New Ethereum ETF update sparks interest – More inside

- Ark Invest and 21 Shares submitted an amended Ethereum spot ETF proposal.

- ETH reacted positively, with an increase of over 2%.

In a recent update, one of the applicants seeking approval for an Ethereum [ETH] spot ETF, Ark Invest and 21 Shares, made a noteworthy development.

This recent announcement drew reactions from ETH, creating anticipation as the final approval date remains uncertain.

Ethereum spot ETF gets amended filing

As per a recent submission to the SEC on the 7th of February, Ark Invest and 21Shares revised their joint filing for a spot Ethereum ETF.

The amended filing introduced notable changes, including incorporating a cash creation and redemption mechanism.

This was in line with the approved Bitcoin [BTC] filing from January, which was well-received by the regulatory agency.

Also, another significant addition was the potential for staking Ethereum. The document outlined the possibility of staking ETH through “one or more trusted third-party staking providers.”

It would allow the fund to lock up some holdings and earn rewards.

Despite the skeptical outlook, with a Bloomberg analyst expressing doubt about SEC approval for ETH staking in a spot ETF, the price of ETH displayed positive movements.

Ethereum rises by over 2%

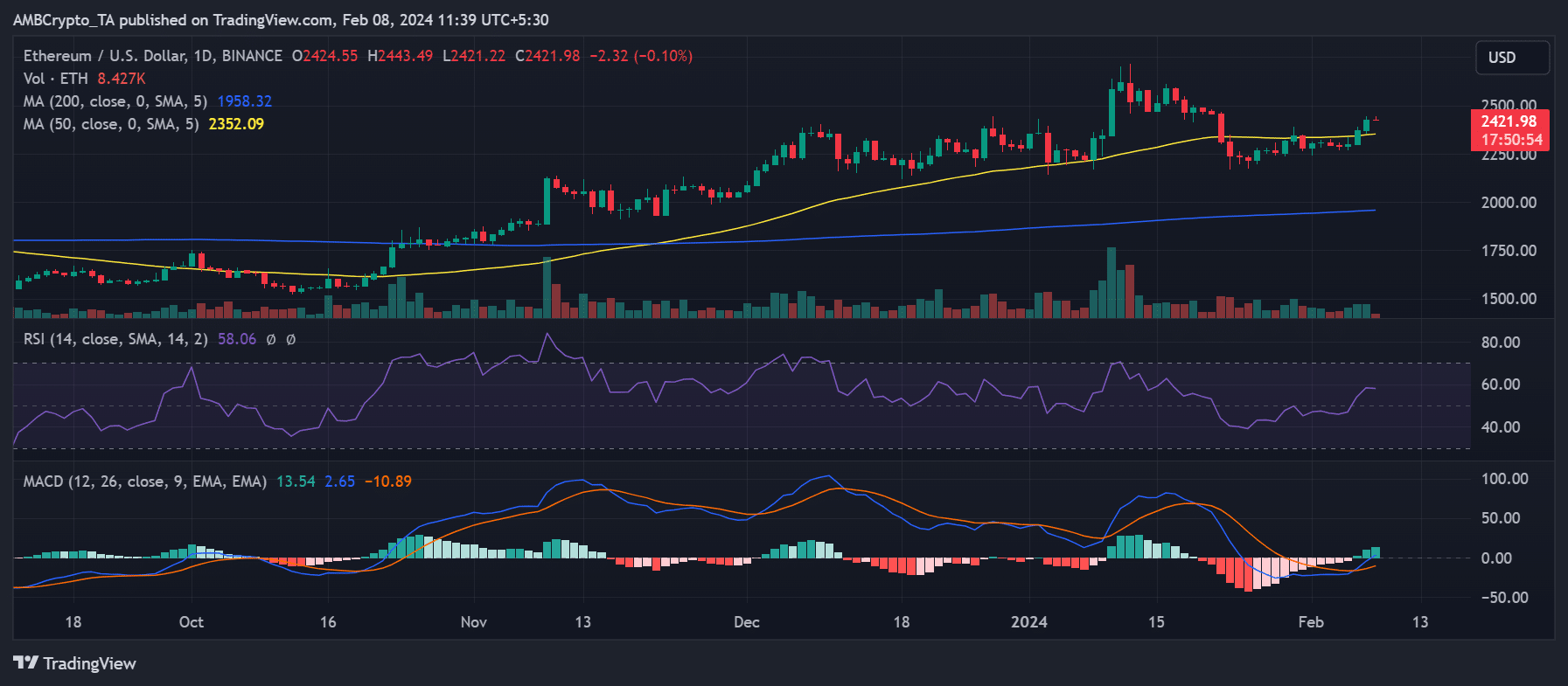

AMBCrypto’s analysis of Ethereum’s daily timeframe on the 7th of February showed a positive conclusion. The chart showed a price rise of over 2%, reaching above $2,424.

At the time of this writing, it was trading at around $2,422, with a slight decline observed.

The increase on the 7th of February moved its price trend above its short Moving Average (yellow line), signaling a positive trend.

Buyers turn aggressive?

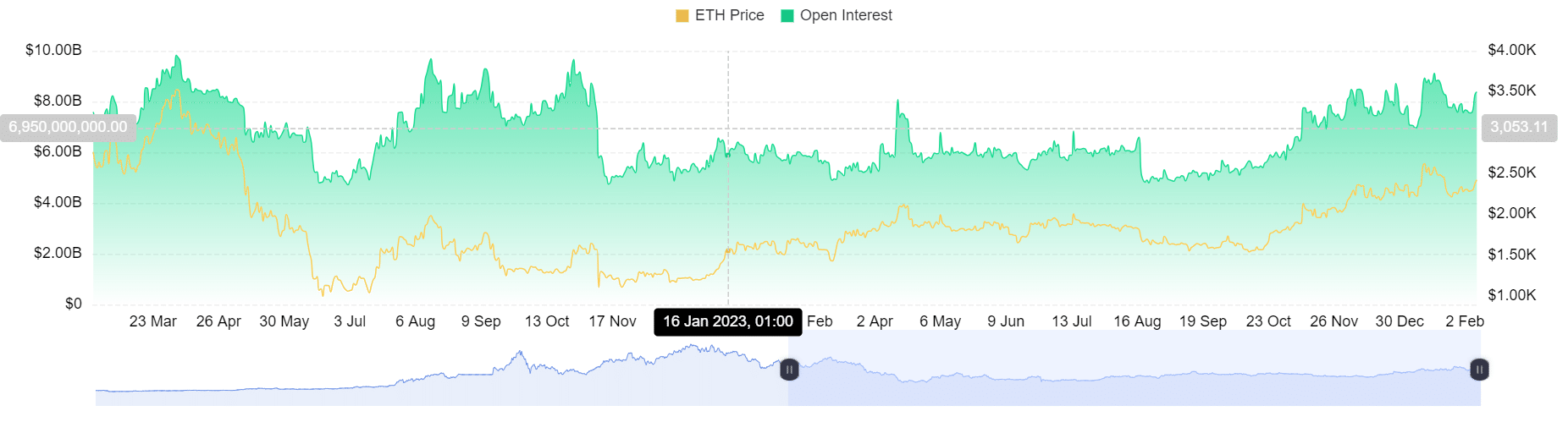

In addition to the positive price trend, Ethereum’s Open Interest experienced an increase on the 7th of January.

Coinglass’ data showed that ETH Open Interest reached over $8 billion, marking the first significant increase in months and weeks.

Also, this increase in Open Interest suggested a flow of funds into the market and signaled positive sentiment.

How much are 1,10,100 ETHs worth today?

Additionally, AMBCrypto’s analysis of ETH’s Funding Rate showed a slight rise after a period of downtrends. The metric increased to 0.0058%, suggesting that buyers displayed some aggression.

Similar to the growing Open Interest, this rise in the Funding Rate also indicated positive market sentiment.

![Sonic [S] sees $1.4 billion liquidity surge as network upgrade sparks investor interest](https://ambcrypto.com/wp-content/uploads/2025/03/F0D8CF78-0B88-471B-BD85-84A9F049FDBA-400x240.webp)