Notcoin up 12% – Can a NOT breakout yield 153% gains?

- As at press time, Notcoin was among the top gainers in the last 24 hours.

- Approximately 70% of addresses holding NOT are profitable.

Notcoin [NOT] has gained over 12% in the last 24 hours, continuing to strengthen its position as the leading coin on the TON blockchain.

At press time, NOT was trading at $0.008112, with a trading volume surge of more than 83% as per CoinMarketCap.

This increase in volume resulted in a 15% volume-to-market-cap ratio, suggesting sufficient liquidity, making it a cryptocurrency to watch in the last quarter of the year.

Currently, Notcoin’s price action shows consolidation within a tight falling wedge pattern that has been forming since its early stages after launching.

The lower trendline, acting as support, has rejected four times. However, during the fourth leg down, the price did not touch the lower trendline, indicating early buying interest, leading to a potential reversal.

If NOT can break above the upper trendline of this pattern and hold, the price could reclaim the $0.014270 level, representing a potential 153% gain if market conditions improve.

This breakout could mark the start of a recovery, with traders anticipating further upward momentum once the consolidation phase is cleared.

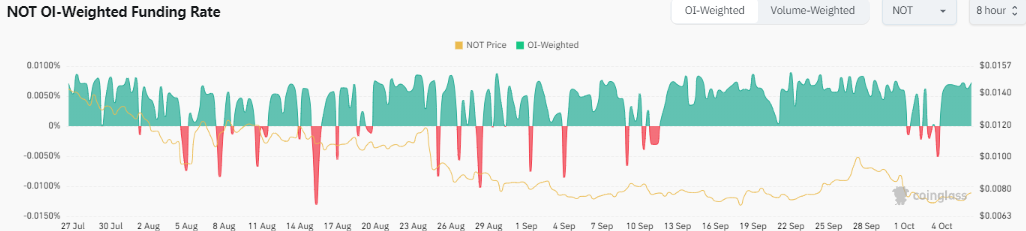

NOT OI-Weighted Funding Rates

An analysis of additional Notcoin metrics, such as the Open Interest (OI) Weighted Funding Rate, indicated a shift in sentiment.

The press time reading stood at 0.0072%, signaling that long positions were now willing to pay shorts, which supported a bullish outlook for NOT.

This change in Funding Rate adds further confluence to the possibility of Notcoin breaking above the falling wedge pattern and targeting a significant price increase.

As the Funding Rates turn favorable, bullish momentum may gain traction, driving the price higher.

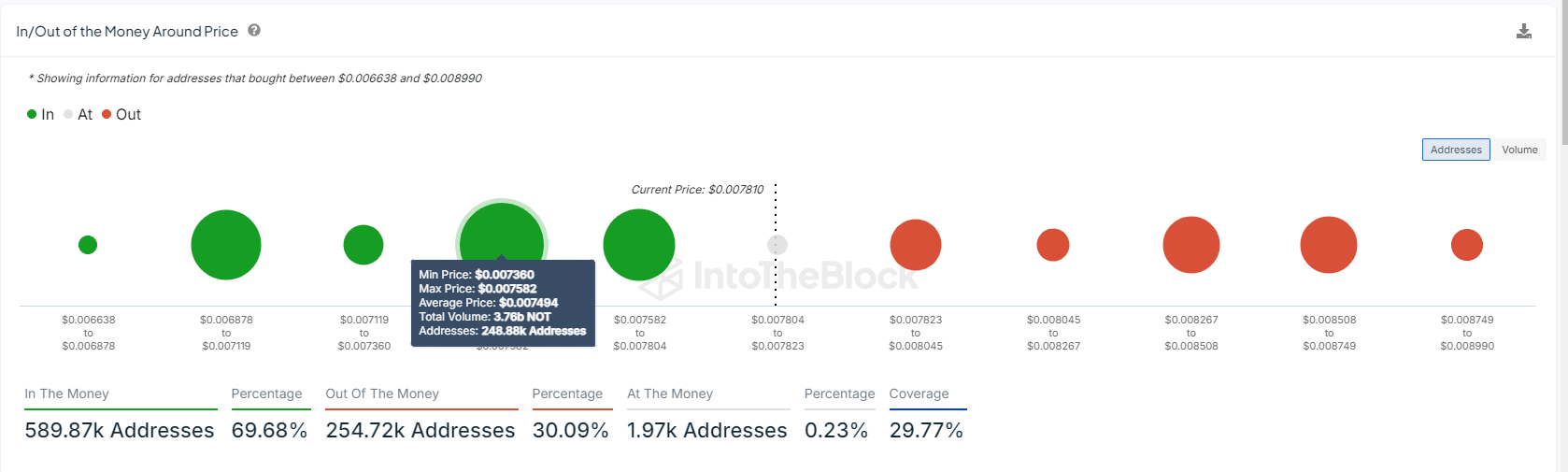

In/Out of the Money around current price

Lastly, examining the in/out of the money around the current price revealed that approximately 70% of addresses holding NOT were profitable, while only 30% were out of the money.

This ratio suggested that traders were likely to hold their positions, aiming for further profits as bullish sentiment took hold during the fourth quarter.

The key zone to watch is between $0.007360 and $0.007582, where the majority of profitable addresses are concentrated.

With 248,000 addresses holding 3.76 billion NOT in this range, this could present an ideal entry point for traders looking to capitalize on a breakout.

Notcoin’s recent performance, combined with favorable market conditions and strong technical indicators, suggested that a breakout from the current consolidation pattern was possible.

Read Notcoin’s [NOT] Price Prediction 2024–2025

If this occurs, the potential for NOT to reclaim higher price levels, such as $0.014270, is within reach.

With increased liquidity and a bullish sentiment building, the next few weeks will be crucial for NOT’s future trajectory.