OpenSea sees a spike in Ethereum-based NFT sales, thanks to these factors

- Ethereum-based NFTs on OpenSea saw its highest monthly sales volume since August 2022.

- OpenSea saw increased activity in the last 30 days.

With Blue Chip non-fungible tokens (NFTs) collections at the forefront, the year has so far seen a resurgence of interest in profile-picture (PFP) NFTs.

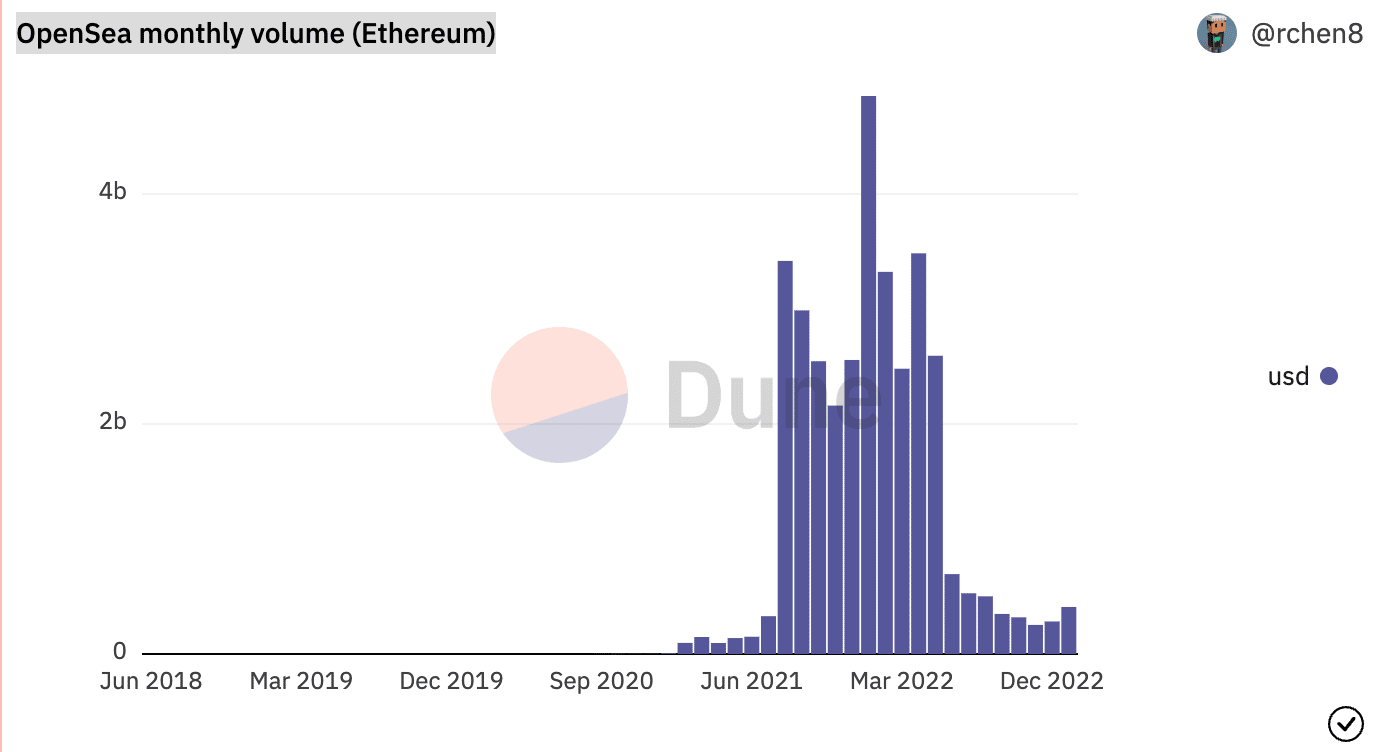

Ethereum-based NFT sales have soared to a four-month high on leading marketplace OpenSea, according to data from Dune Analytics. The monthly sales volume is expected to close the trading month at its highest level since August 2022.

So far this month, the sales volume of Ethereum-minted NFTs on OpenSea has totaled $409 million. This represented a 21% increase from the $283 million logged as sales volume at the end of 2022.

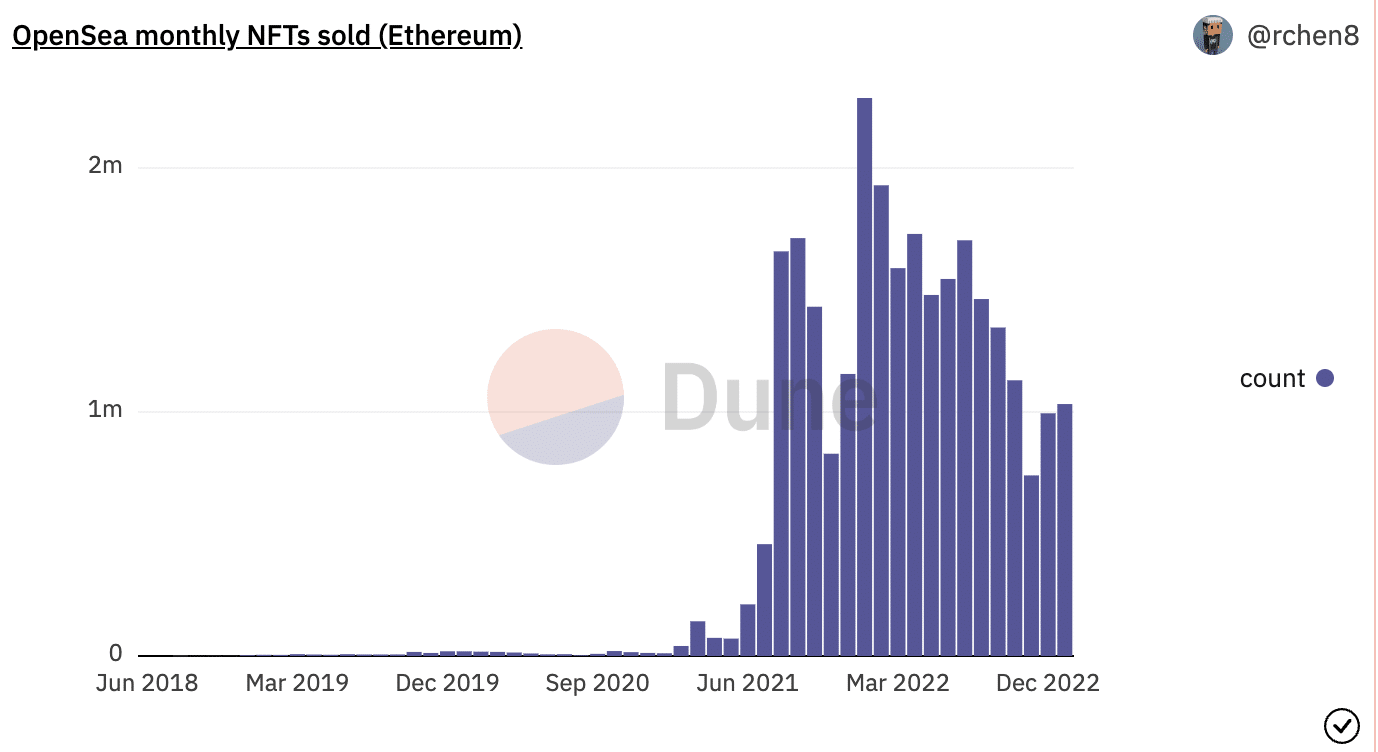

The recent increase in sales volume can be attributed to a surge in the number of Ethereum-based NFTs sold on the OpenSea marketplace.

In the last 28 days, 1.03 million Ethereum-minted NFTs have been sold on the leading NFT marketplace. According to data from Dune Analytics, this represented a two-month high in the sales count of Ethereum-based NFTs on OpenSea.

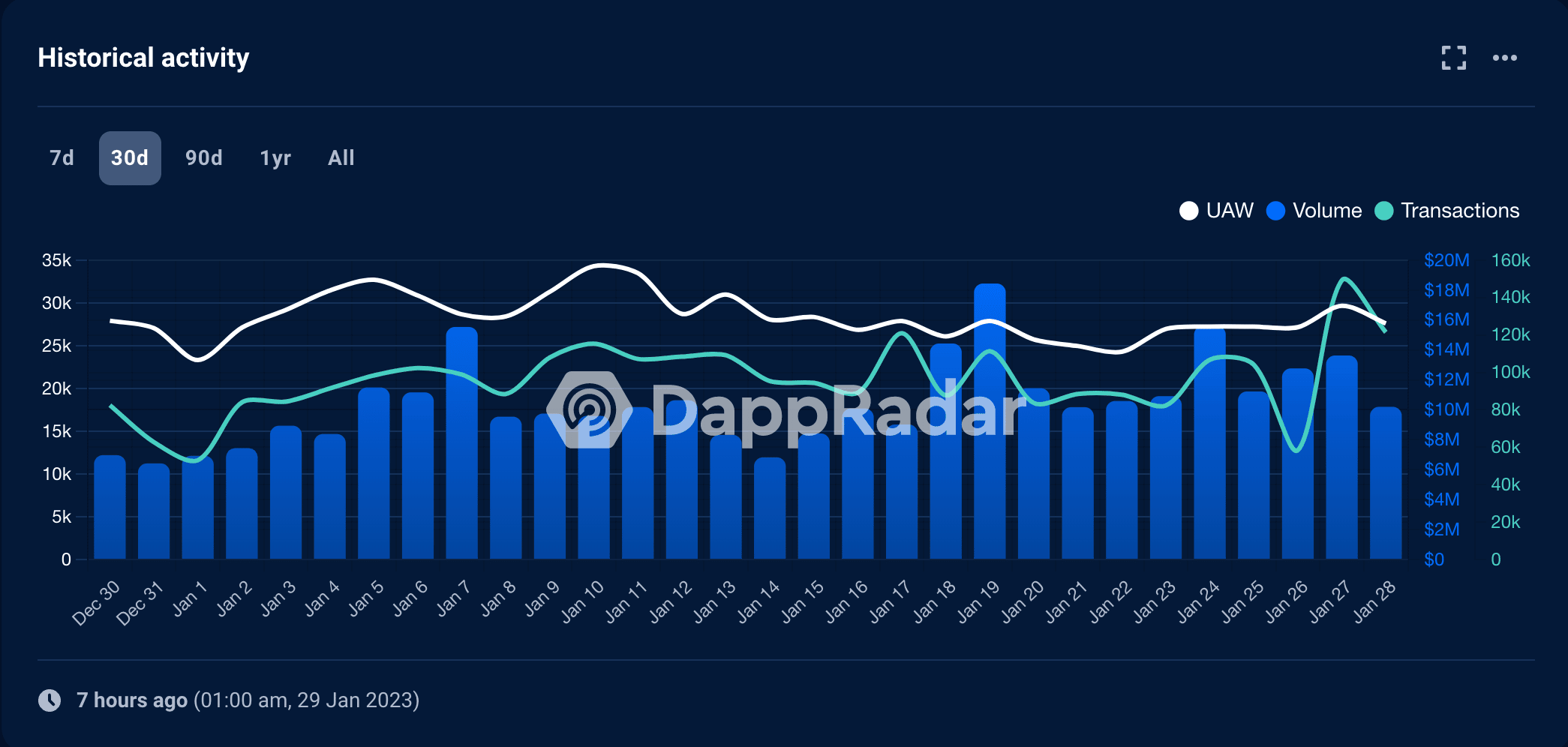

In addition to the surge in the sales volume and count of Ethereum-based NFTs on OpenSea, the marketplace itself has seen increased traction since the commencement of the 2023 trading year. Per data from DappRadar, in the last month, the transactions count on OpenSea grew by 9%.

The growth in transactions count of the decentralized application (dApp) resulted in a rally in sales volume. In the last 30 days, sales volume on OpenSea grew by 62%. All of these happened, despite the 1.21% decline in the count of unique active wallets within the period under consideration.

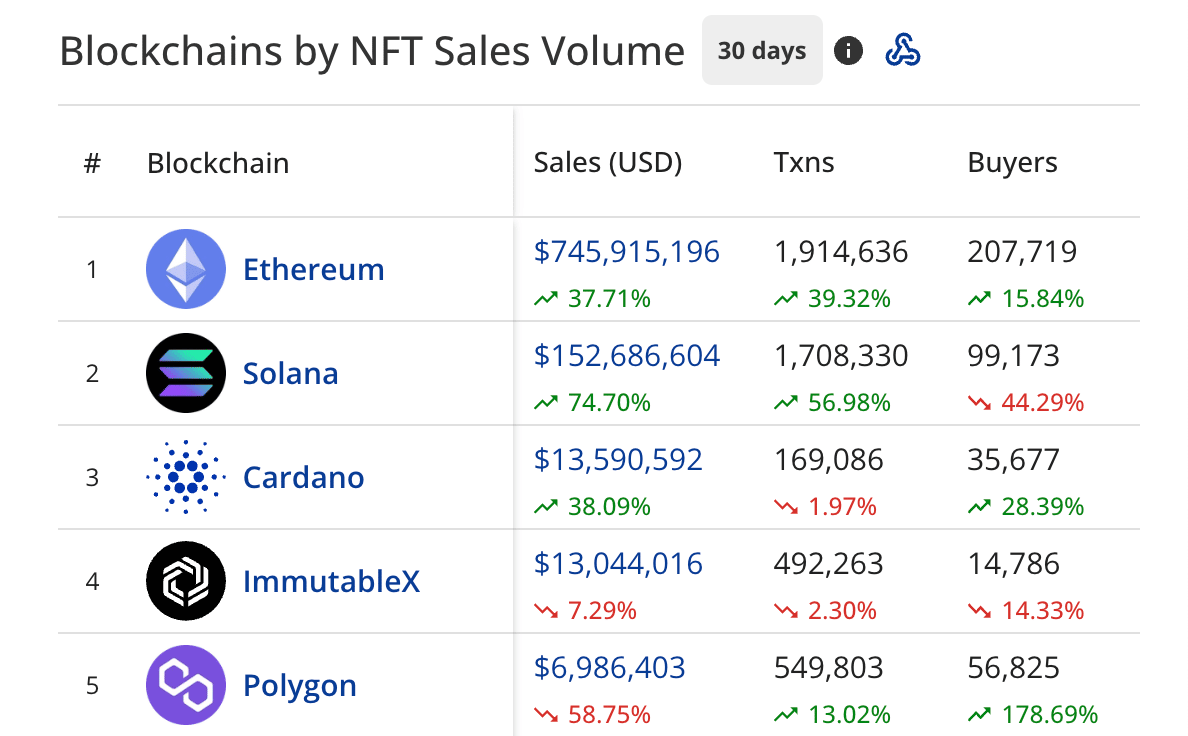

Ethereum is king

In the NFT vertical of the crypto ecosystem, Ethereum-based NFTs have seen the most sales in the last month. According to data from CryptoSlam, NFTs sales from the Ethereum chain in the last 30 days totaled $745 million.

Within this period, 207,719 buyers and 211, 813 sellers participated in 1.91 million sales transactions on the chain.

What is the market saying?

Blue Chip NFTs have grown in value since the year started. These NFTs are a subcategory of the broader NFT market that is of high quality and value. Examples include Bored Ape Yacht Club [BAYC], Mutant Ape Yacht Club [MAYC], Crypto Punks, and Meebits.

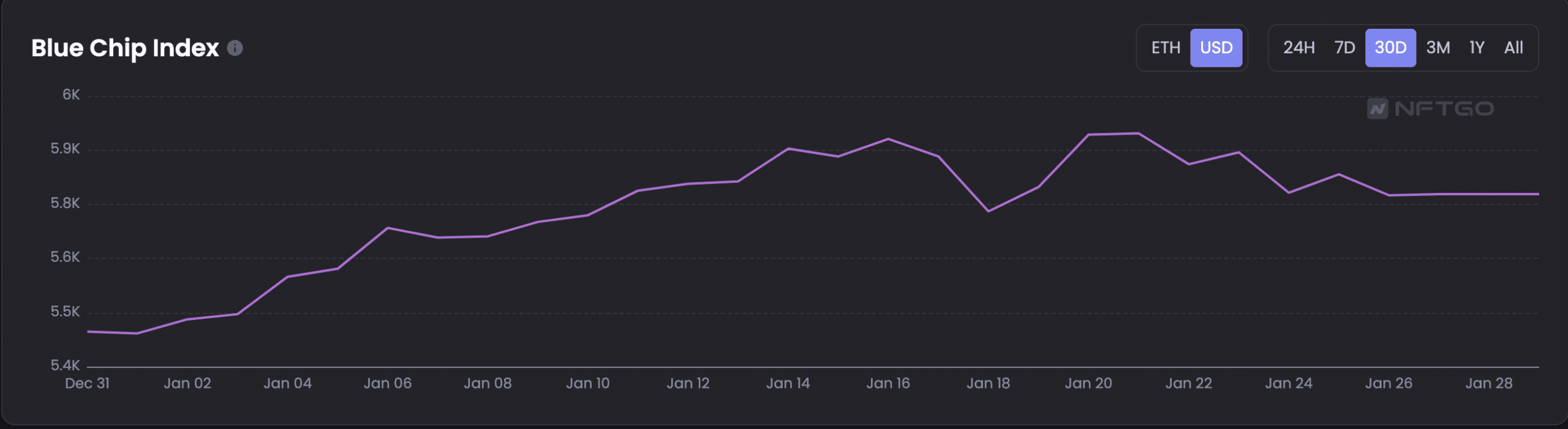

According to NFTGo, the Blue Chip Index is calculated by weighing the market capitalization of Blue Chip NFT collections to determine their performance. So far this year, the Blue Chip Index has climbed by 6%.

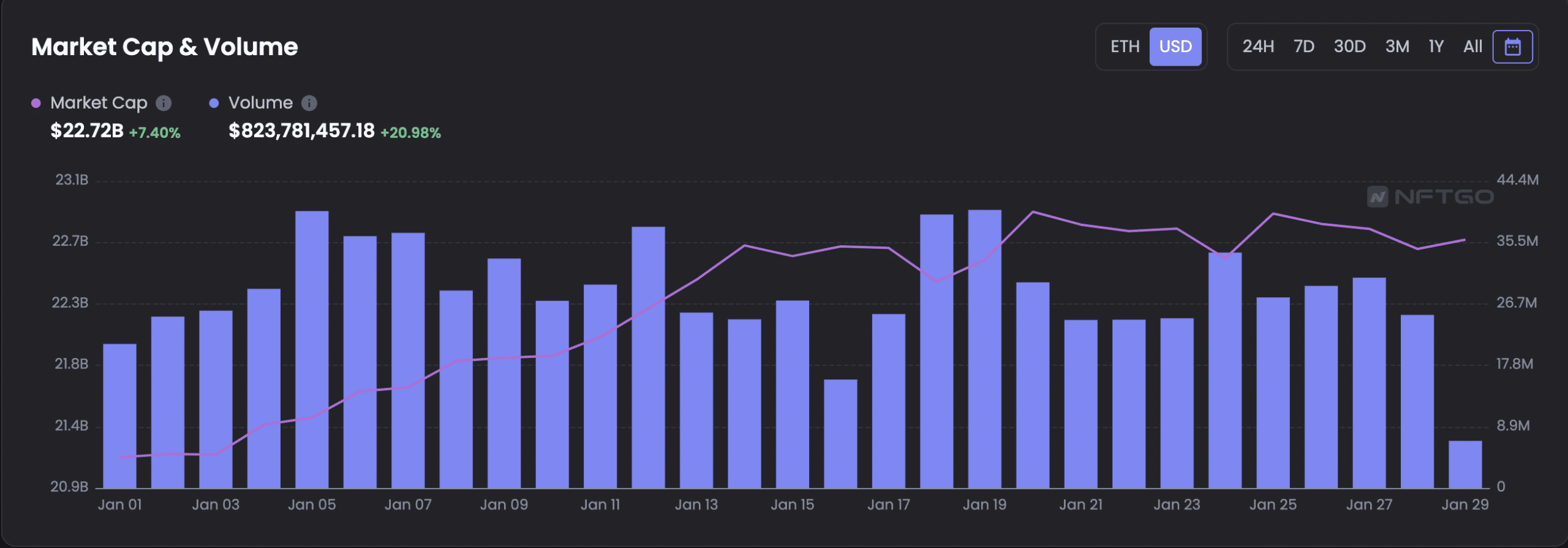

As for the general market, market capitalization and sales volume have gone up by 7% and 21%, respectively, in the past 28 days.