Nigeria – Can SEC’s new crypto rules be a blueprint for the United States?

- Nigeria has a 6.50% crypto-ownership rate, signaling rapid growth amid regulatory challenges

- Nigeria’s SEC has now implemented new rules and ARIP to secure digital asset markets effectively

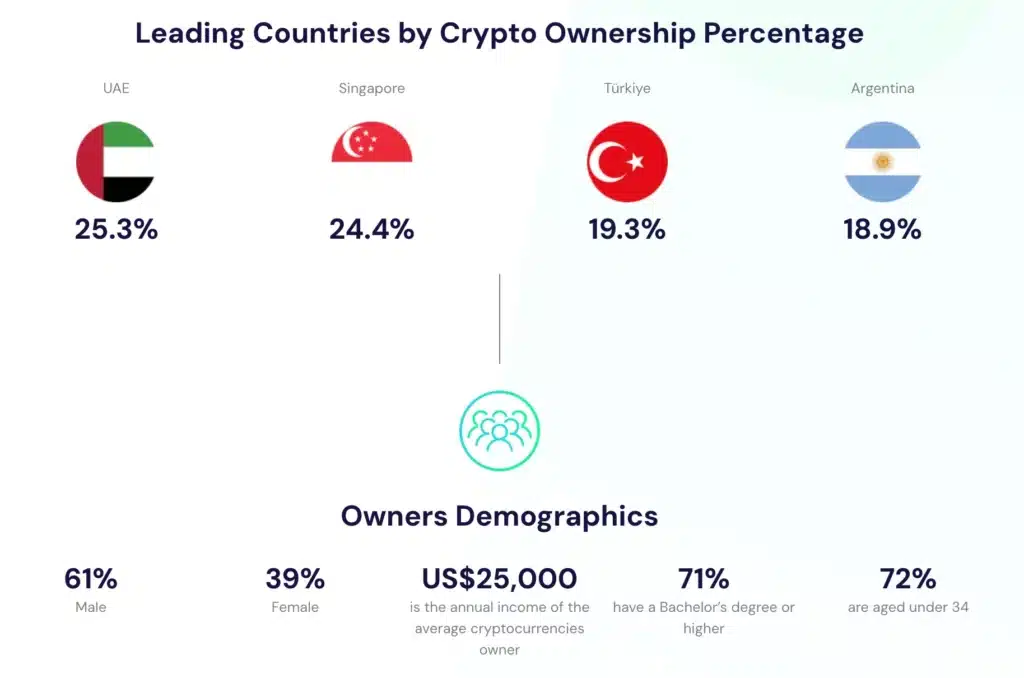

Cryptocurrency adoption is on the rise globally, and recent data from Triple.A confirms this trend. In fact, as of 2024, an estimated 6.8% of the world’s population owns cryptocurrencies, translating to over 560 million users worldwide.

Among the nations making significant moves on this front, Nigeria stands out with a cryptocurrency ownership rate of 6.50%. This is another sign of Nigeria’s growing acceptance and influence in the global crypto landscape.

Nigeria’s SEC moves towards cryptocurrency adoption

Nigeria’s Securities and Exchange Commission (SEC) is in the news now after it updated its regulations on Digital Asset Issuance, Offering Platforms, Exchange, and Custody.

In a public statement, the SEC explained that these amendments are aimed at building a stronger regulatory framework tailored to the specific challenges of digital asset markets.

“The purpose of the amendment is to expand the scope of regulation in line with the current realities.”

These revised rules want to address digital asset complexities and risks, ensuring a secure, well-regulated environment for all stakeholders.

Is there more to it?

Additionally, as part of its efforts to regulate the cryptocurrency market, the Nigerian SEC has also launched the Accelerated Regulatory Incubation Programme (ARIP) for virtual assets service providers (VASPs). Here, ARIP provides a structured process for VASPs to comply with the new regulatory requirements.

To simplify the process, the SEC has also established a dedicated application window on its ePortal for VASPs participating in the program, with a mandatory completion of the onboarding process within 30 days from the circular’s issuance.

This initiative would streamline the compliance process and ensure that VASPs operate within the updated regulatory framework.

Nigeria’s long-standing efforts

Here, it’s important to note that despite past regulatory challenges, Nigeria has seen significant growth in cryptocurrency adoption.

In December 2023, the Central Bank of Nigeria (CBN) lifted its 2021 ban on crypto transactions, introducing new guidelines to combat money laundering and terrorist financing. These rules now mandate VASPs to adhere to Know Your Customer (KYC) requirements, but have also raised concerns about user privacy.

Nonetheless, Nigeria has become a leader in peer-to-peer (P2P) crypto trading volume and overall transaction growth, fueled by the popularity of stablecoins as a hedge against inflation.

Should the U.S learn from Nigeria?

With the crypto market evolving, Nigeria’s regulatory approach serves as a model for other nations like the United States. Especially since they are also navigating digital asset regulation amid rapid adoption.

Robinhood CEO Vlad Tenev probably put it best when he claimed,