OpenSea makes major changes in its marketplace policy, thanks to Blur

- OpenSea slashed marketplace fees temporarily, and royalties were made optional.

- Its competitor Blur captured almost half of the total volume across all marketplaces.

Popular NFT marketplace OpenSea announced that it will cut its 2.5% service fee on sales for a limited period of time and will move towards optional creator royalties, as the competition among NFT marketplaces heats up.

We’re making some big changes today:

1) OpenSea fee → 0% for a limited time

2) Moving to optional creator earnings (0.5% min) for all collections without on-chain enforcement (old & new)

3) Marketplaces with the same policies will not be blocked by the operator filter— OpenSea (@opensea) February 17, 2023

OpenSea stated that it will enforce a minimum of just 0.5% creator royalty for all collections without on-chain royalty enforcement.

It also said that it will allow sales on NFT marketplaces like Blur with the same policies, going back on its earlier policy of blocking marketplaces that don’t honor royalty payments.

‘Blur’red path for OpenSea

Blur marketplace, which released its native token BLUR recently, has expanded at a rapid pace since its launch just four months ago. A combination of enticing marketplace rules, where it charges zero trading fees, and a marketing strategy of dropping BLUR tokens to boost activity on the platform, has threatened OpenSea’s dominance in the NFT marketplace landscape.

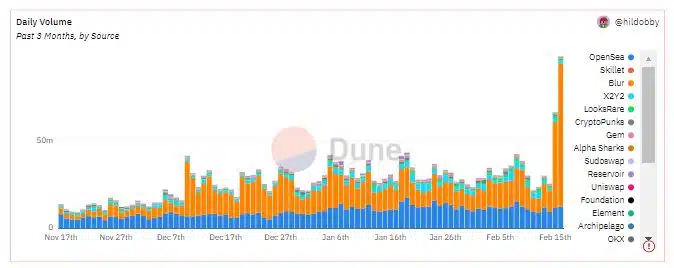

In fact, the daily trading volume on Blur increased by more than four times since the launch of Blur token, data from Dune Analytics revealed. Blur’s share of the total NFT trading volume remained above 70% since the launch, comfortably surpassing OpenSea.

OpenSea’s daily active users plunge

Blur’s gain has been OpenSea’s loss. As evident from data by Token Terminal, key indicators on OpenSea showed a decline. The daily active users on the marketplace nosedived from a monthly peak of 90.6k on 10 February to a little over 42k, at the time of writing.

OpenSea’s revenue has also been hit as more traders flocked to Blur, resulting in reduced transaction fees on the platform. With OpenSea effectively cutting off its primary source of revenue by dropping fees, it remains to be seen which other avenues would be explored to increase revenue.

How much are 1,10,100 BLURs worth today?

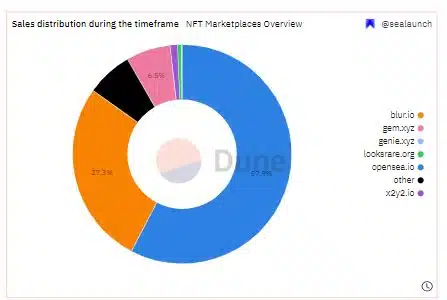

Interestingly, despite Blur’s popularity, OpenSea got the better of its competition when sales numbers were looked at. Data from Dune Analytics revealed that OpenSea enjoyed a 57% market share in overall sales counts.

This could be because it catered more to individual investors, unlike Blur which has pitched itself as the NFT marketplace for professional traders.