Notcoin’s weekend – What to expect from its latest breakout?

- OI spikes over the past month were unsuccessful in the attempt to break the $0.012 resistance

- Hike in buying pressure on this breakout attempt meant the chances of success may be higher

The social media engagement behind Notcoin [NOT] has been highly negative since mid-July. In fact, over this period, the altcoin’s value dropped from $0.0174 to $0.118 – A 32% drop.

The losses in early August were much heavier as NOT has pulled itself upwards considerably since then. The token showed positivity in the Futures market, but is this enough to flip the bearish market structure?

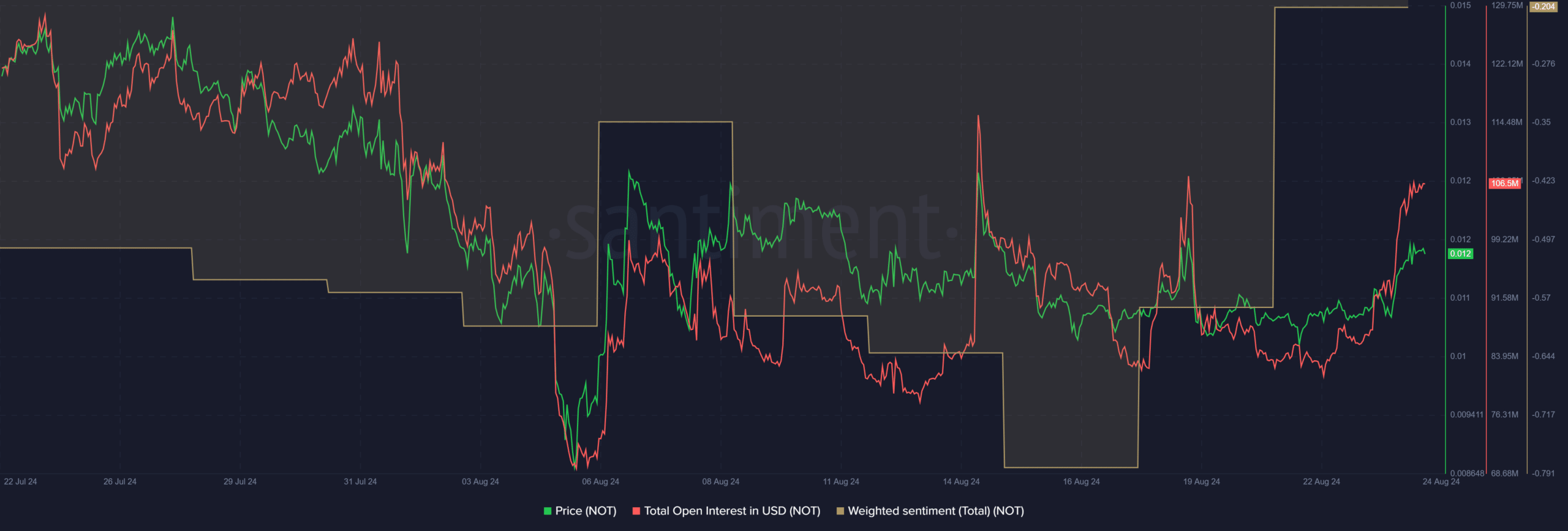

Open Interest patterns spark worry

Source: Santiment

The Open Interest has climbed from $83 million to $105 million since Thursday, 22 August. During this period, NOT gained by just over 11% on the charts. Generally, a price and OI hike indicate strong bullish sentiment.

While this is true for the prevailing price move, the recurring pattern in August favored the bears. The strong Open Interest surges on 31 July and on 14 and 19 August were followed by sharp price declines.

This indicated that the earlier OI spikes were fake breakouts past the $0.012 resistance zone.

Will the current retest of $0.012 have better luck?

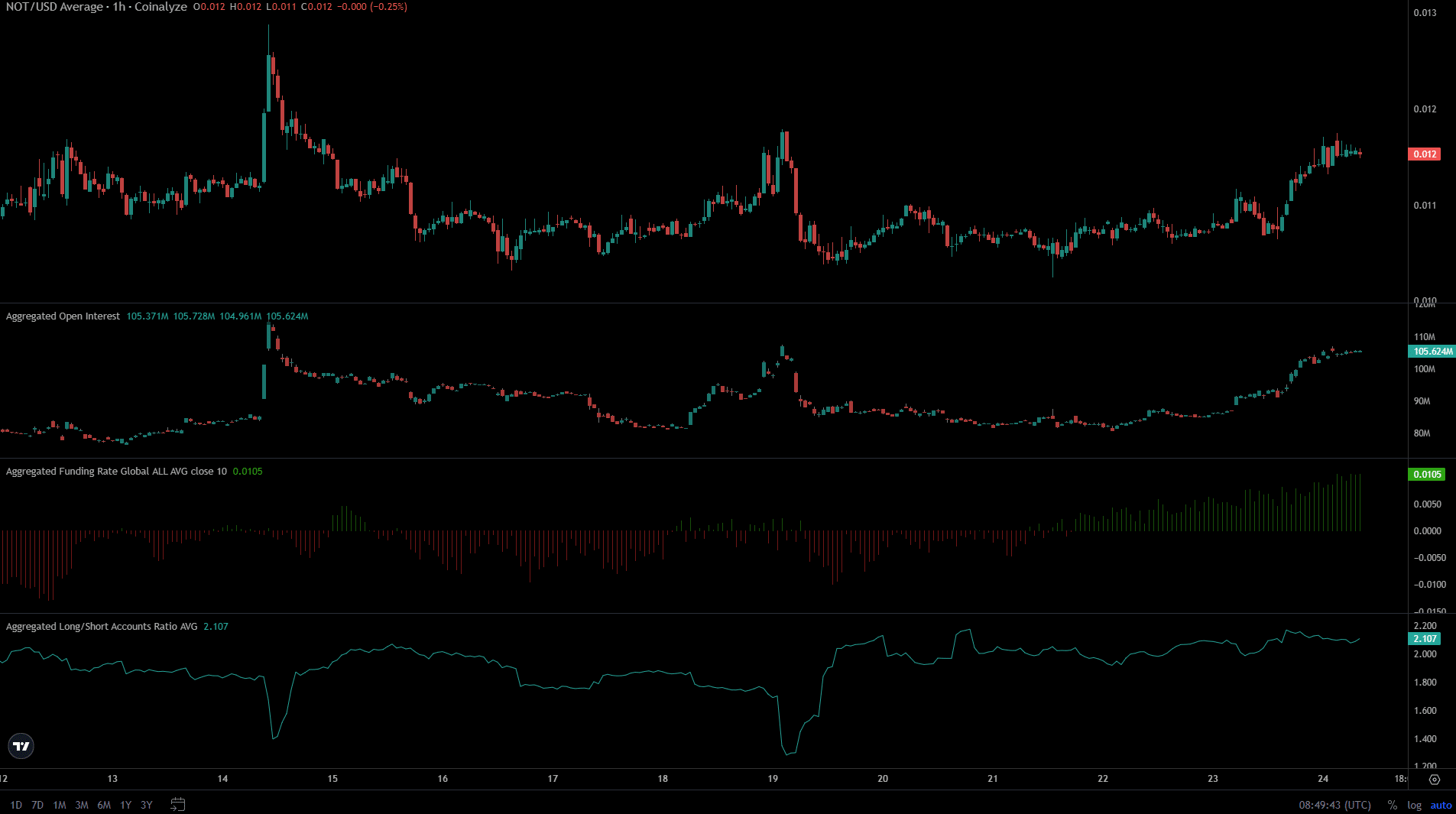

Source: Coinalyze

The funding rate seemed to be steadily climbing to indicate that the long trade was increasingly popular. The long/short ratio also stood above 2 to signify hefty bullish expectations.

They did not signal a reversal is due or that the market is overextended, but captured the firm bullish sentiment in the Futures market.

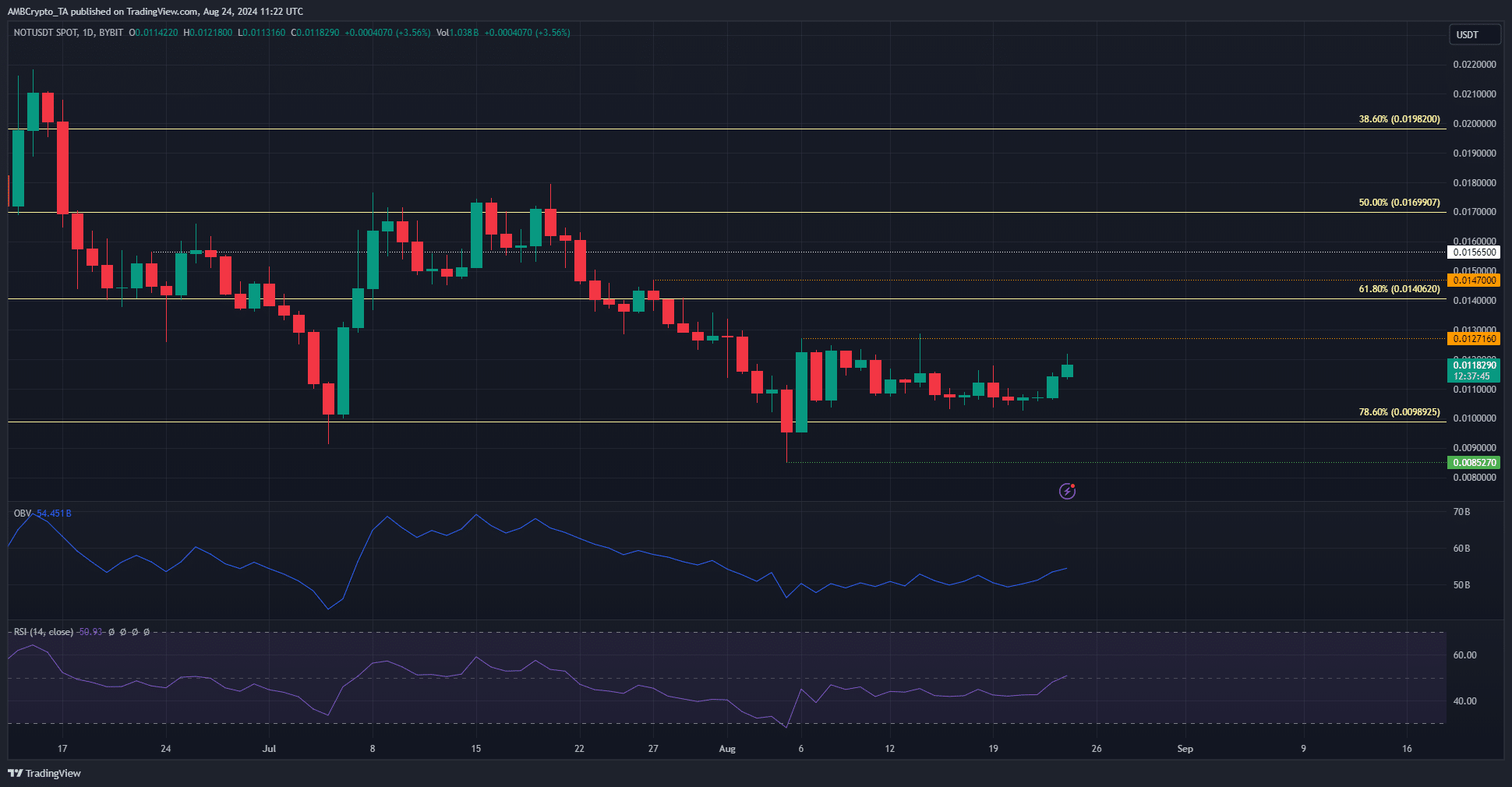

Zooming out to the 1-day timeframe, we can see that the market structure was still bearish at press time. The $0.0127-level marks the recent lower high that Notcoin must break to flip the market structure bullishly.

Read Notcoin’s [NOT] Price Prediction 2024-25

The OBV has climbed since 5 August and signaled that such a market structure shift is likely. The daily RSI had a reading of 50.9 and could be an early signal of the momentum shift in the Notcoin market.