NEIRO coin is up 49% in 24 hours – What’s next for the memecoin?

- Neiro coin rallied nearly 50% in 24 hours.

- A whale jumped on the trend while early investors cashed out.

Neiro [NEIRO] jumped 49% in 24 hours as memecoins began the week with an explosive recovery. The rally followed Bitcoin [BTC] upswing towards $64K, triggering a relief rally in the markets.

But NEIRO’s explosive upswing was also driven by whale actions. According to the blockchain analytics platform SpotOnChain, a major whale scooped 1.466B $NEIRO, worth $1.8 million during the rally.

“rektdolphin.eth is the top $NEIRO purchaser during this period, swapping a total of 190.5B $PEPE and 6 $ETH for 1.466B $NEIRO ($1.8M) around 4 hours ago, now making $334K (+19%).”

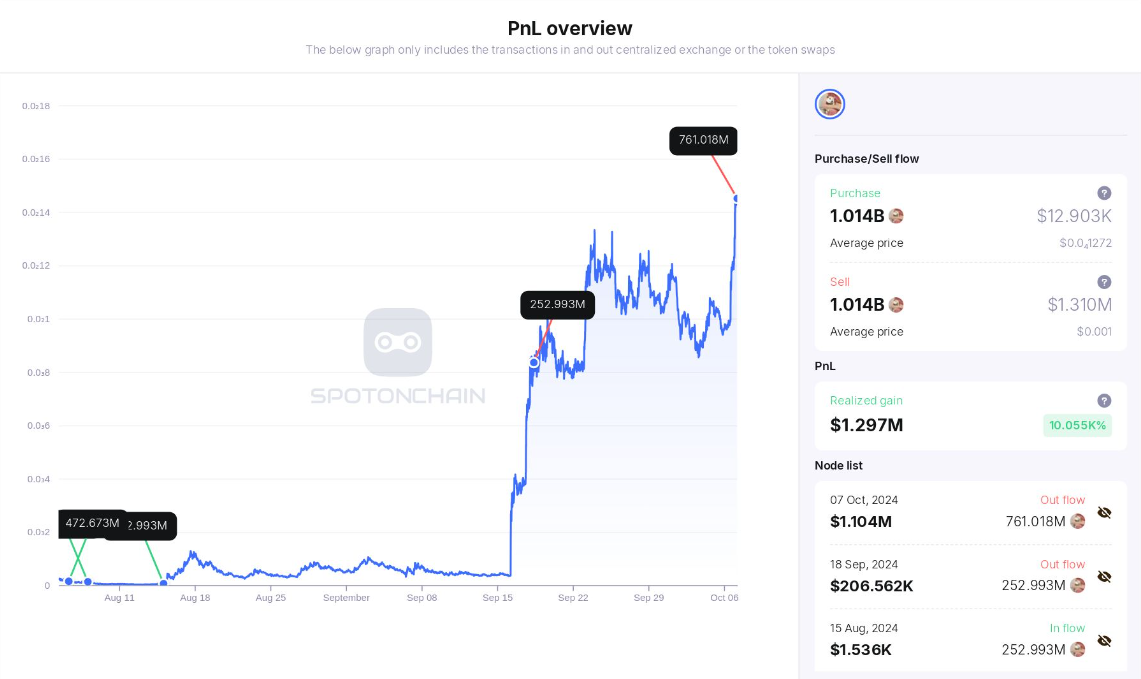

Afterward, another early whale trader closed its NEIRO position with a whopping +10,055% profit.

What’s next for NEIRO?

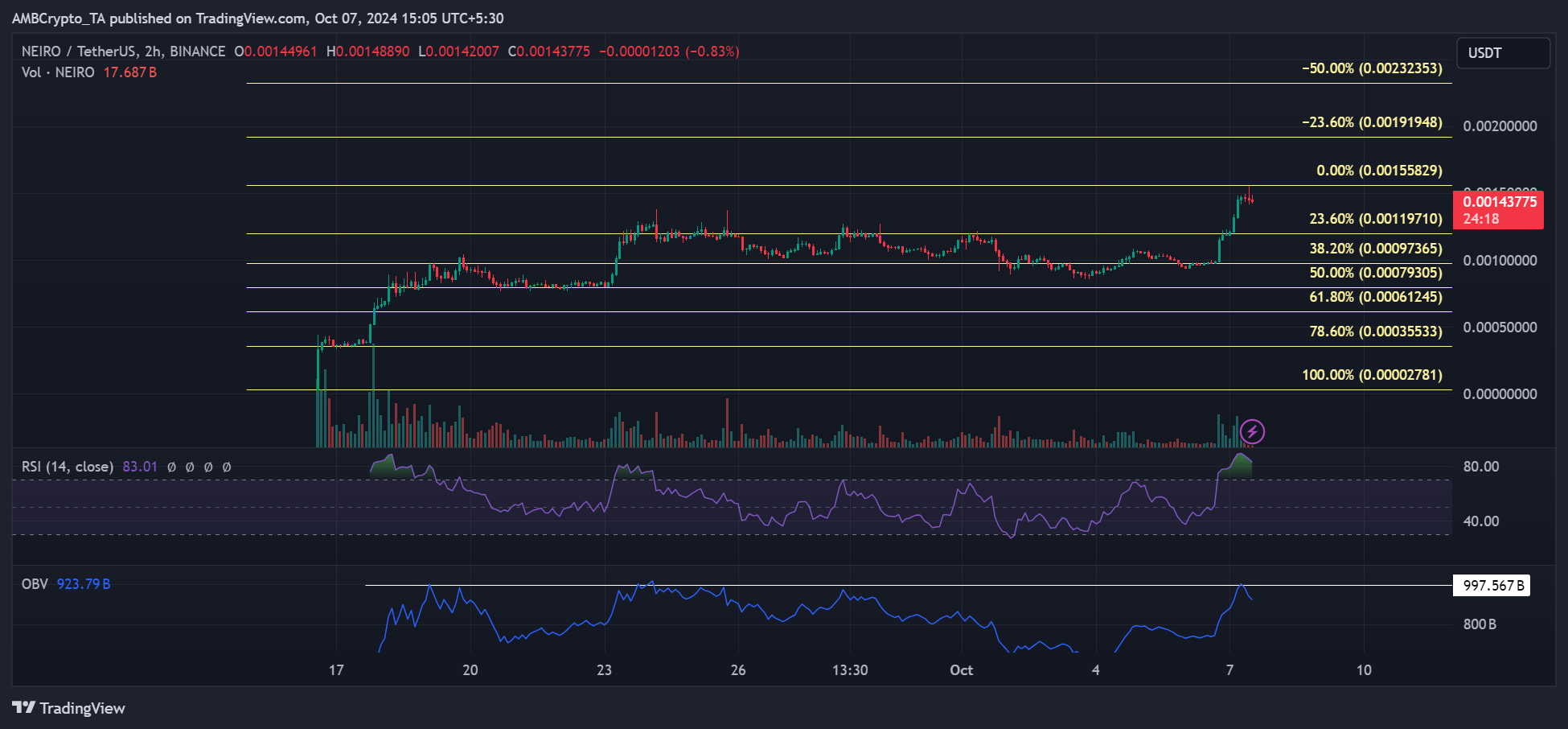

The recent rally was fronted from the 38.2% Fib level on the price charts. Trading volume jumped triple-digit in the past few hours, underscored by the rising OBV (on-balance volume).

However, the indicator peaked at its recent resistance level near 997 billion. If OBV fails to break above the resistance, a cool-off to the rally could be likely.

The RSI on lower-time frame charts also flashed an overbought signal, further reinforcing potential cool-off, especially if profit-taking intensified.

If so, 23.6% ($0.00119) and 38.2% (0.0009) Fib levels were crucial to watch in the short term.

On the contrary, an extended rally could set the NEIRO to tap $0.002, especially if BTC climbed higher.

Key levels to track

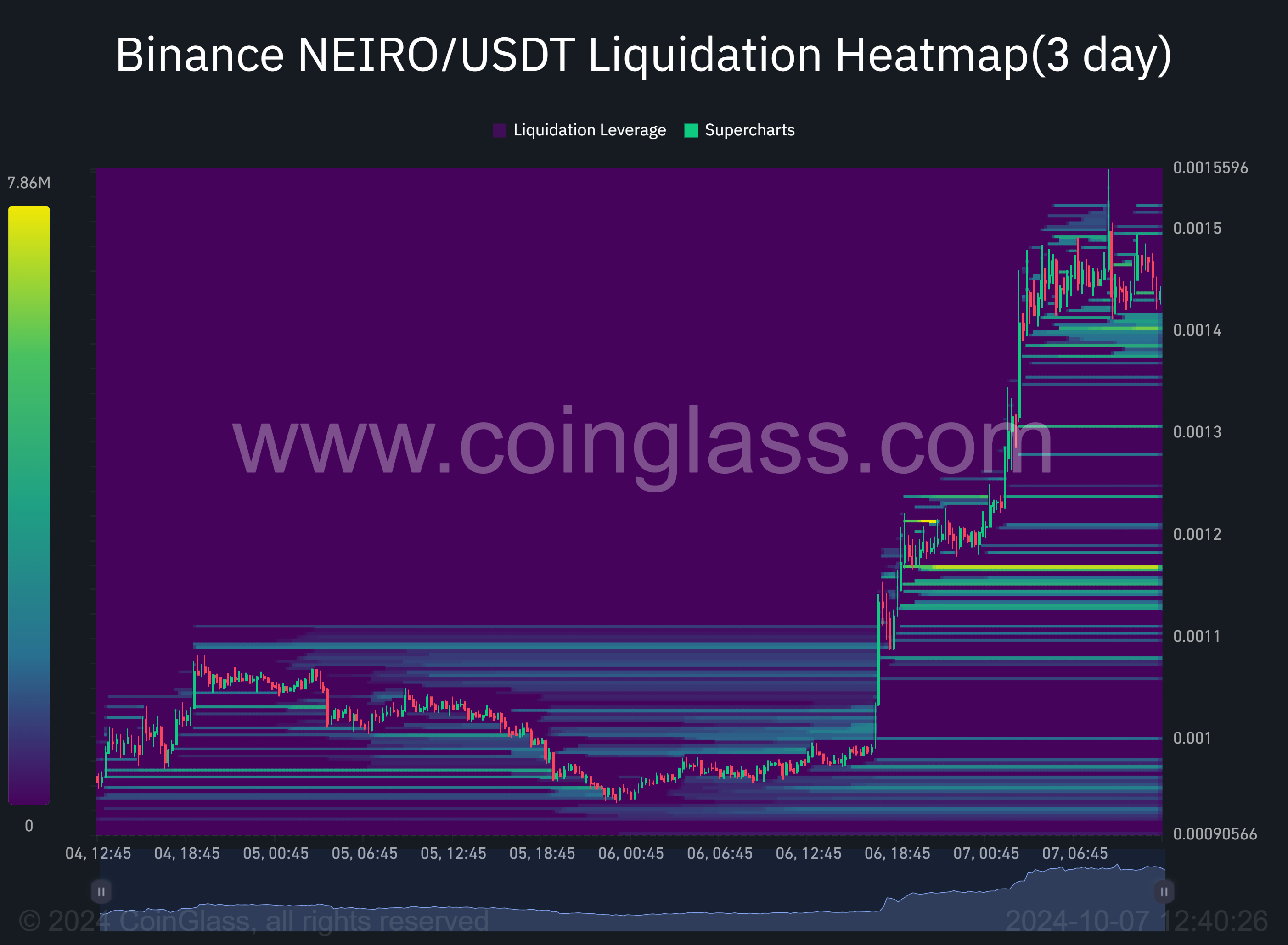

According to liquidation clusters, data showed pockets of liquidity at $0.0014 and below $0.0012 (at 23.6% Fib level).

These were leveraged long positions that might trigger a liquidity grab and drive NEIRO price downwards before continuing with the recovery.

Read Neiro’s [NEIRO] Price Prediction 2024–2025

That said, the derivatives market demonstrated massive speculators’ interest without a clear direction at the time of writing. Volume and Open Interest (OI) were up triple-digits, illustrating massive market interest.

But, there were almost similar liquidations of long and short positions in the past four hours before press time. This showed no clear market direction and called for caution in the short term.