New Bitcoin whales surge: Could their massive accumulation spark the next rally?

- New Bitcoin whales are reshaping the market structure, driving demand while limiting available supply.

- This dynamic may fuel upward price movement in the coming months.

High-net-worth wallets with 1,000+ Bitcoin [BTC] are accumulating fast, signaling strong confidence in Bitcoin. Since November 2024, new Bitcoin whales have added over 1 million BTC, including 200,000 this month.

A short holding period (<6 months) indicates strong conviction at current price levels. This sustained buying pressure suggests recent “dips” are being absorbed, reducing the likelihood of prolonged corrections.

With risk-off sentiment dominating the market, retail capital has yet to return. In this climate, the continued accumulation of new whales could establish a strong price floor, reinforcing Bitcoin’s support in this cycle.

Bitcoin’s liquidity profile is shifting

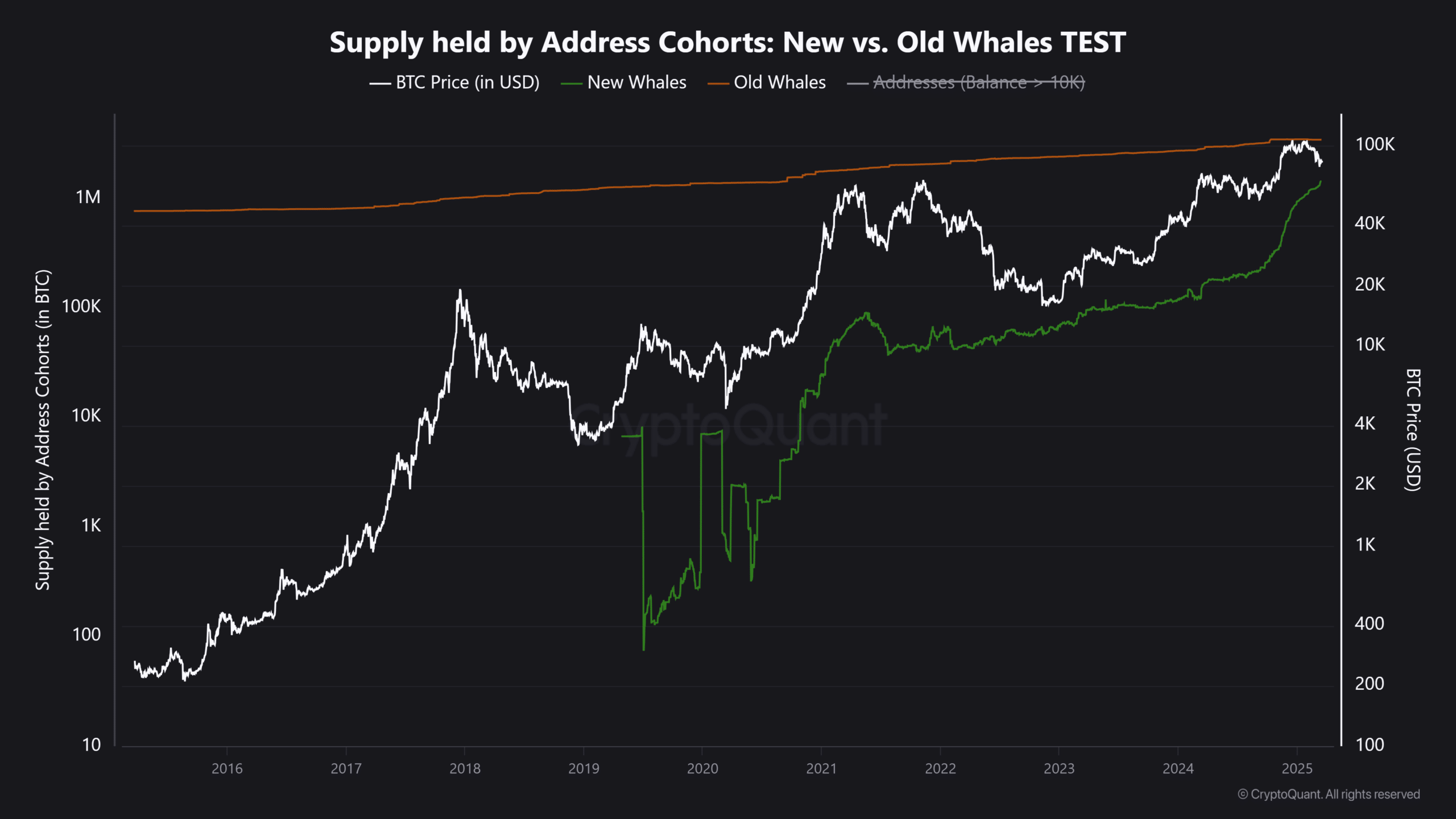

The rapid accumulation of new whale addresses indicates strong inflows of fresh capital, as reflected in the data below.

Total holdings by these entities (1,000+ BTC, <6 months old) have surged from 345k BTC to over 1.5 million BTC. At the current market price of $83,580, this represents approximately $125 billion in Bitcoin.

Meanwhile, long-term whale holdings (BTC held for several years) have declined from 3.48 million to 3.45 million BTC, aligning with Bitcoin’s price correction from its $109k all-time high on the 20th of January to $96k on the 6th of February.

The sell-side liquidity from both old whales and weak hands have been absorbed by these new whales, whose 2,00,000 accumulation this month has prevented BTC from retracing below $78k.

New Bitcoin whales signal strength: What’s next?

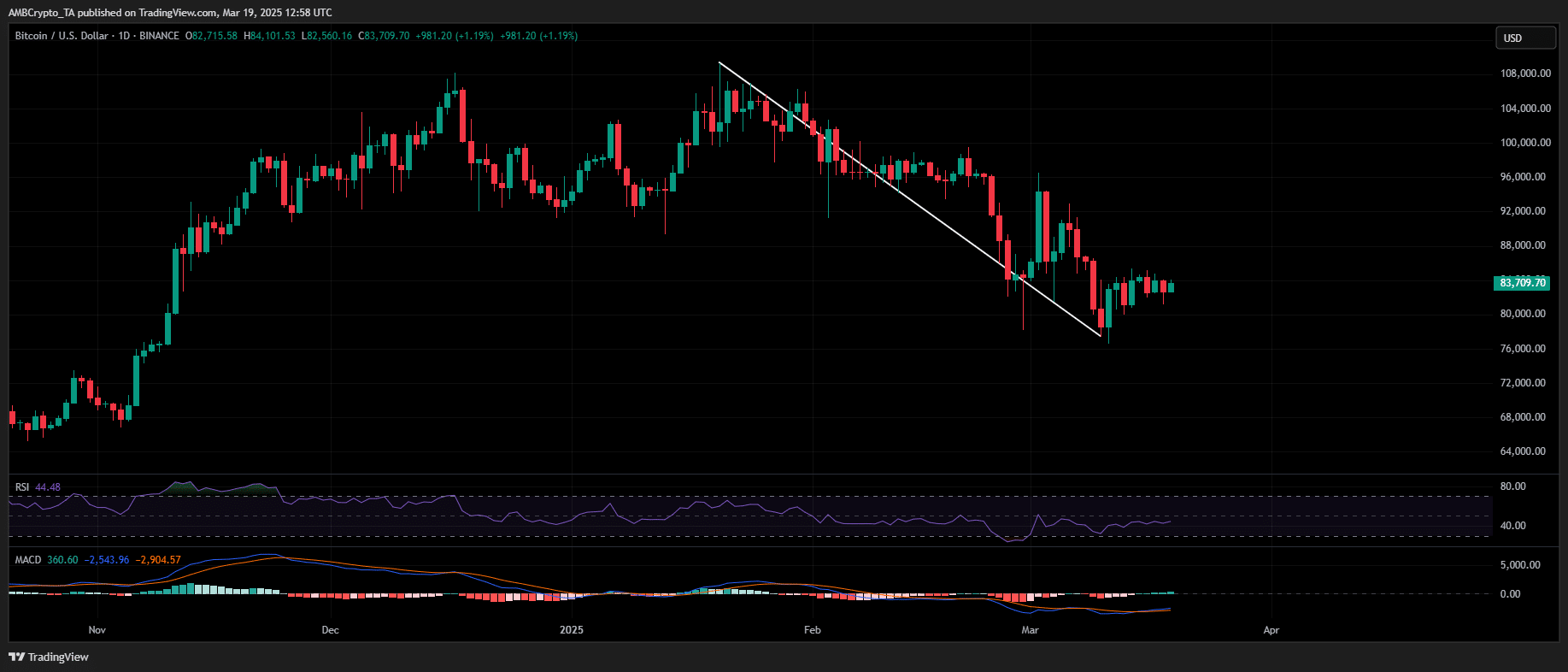

Bitcoin’s recent price swings – from its ATH of $109k to its drop below $80k– have been largely influenced by old whale distributions and macro-driven liquidity shifts.

However, new whale inflows are reinforcing support, mitigating downside risks. If accumulation continues at current levels, BTC’s probability of retesting all-time high increases.

Additionally, macro factors like potential rate cuts, once Trump’s economic reset takes effect, could further strengthen Bitcoin’s long-term trajectory, positioning $150k–$160k as a viable long-term target.