Odds of Bitcoin, Ethereum starting October on a positive note are…

- BTC and ETH saw a surge in long liquidation volume with the price drop in the last trading session.

- The assets have started the new month with positive moves.

Bitcoin [BTC] and Ethereum [ETH] ended September on a volatile note, with both assets experiencing declines. Short-position traders dominated the market, driving long liquidation volumes higher.

Despite these drops, the absence of a significant sell-off indicates a positive sign for the market.

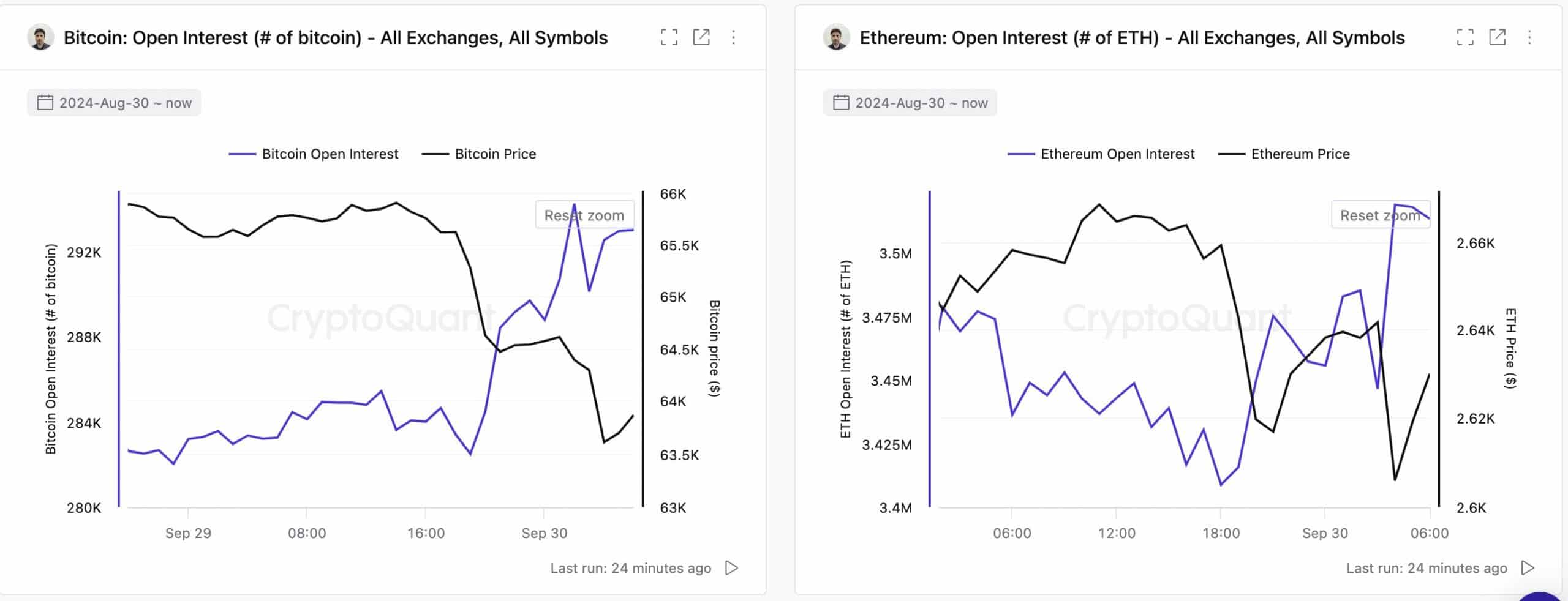

Bitcoin and Ethereum open interest declines

According to CryptoQuant, Bitcoin and Ethereum’s open interest (OI) saw notable declines during the last trading session. Bitcoin’s open interest dropped from $18.6 billion to $18.1 billion, indicating that traders were closing futures positions.

This decrease in OI generally signals lower liquidity, volatility, and interest in derivatives trading, which can potentially lead to a long/short squeeze.

Similarly, Ethereum’s open interest also saw a slight decline, though less significant than Bitcoin’s. As of now, BTC’s open interest has bounced back to $18.3 billion, and ETH’s OI has risen to $9.4 billion, reflecting renewed market activity.

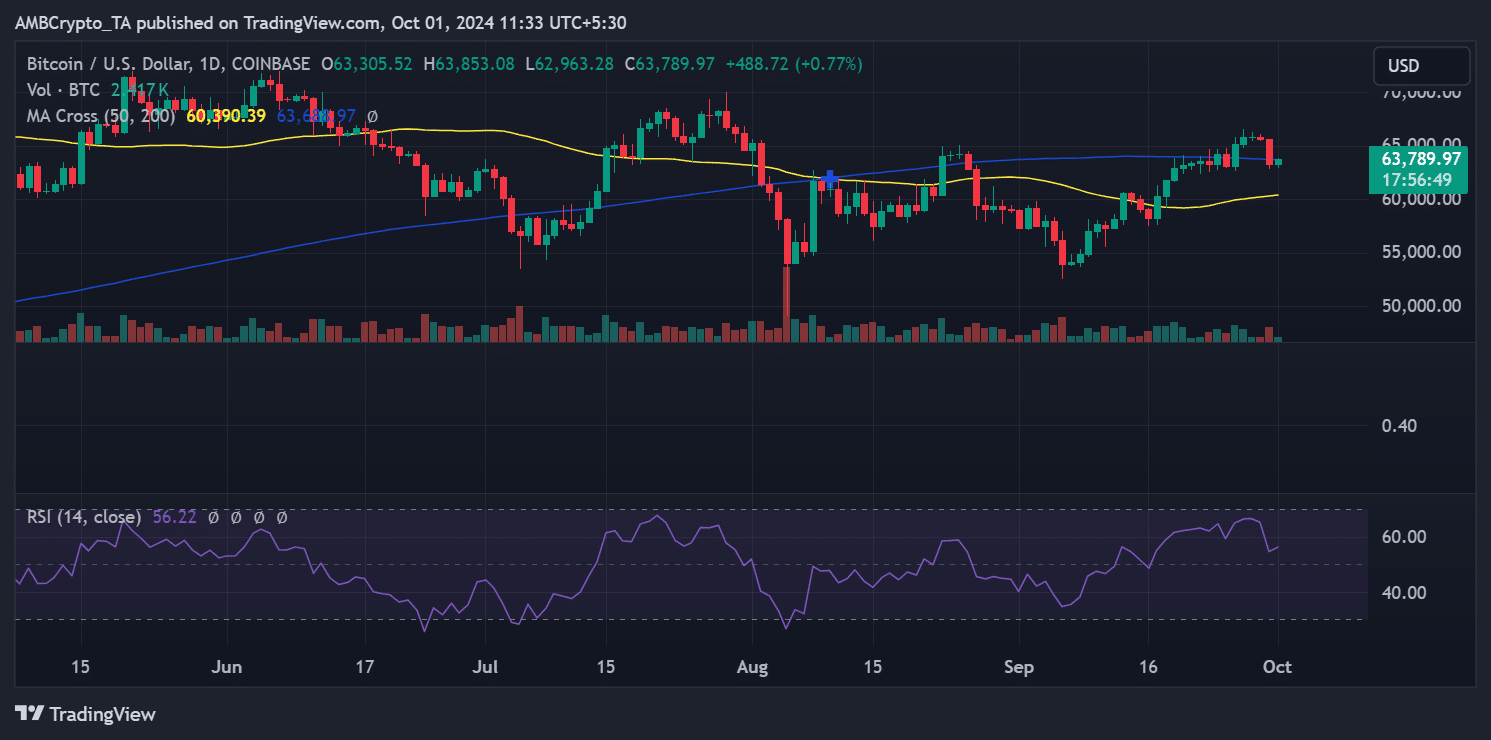

Bitcoin and Ethereum prices follow OI trends

The drop in open interest had a direct impact on both Bitcoin and Ethereum prices. Bitcoin experienced a 3.50% decline, falling from $65,600 to $63,301, dipping below its 200-day moving average.

Similarly, Ethereum dropped by 2.13%, from $2,657 to $2,601, staying below its 200-day moving average but still above the 50-day moving average.

As of this writing, both assets have shown a slight rebound. Bitcoin was trading at $63,789 with a 0.7% increase, while Ethereum gained over 1%, trading around $2,639.

Exchange flows remain stable

Despite the recent declines, there hasn’t been a significant sell-off. Data from CryptoQuant shows that Bitcoin recorded a negative exchange flow, indicating a balanced flow of BTC between exchanges and personal wallets.

On the other hand, Ethereum saw a slight increase in exchange inflows, with 14,000 ETH flowing into exchanges during the last trading session.

However, this volume wasn’t enough to trigger a major sell-off. Currently, the flow has turned negative again, with over 23,000 ETH being withdrawn from exchanges, signaling reduced selling pressure.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

While Bitcoin and Ethereum faced notable declines in the final days of September, the lack of a major sell-off and the slight price rebound suggest a relatively stable market.

Open interest trends and exchange flows indicate that investors are not rushing to exit their positions, showing potential for recovery in the near term.

![DEX Token Jupiter [JUP] promises volatility in the short-term despite steady network activity, sentiment](https://ambcrypto.com/wp-content/uploads/2025/08/Jupiter-Featured-400x240.webp)