Solana memecoin BOME gains 322%, but how long will the hype last?

- BOME had already topped $1 billion in market valuation at press time.

- Binance announced the listing of the meme coin on its spot and derivatives exchange.

The crypto market’s unquenched appetite for meme coins continues as a new kid on the block has made heads turn.

BOME’s boom

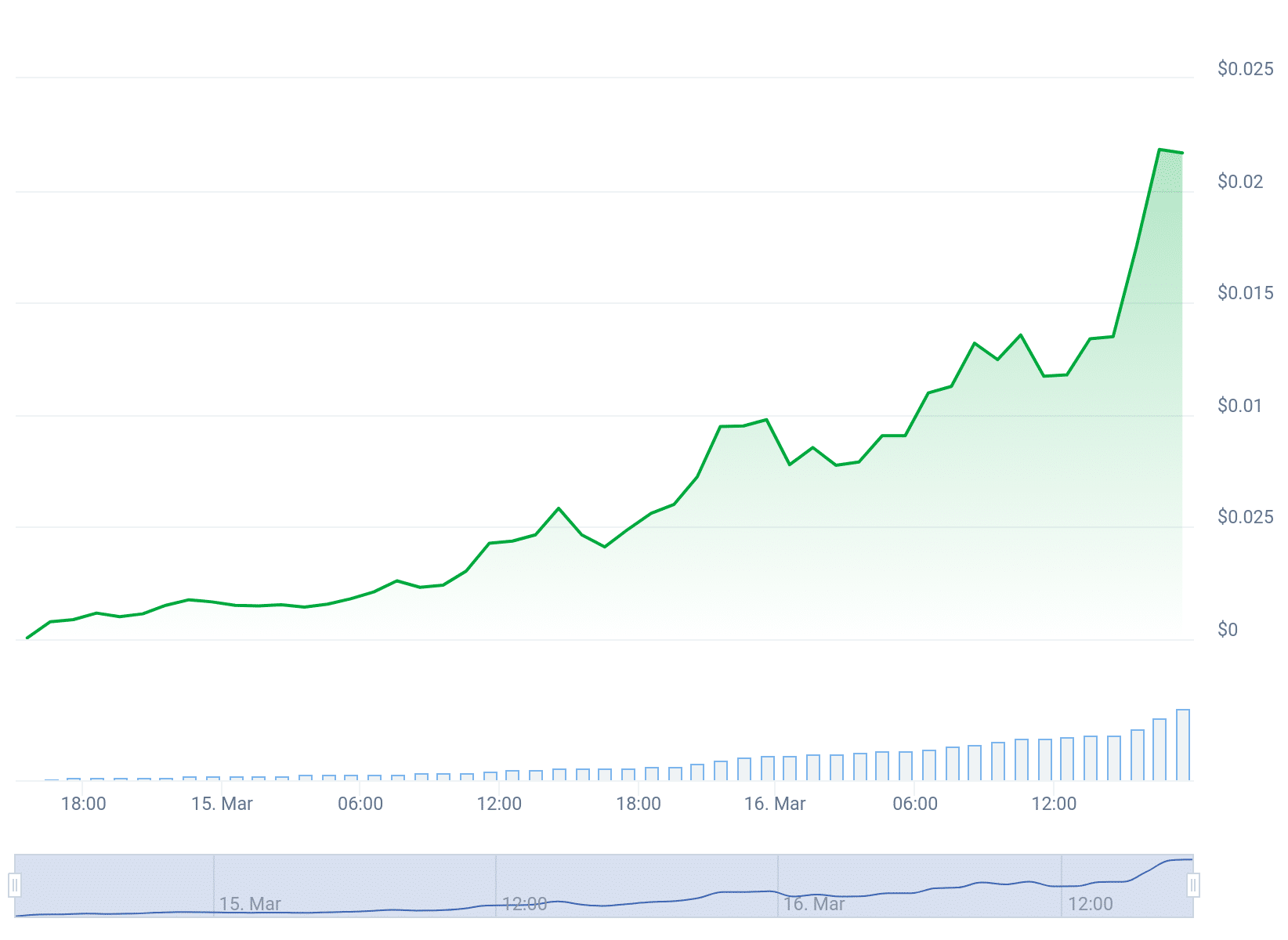

In a sensational turn of events, Solana [SOL]-based BOOK OF MEME [BOME] token skyrocketed 322% in the last 24 hours.

Also, it has bagged the 100th rank by market capitalization in just over 48 hours since launch, according to CoinGecko.

The coin already exceeded $1 billion in market valuation at press time, with a trading price of $0.02202.

Tracing the origins and growth

Created by art producer Darkfarms who also designed a similar frog-themed token Pepe [PEPE], BOME is an experimental token project aiming to combine memes and decentralized storage solutions.

The pre-sale began on the 13th of March, requiring users to send SOL tokens to a designated address to claim the airdrop.

Over 10,000 SOL were raised as part of the campaign, which were subsequently added to a liquidity pool.

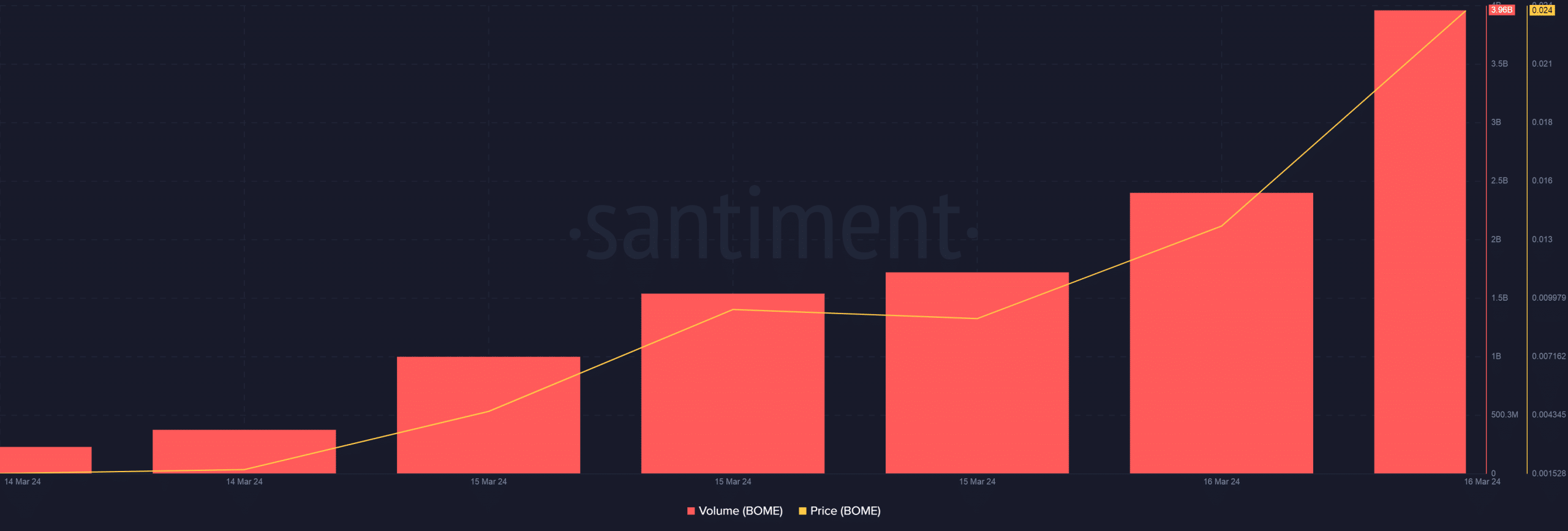

Since then, demand for BOME has picked up steadily as users rushed to place massive buy orders. Seeing the rise, several prominent crypto exchanges like Kucoin, Bitget, and Gate.io, listed the memecoin.

According to AMBCrypto’s analysis of Santiment’s data, trading volumes have risen meteorically, with nearly $4 billion settled as of the 16th of March.

The premier listing

The biggest shot in the arm came when the world’s largest exchange, Binance, announced the listing of BOME spot trading pairs.

Interestingly, the notification came hours after BOME was listed on its derivatives arm, Binance Futures.

This key announcement was preceded by a whale investor’s intriguing moves, which piqued the interest of market watchers.

How much are 1,10,100 SOLs worth today?

According to on-chain data tracker LookonChain, the whale withdrew 12.7K SOL from Binance and used it to purchase 314 million BOME tokens, hours before Binance’s announcement.

This transaction fueled speculations of insider trading in the market. Note that having access to non-public information amounts to a fraudulent practice.