Now that Cardano’s load is at 94% users can expect this in the near future

- As of 8 May 2023, Cardano’s load stood at 94% and was expected to hit 100% in the near future

- Furthermore, at press time, most traders favored shorter positions which wasn’t a good sign

Cardano [ADA], just like most cryptocurrencies in the market, witnessed a downfall over the weekend (6-7 May). However, as per Sebastian Guillemot, co-founder of dcSpark and contributor to the Cardano platform, Cardano’s load stood at 94% as of 8 May 2023. What does this mean for Cardano and ADA in the near future? Let’s find out…

Cardano is currently at 94% load!

Only 6% left until Cardano is at max capacity

What does that mean, and how can you be prepared ? pic.twitter.com/1TZsIUg10N

— Sebastien Guillemot (@SebastienGllmt) May 8, 2023

How much are 1,10,100 ADAs worth today?

Some specifics to know here…

The Cardano contributor stated that all transactions on the network were processed on a first-come first-serve basis. However, upon hitting the 100% load, transactions would be queued up and users may have to wait for their transactions to go through.

Additionally, the higher the load after 100%, the longer the transaction wait time. Another outcome of the load hitting 100% would be that stake pools could sell priority access to users and dApps. They may also reach a point where they could prioritize one DEX over another.

Addressing the age-old issue of whether the blockchain was in a better position than in 2021, the executive stood in an affirmative position. Furthermore, the exec stated that block sizes could be increased and tiered fees could be introduced.

Next question: are we actually better off than in 2021?

Yes! Actually, a lot of the scalability roadmap from 2021 has been implemented

Of course, there is more that can be done pic.twitter.com/N2tFJcok7E

— Sebastien Guillemot (@SebastienGllmt) May 8, 2023

Guillemot also stated that Cardano could improve its overall scalability.

Will ADA fend off the bears?

At the time of writing, the news didn’t show any impact on the performance of ADA. The altcoin was exchanging hands at $0.363 and was down by 4.12% in the last 24 hours.

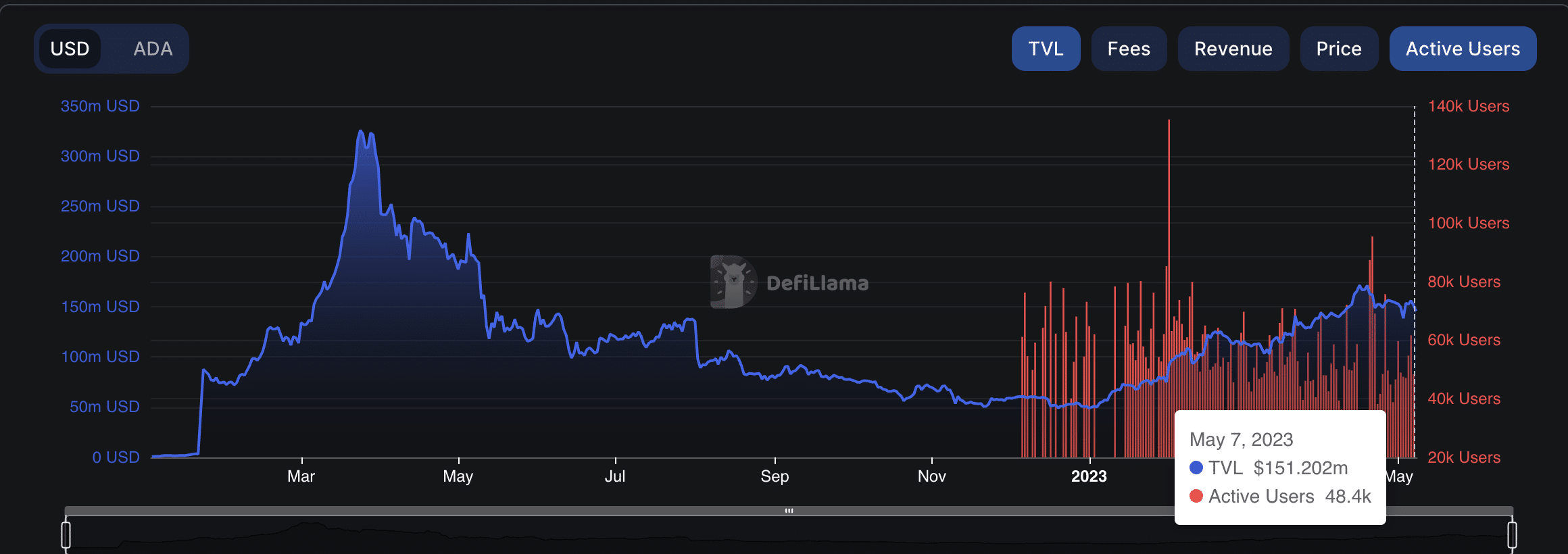

Additionally, the altcoin was trading 5.75% lower over the last seven days. Furthermore, data from DefiLlama showed that, at press time, ADA’s Total Value Locked (TVL) stood at $145 billion.

Is your portfolio green? Check the Cardano Profit Calculator

ADA’s TVL dropped by 3.6% over the last 24 hours. The number of active users on the network also witnessed a decline. Furthermore, as of 7 May, the number of active users stood at 48.4k and was more so in the same area as compared to the last few days.

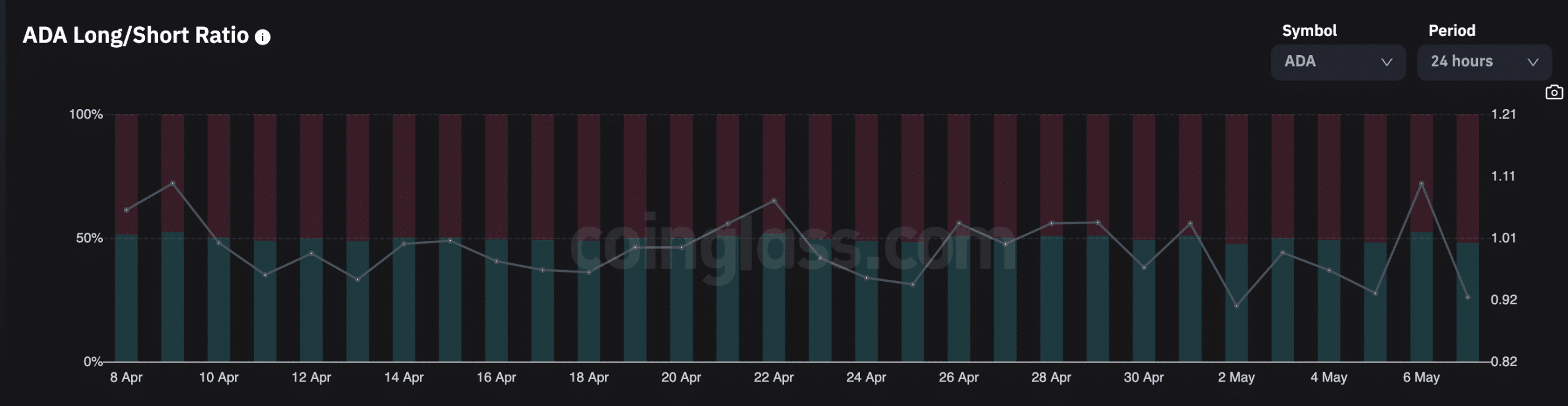

Additionally, as per data from CoinGlass, ADA’s long/short ratio didn’t exactly paint the best picture. The narrative could be deemed as bearish since most traders favored shorter positions, especially over the last two days.

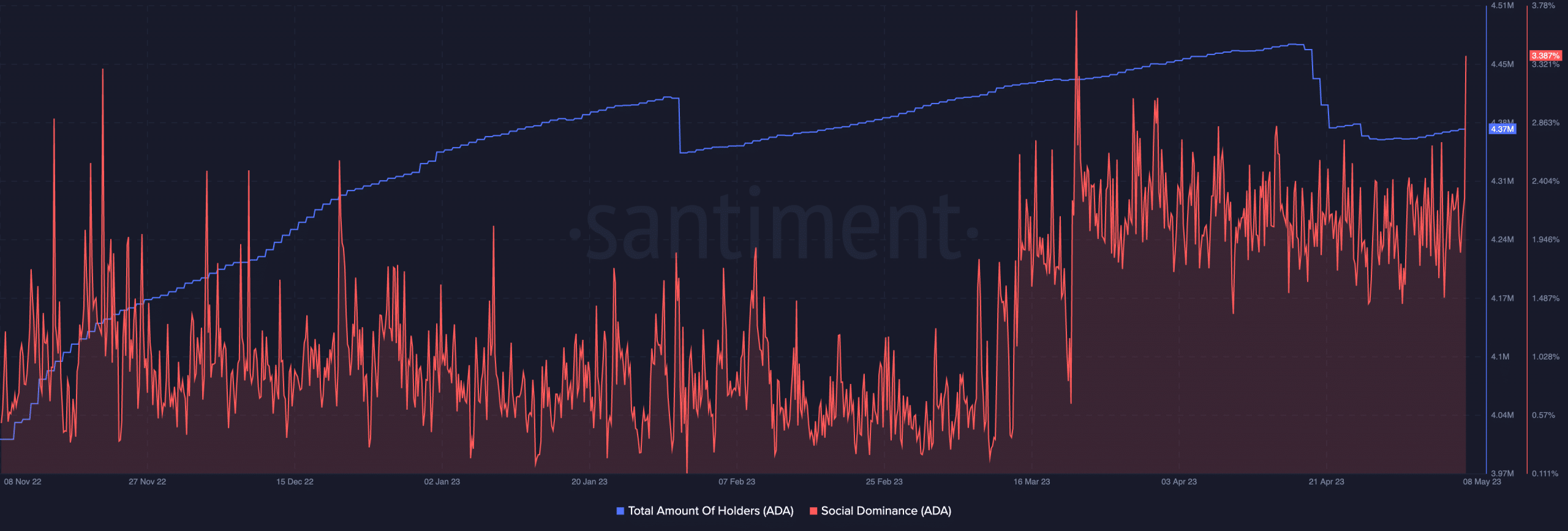

Data from Santiment also revealed that the total amount of ADA holders witnessed a fall since the end of April. The press time number of 43.7 million did show a slight increase in the last few days but couldn’t be considered significant enough for a bullish narrative.

However, ADA’s social dominance skyrocketed and reached its second-highest peak over the last three months. This indicated that there was much chatter about the chain on the social front. However, ADA will have to do much more than just be the talk of the town to reverse its ongoing bearish narrative.