ONDO forms ‘strong low’ at $0.58 – Mapping its road to $1.20

- The daily chart indicates a potential higher low forming around the $0.6500 level, a key accumulation zone.

- ONDO’s partnership with BlackRock to tokenize U.S. Treasury assets solidifies its position as a fundamentally strong crypto project.

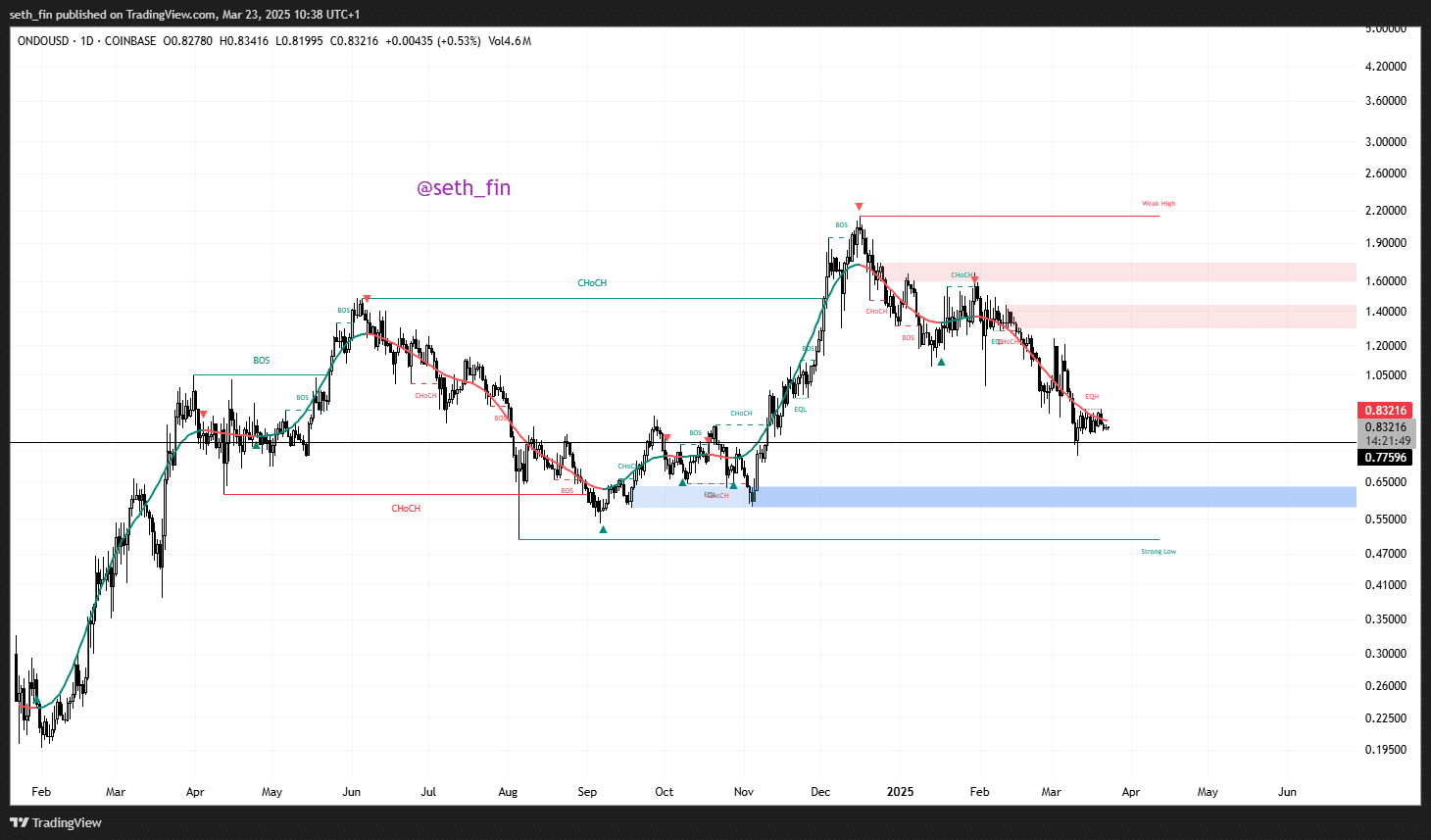

The Ondo [ONDO] daily chart indicates a potential higher low forming around the $0.6500 level, a key accumulation zone. After rallying to a peak near $1.4000 in late 2024, ONDO underwent a correction, falling to $0.83216, at press time.

A crypto analyst highlights a “Strong Low” at $0.5800, with the price now testing support between $0.6500 and $0.83216.

The formation of a higher low indicates weakening selling pressure and suggests a potential trend reversal. If ONDO surpasses the $0.9500 resistance level, bullish momentum could propel its price toward $1.20.

This pattern mirrors ONDO’s previous rebounds from accumulation zones, further supporting its potential for upward movement if market sentiment strengthens.

ONDO’s fundamental strength

ONDO’s partnership with BlackRock to tokenize U.S. Treasury assets underscores its strength as a leading crypto project. Tokenization enables fractional ownership and improves liquidity, effectively bridging traditional finance and blockchain.

BlackRock’s involvement adds significant credibility, drawing institutional interest and bolstering ONDO’s role in real-world asset (RWA) tokenization.

By offering on-chain access to stable, yield-generating assets, ONDO addresses the growing demand for DeFi solutions that integrate traditional financial instruments. Its regulatory compliance and institutional-grade infrastructure further enhance its appeal.

As RWA adoption grows and DeFi evolves, the altcoin is well-positioned for sustainable long-term growth.

Investor sentiment and market positioning

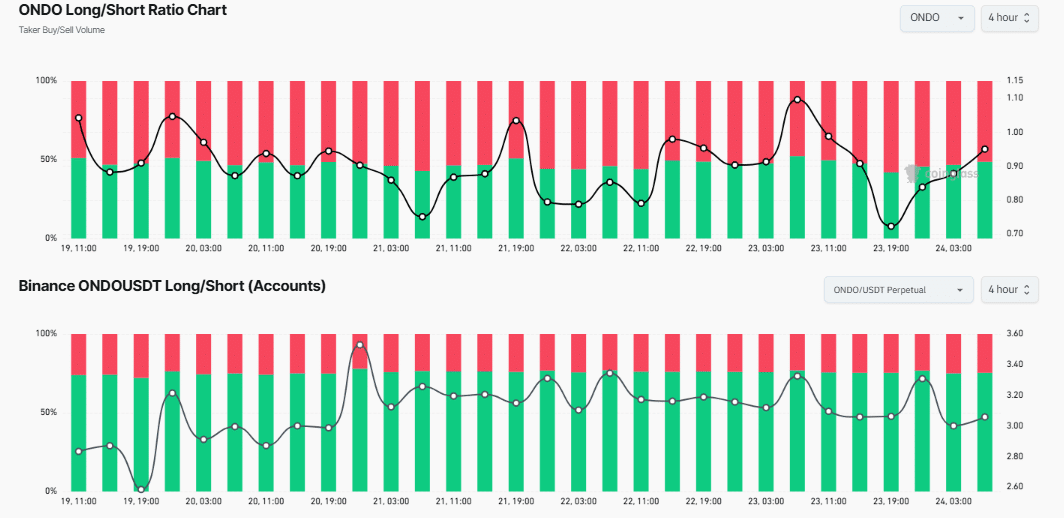

ONDO’s Long/Short Ratio revealed balanced sentiment among investors. At the time of writing, the ratio stood at 0.90 on Binance, with perpetual contracts slightly higher at 1.00.

The past week saw fluctuations between 0.70 and 1.15, reflecting market indecision as ONDO consolidates near its accumulation zone.

A slight increase in long positions reflects cautious optimism, aligning with the higher low formation on the price chart. However, the lack of a clear directional bias indicates that traders are waiting for confirmation of a reversal before committing to significant positions.

This mirrors the broader market’s consolidation phase, highlighting the importance of clear breakout signals for a decisive trend to emerge.

Overall, ONDO’s price movement, strong fundamentals, and investor positioning suggest the project is at a critical juncture. The formation of a higher low points to a potential trend reversal, while its partnership with BlackRock reinforces its long-term viability.

If ONDO maintains support and breaks resistance, it could gain renewed momentum, consistent with historical trends and broader market dynamics.