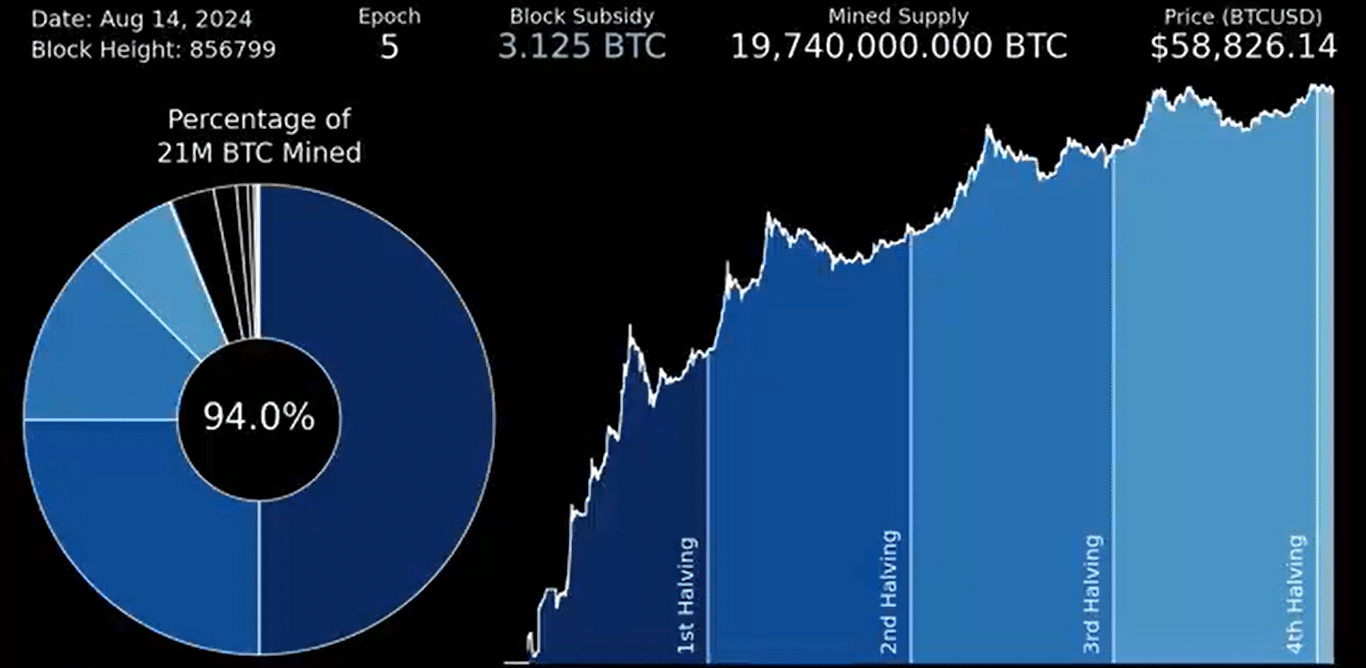

Only 6% Bitcoin remains unmined: What does this mean for BTC?

- Only 6% of Bitcoin’s total supply remains to be mined, as the U.S. moved 10000 BTC

- Bitcoin’s heat map showed the compression as market risk decreased.

Recent interest from major global governments and big financial firms has boosted the crypto market, especially Bitcoin [BTC].

After the April 2024 halving event, Bitcoin’s supply reduced, leaving just 6% unmined, as Bitcoin News noted on X (formerly Twitter).

Analysts have predicted that by 2030, less than 1% of Bitcoin will be available for mining. This realized scarcity is expected to drive Bitcoin’s price higher as demand increases.

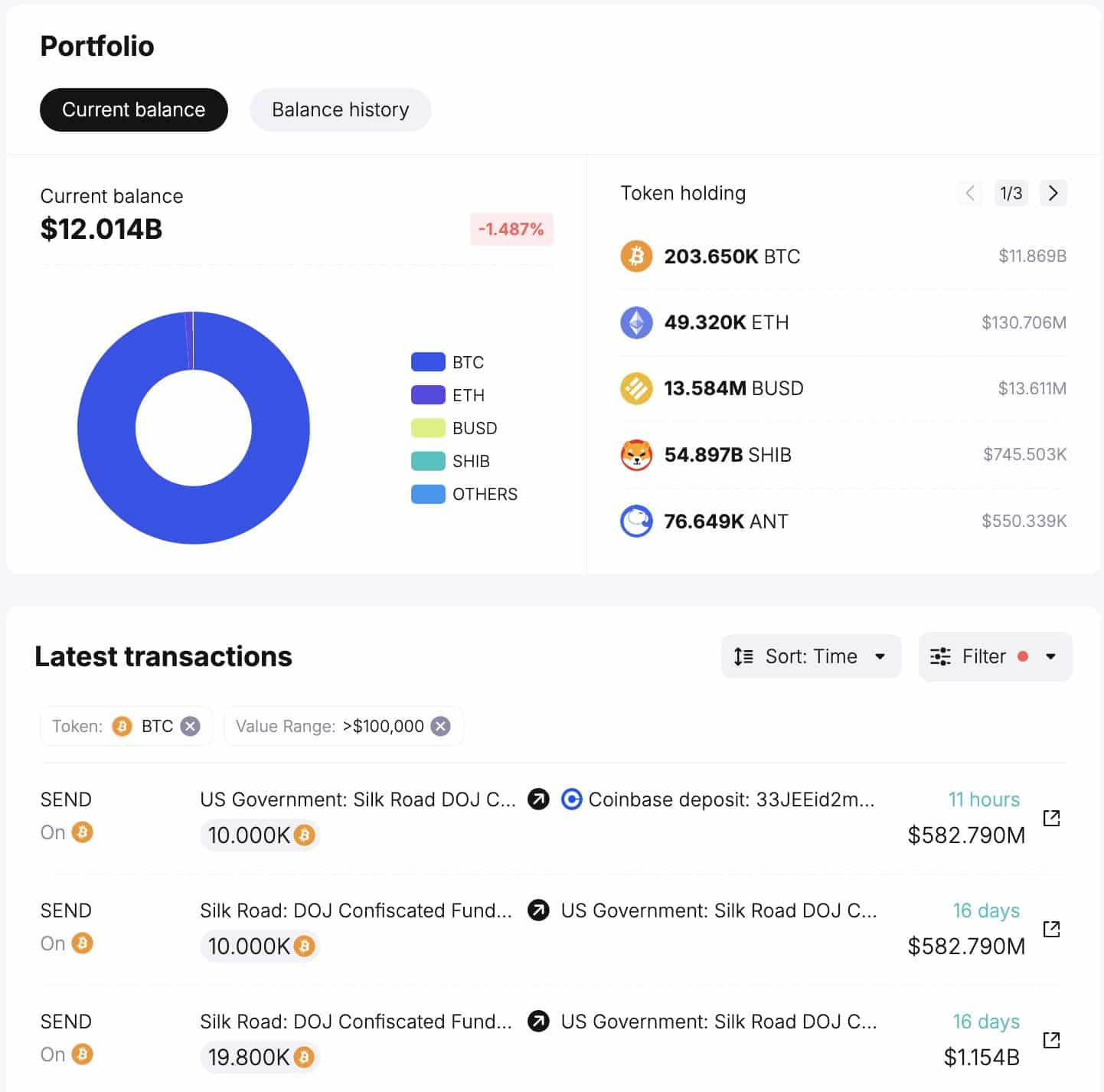

Additionally, the U.S. government recently transferred 10,000 BTC ($540 million) to Coinbase, adding to the 15,999 BTC ($966.5 million) already deposited this year at an average price of $60,410.

The government still holds around 203,600 BTC, valued at $11.9 billion. This activity is likely to influence Bitcoin’s price, potentially driving it higher.

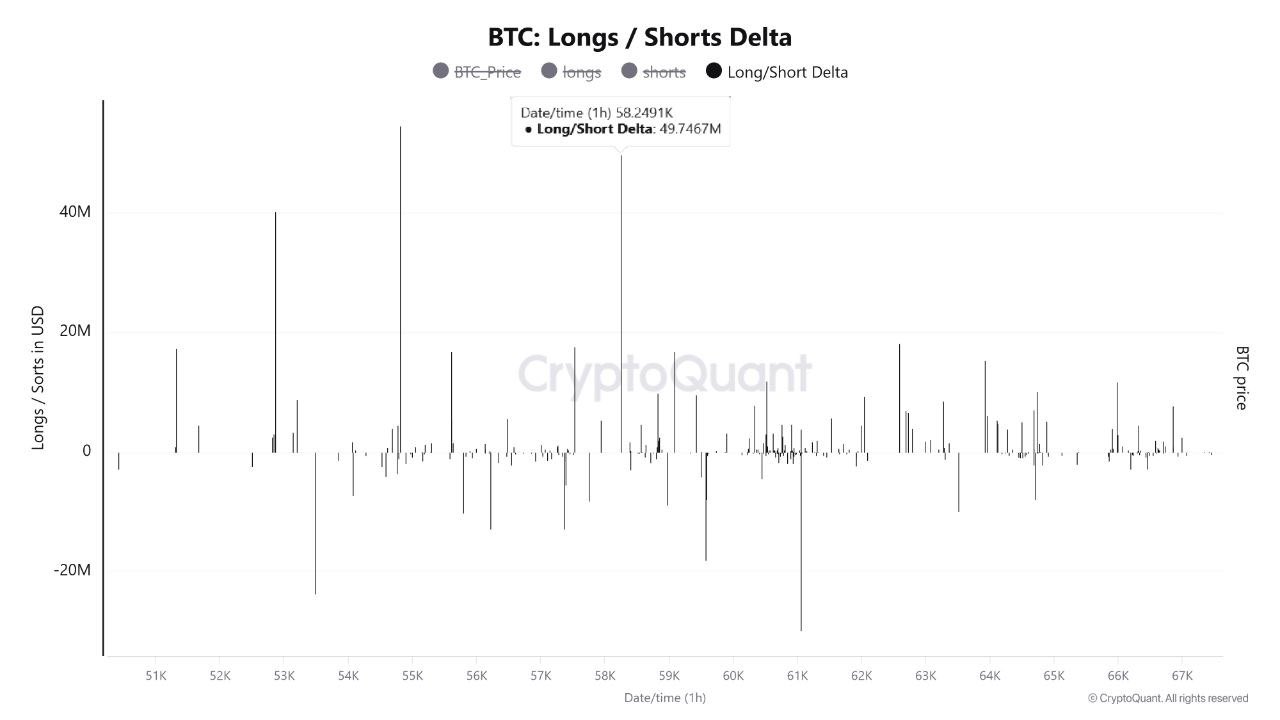

BTC longs/shorts delta

Bitcoin recently found its first support level after a brief market dip that saw a significant sell-off of long positions, indicating a bearish trend.

However, as the long liquidations eased, Bitcoin’s price began to recover and was now positioned for further gains.

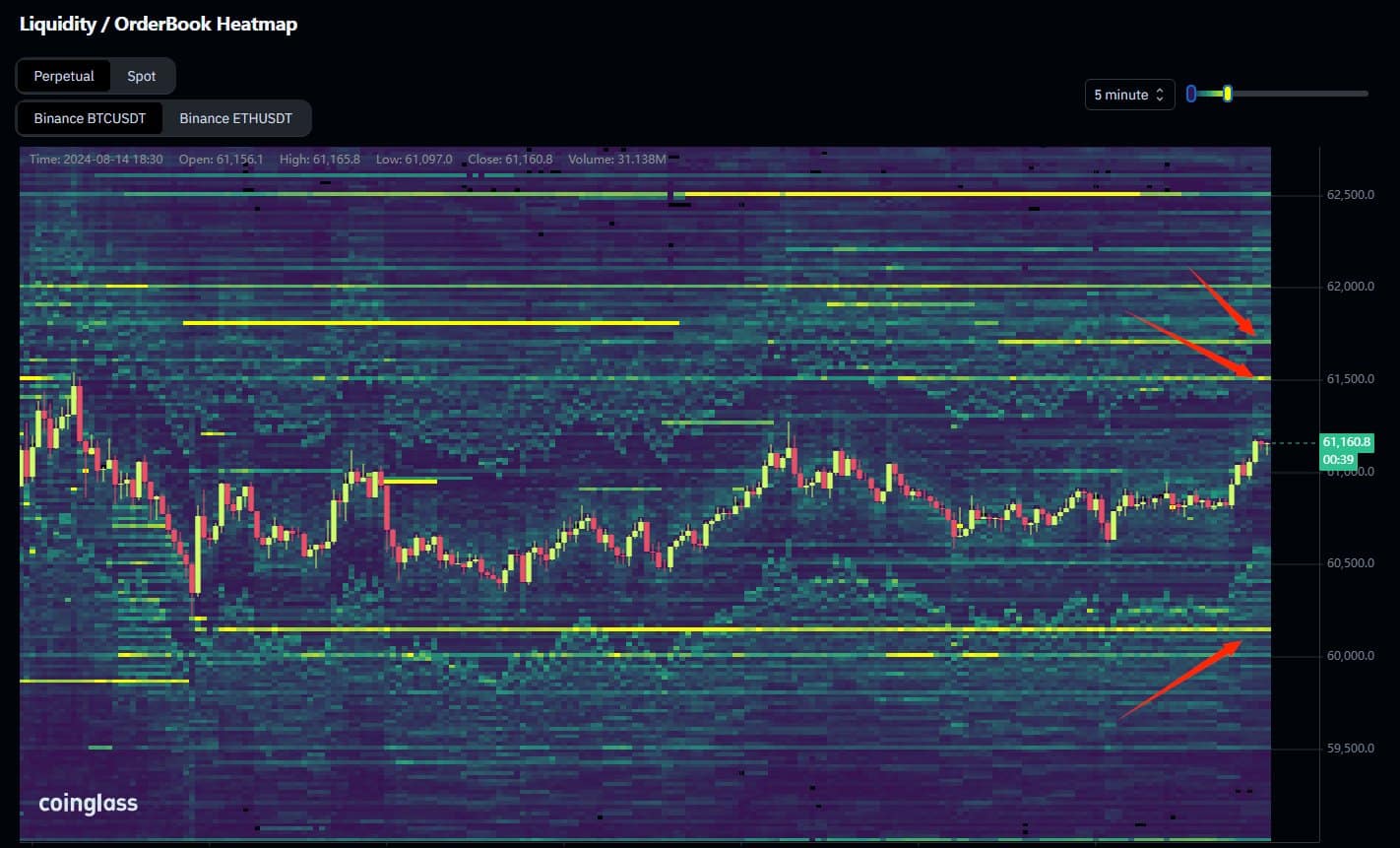

Bitcoin heat map showing the compression

Bitcoin’s heat map was showing a compression within a tight range of $58K to $61K at press time, while the negative Funding Rates indicated increased short interest from retail traders, a sign of reversal.

The consolidation suggested a potential breakout as Bitcoin geared up for higher prices, especially as the market approaches Q4 of 2024.

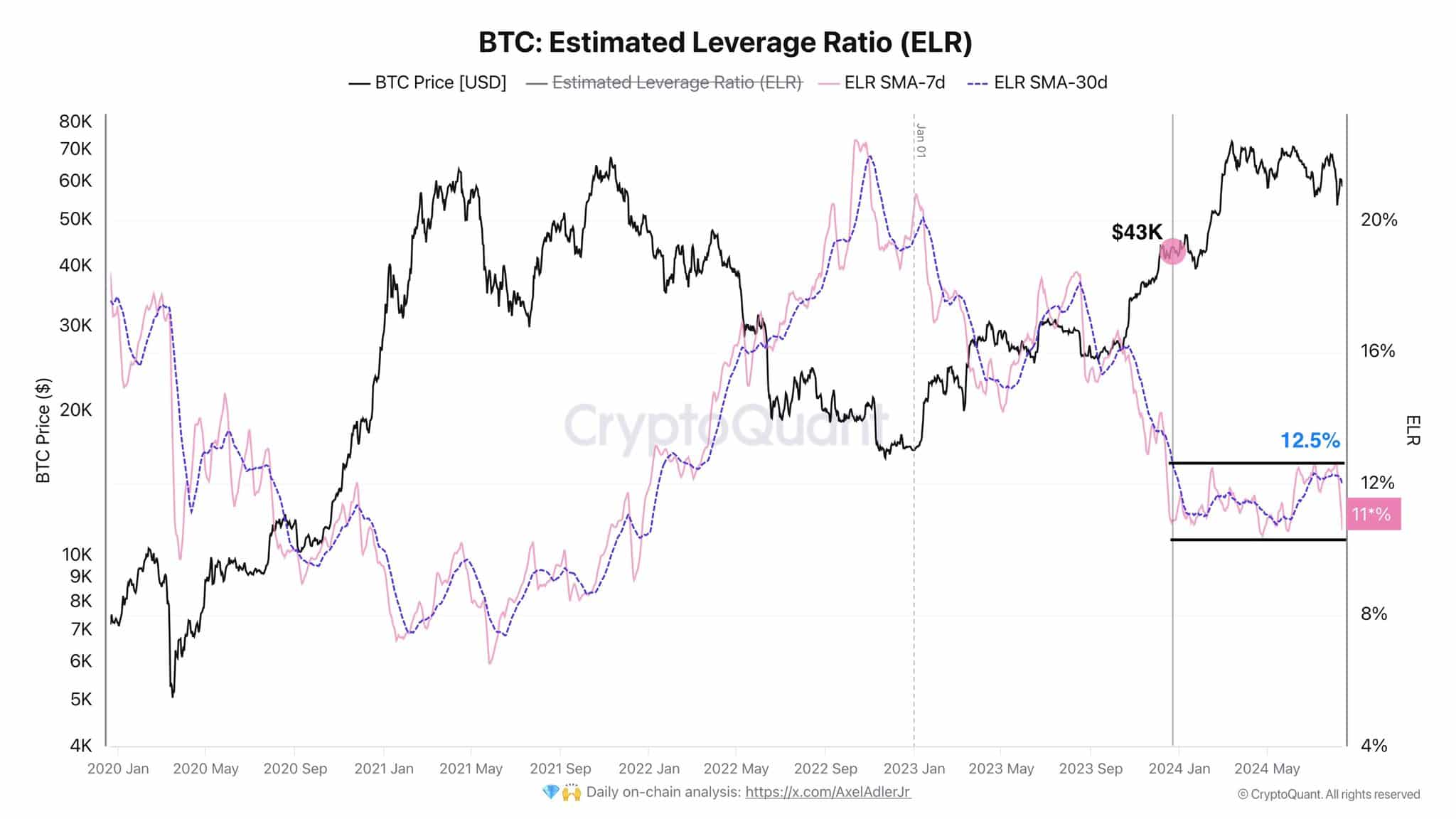

Average weekly ELR shows decrease in market risk

The average weekly Estimated Leverage Ratio (ELR), which measures the ratio of open interest to exchange reserves, has dropped by 1.5%.

The decline suggested that the market risk was decreasing, or traders were becoming more cautious, signaling that BTC is set to pump.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin repeating 2016’s action?

In mid-2016, Bitcoin surged before halving events but dropped sharply afterward, reaching new lows and leading to predictions of a bear market.

However, Bitcoin reversed its course at the end of Q3, leading to a strong upward trend. This pattern was repeating at press time, and Bitcoin s expected to rally again when liquidity increases in late Q3 or early Q4 2024.