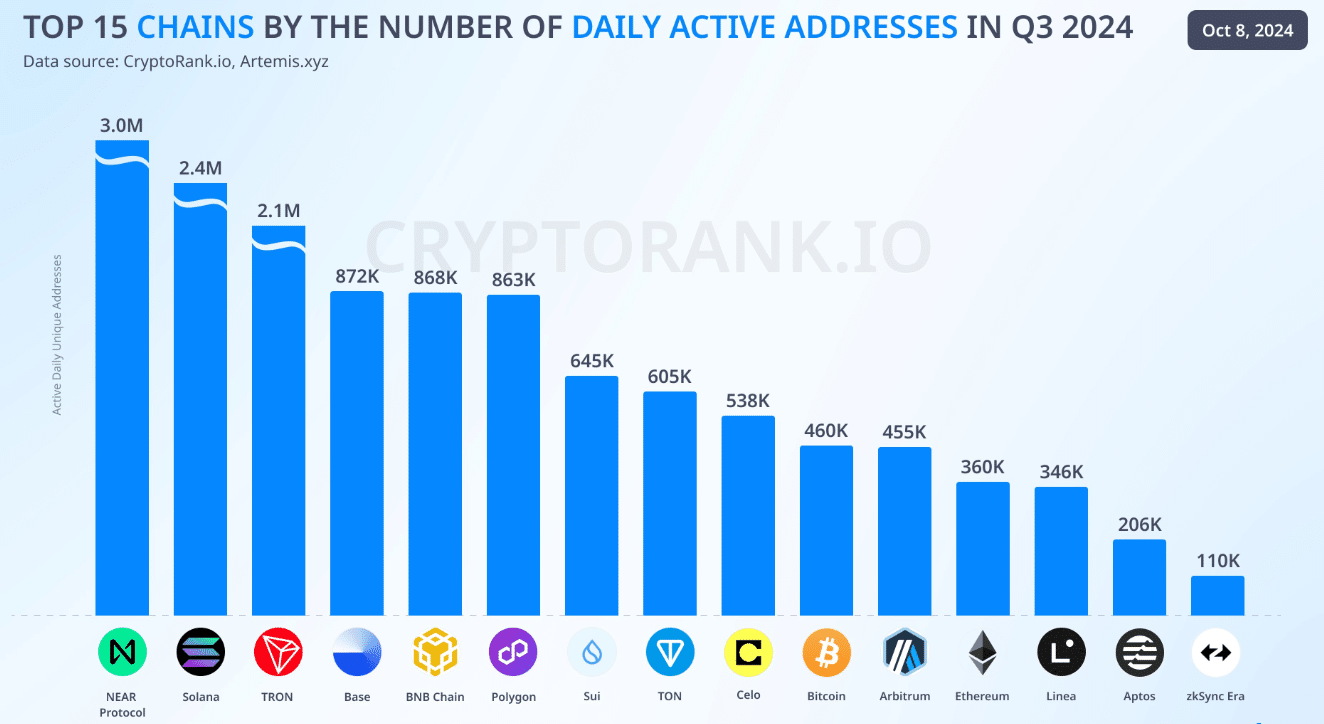

During the third quarter of 2024, the number of daily active addresses on the NEAR Protocol reached 3 million per CryptoRank, ranking it as the top network by this metric.

In comparison, the second and third-ranking networks by this metric, Solana [SOL] and Tron [TRX], saw 2.4M and 2.1M daily active addresses, respectively, during the quarter.

This growth coincided with the growth of the AI crypto sector. According to a recent report by DappRadar, AI-related decentralized applications (dApps) reported a 71% growth in Q3 compared to the second quarter.

Furthermore, AI dApps have reported an average of 4.3 million daily unique active wallets, also pointing towards the growth of the industry.

As the AI crypto sector continues to grow, will NEAR form a bullish leg, or will the price continue to succumb to broader market sentiment?

NEAR price analysis

NEAR traded at $4.87 at press time after a 2.36% drop in 24 hours. Trading volumes were also down by more than 30% according to CoinMarketCap, showing a lack of market participation.

NEAR has been on a bearish streak since the start of the month, as the Moving Average Convergence Divergence (MACD) indicator shows.

The MACD line is trending below the signal line, indicating a bearish trend. The downtrend is also seen in the red MACD histogram bars.

Buyers are also inactive, with the Relative Strength Index (RSI) at 51 showing a neutral market sentiment. However, the RSI line below the signal line shows that the momentum is bearish.

If the bears continue to gain control, the price will likely drop to test the support level at the 0.236 Fibonacci level ($4.761).

Conversely, if buyers step in, NEAR will likely soar to the next resistance level at $5.31, after which the price could aim for prices above $6.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

While technical indicators show that the current momentum is bearish, the long/short ratio on Binance shows that traders are betting on an upward recovery.

According to Coinglass, 71% of accounts on Binance had taken long positions, while only 28% were short accounts.