Bitcoin

New Bitcoin wallets hit 4-year low: Decoding what it means for BTC

Bitcoin has recorded a significant drop in new wallet creations, reaching its lowest level since 2018.

- New Bitcoin wallet creations have fallen dramatically, reaching levels last seen in 2018.

- Despite the drop, technical analyses suggest a potential upcoming rally post-Bitcoin halving.

Bitcoin [BTC], the leading cryptocurrency, has been experiencing a stagnant phase, struggling to surpass the $67,000 resistance level.

Recently, it achieved a 24-hour high of $67,697 but then saw a slight retreat, now trading at around $66,886.

This minor fluctuation comes at a time when Bitcoin’s ecosystem is showing signs of reduced activity, particularly in the creation of new addresses.

Just six months ago, the Bitcoin network was buzzing with activity, partly fueled by excitement over spot Bitcoin ETFs

, developments like Ordinals, and anticipation of the upcoming halving event.This led the average weekly number of new Bitcoin addresses to nearly reach the peak levels last seen in December 2017. However, recent data indicates a significant downturn in this trend.

Dramatic drop in network participation

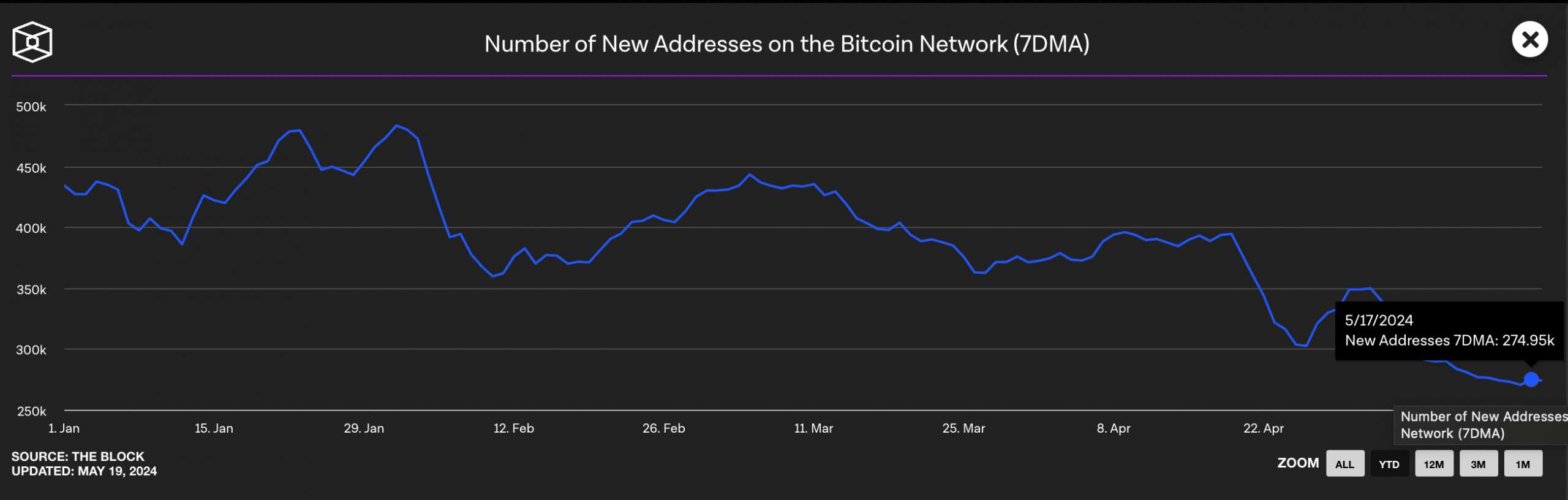

The seven-day moving average number of new addresses on the Bitcoin network has plummeted to levels not seen since 2018.

Specifically, there has been a decrease from 625,000 new addresses per day six months ago to just 274,000 at press time, according to The Block’s

data.This decline in new address creation mirrored the situation in early 2018, when interest in joining the Bitcoin network similarly waned after a period of heightened enthusiasm.

Other key metrics have also shown a downturn. For instance, miner revenue and hash rate, critical indicators of the health and security of the Bitcoin network, have reached record lows.

Daily active addresses have followed suit, dropping from highs of over 73,000 in early March to under 20,000 at the time of writing, based on

data from Santiment.Bitcoin: Market outlook amid declining metrics

While the decline in these metrics might seem negative, it is essential to understand the broader context.

Historical data suggests that Bitcoin often undergoes significant corrections before a major rally, especially post-halving.

Technical analyses indicate that Bitcoin could drop to around $60,000, a level seen as crucial for gathering the liquidity needed to fuel a significant uptrend following the halving.

This is echoed by AMBCrypto’s recent technical analysis on BTC’s daily chart, showing that Bitcoin was testing resistance at the $67.3k level and remained above its 20-day Exponential Moving Average (EMA).

Is your portfolio green? Check out the BTC Profit Calculator

The Relative Strength Index (RSI) noted an uptick, hinting that Bitcoin might soon convert its current resistance into support, indicating a bullish short-term outlook.

However, the Chaikin Money Flow (CMF) suggested a potential price correction could be imminent.