OpenSea’s poor March – What’s going on with NFTs?

- NFT sales volume has dropped by 4% since the beginning of March.

- The month has also seen a decline in the performance of Blue-Chip NFTs.

Leading non-fungible token (NFT) marketplace OpenSea is poised to close March with a decline in its monthly NFT sales volume.

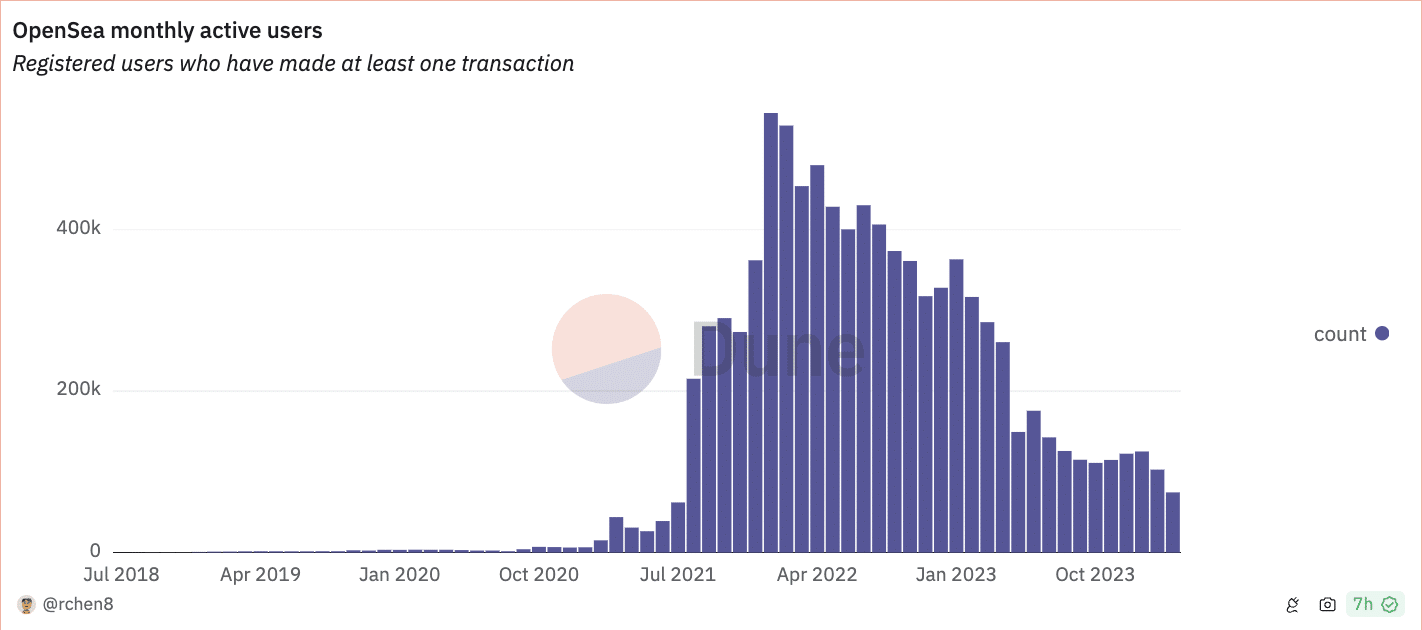

According to data from a Dune Analytics dashboard prepared by Rchen8, NFT sales on the marketplace in the past 28 days have totaled $147 million, representing a 4% decline from the $153 million recorded in February.

The fall in OpenSea’s sales volume is due to the steady decline in user activity on the marketplace since the beginning of the year. So far this month, 75,000 active users have completed at least one transaction on OpenSea.

This marked a 27% drop from the 103,000 active users recorded in February and a 40% decrease from January’s 125,000. According to the Dune Analytics dashboard, March represents OpenSea’s lowest monthly user count since July 2021.

Due to the fall in user activity on the marketplace so far in March, the monthly count of NFTs sold on OpenSea has plummeted to its lowest year-to-date.

In the last 28 days, the number of NFTs sold on OpenSea has totaled 123,000. This has marked a 38% drop from the 199,000 total NFTs sold on the marketplace in January, representing the marketplace’s lowest monthly count since May 2021.

Interestingly, despite the low user activity and sales volume on OpenSea this month, the platform’s monthly fees derived from primary transactions and royalties have risen to their highest since the beginning of the year.

In the last 28 days, fees from primary transactions and royalties have each amounted to $4 million.

Blue-Chip NFTs in Q1 2024

The first two months saw a rise in activity in the NFT vertical of the ecosystem. This manifested in the growth of floor prices for several NFT collections.

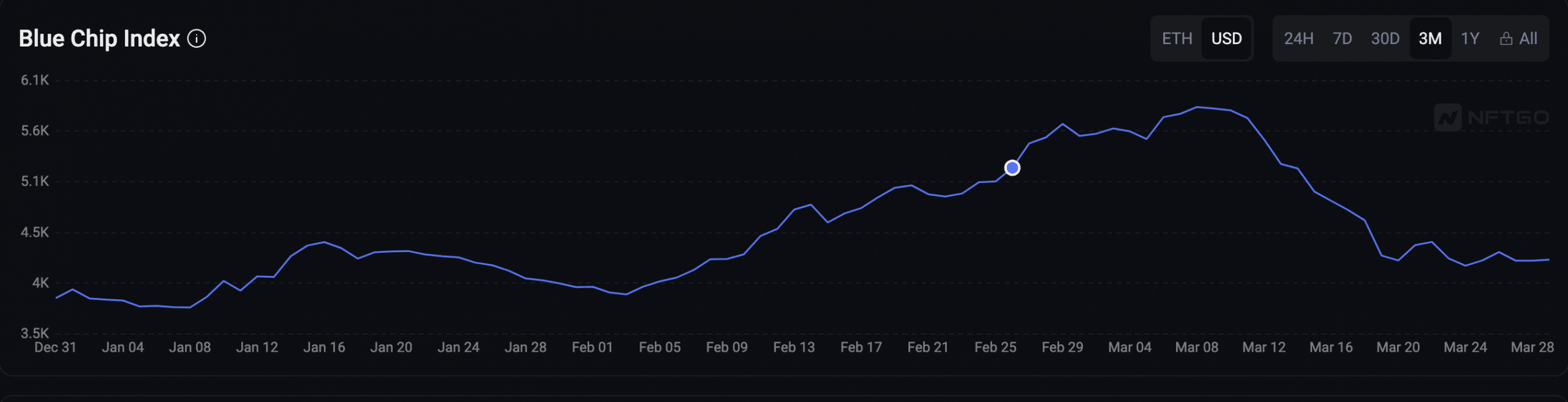

Regarding Blue-Chip NFTs, their values climbed between January and February. These are NFT collections characterized by their high floor price, strong community, and potential for future utility.

However, according to NFTGo’s data, the Blue-Chip Index, which measures their performance, peaked at 5,800 ETH on 8 March and has since initiated a decline.

At 4,263 ETH at press time, the 27% decline in the Blue-Chip Index recorded in the past three weeks suggested a decrease in the performance of top NFT collections since then.