NFT market witnesses a domino effect with Blur triggering the falls

- The NFT sector observed an alarming decline in interest. NFTs across Ethereum, Solana, and Bitcoin were impacted.

- BLUR’s Blend and Azuki Elementals played a huge role in the recent market drawdown.

At the start of the year, the NFT sector experienced a substantial increase in interest, driven by the introduction of Ordinals and other factors. However, over time, the NFT market witnessed a huge fall in overall market capitalization and volume.

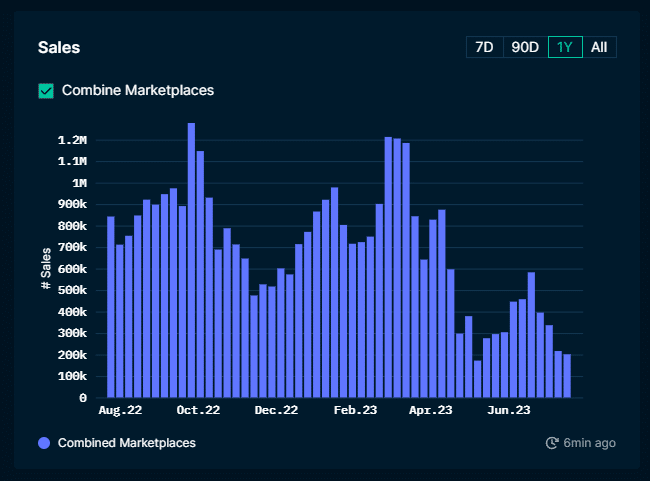

Over the last year, activity across networks such as Ethereum, Bitcoin, and Solana fell materially. According to Nansen’s data, NFT sales across all marketplaces on Ethereum fell significantly.

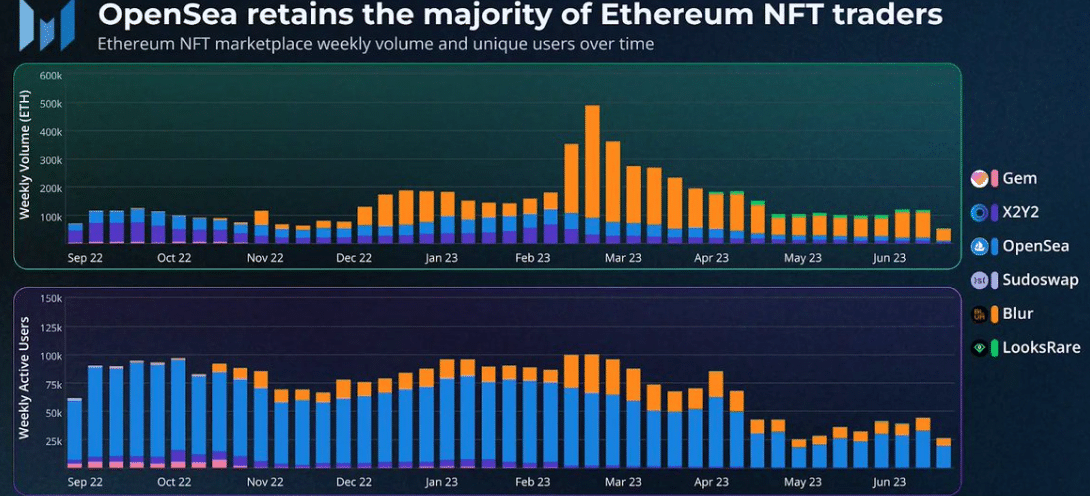

Additionally, the number of active addresses on prominent exchanges also started to fall based on Messari’s data. OpenSea, SudoSwap and Blur observed a significant decline in activity over the past few months.

How did this all start?

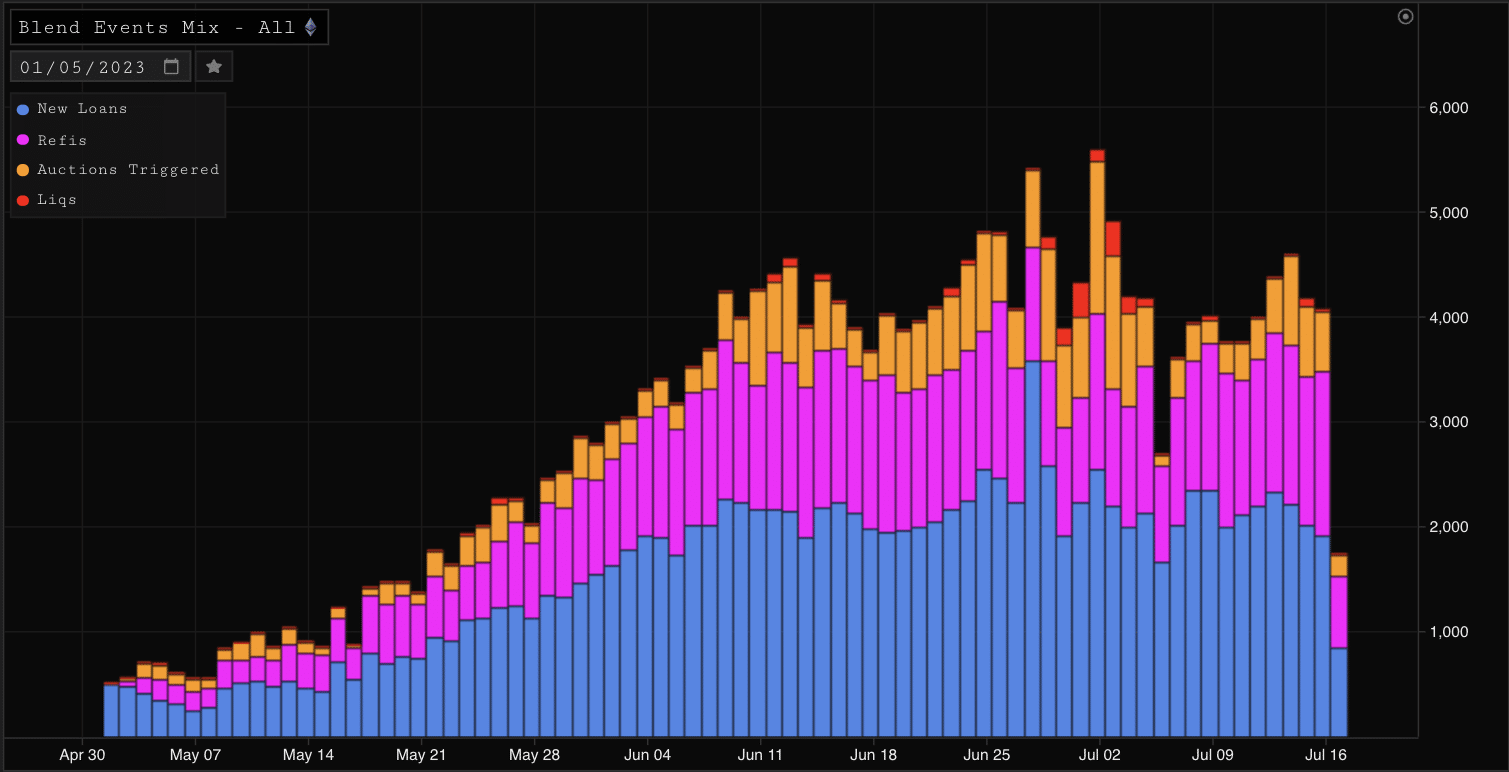

Parsec Finance’s data suggested that one of the major reasons for the decline in NFT interest would be the introduction of leverage into the NFT ecosystem.

On April 29th, Blur introduced Blend, a flagship lending and borrowing feature seamlessly integrated into its main UI. Users could easily perform three main actions: borrowing against their NFTs, lending their ETH with NFT collateral, and purchasing NFTs using borrowed ETH.

To incentivize lenders, daily distributions of BLUR points were offered. Thus, encouraging them to provide loans at high loan-to-value ratios and low annual percentage yields. As a result, borrowers who lacked sufficient capital still took loans, contributing to the accumulation of unhealthy leverage and leading to potential liquidation risks.

This combination of functionalities boosted liquidity for users and encouraged the use of leverage within the NFT market, with Azuki leading the way. At one point, the Blur escrow wallet held 7% of the supply, representing NFTs that were either borrowed against or acquired on leverage, both subject to potential liquidation.

During bullish or stable market conditions, high-leverage behavior thrived. However, when the market took a downturn, problems arose, potentially leading to domino effects as one collection’s significant drawdown affects others. In this case, the most leveraged collection, Azuki, was the first to fall.

Azuki comes into the picture

Another factor that played an important role here was Azuki’s Elemental launch. Elementals was a new batch of 20,000 NFTs minted under Azuki’s name which sold out instantly, generating $40 million for Chiru labs. The reveal of similar artwork to the original collection upset holders, triggering a sell-off and affecting the broader market.

Is your portfolio green? Check out the BLUR Profit Calculator

The sudden liquidity drain exacerbated the situation, leading to multiple liquidations across nine collections, including Azuki and Beanz. Azuki experienced a 70% drawdown over nine days, while the broader market suffered similar downturns.