Optimism around PEPE rises: Key levels in focus

- Whale accumulation and a breakout from a falling wedge drive renewed bullish momentum.

- Onchain metrics and liquidation data reinforce confidence as PEPE eyes higher resistance levels.

Market excitement around Pepe [PEPE] is growing, driven by a whale’s massive $2 million purchase at $0.00001899.

This move has increased optimism about the token’s prospects, even as PEPE experiences a slight retracement. At press time, the token was trading at $0.0000192, down 3.93% in the past 24 hours.

Despite the pullback, traders remain focused on PEPE’s key levels and its potential to resume its upward trajectory.

PEPE: Is a bounce imminent?

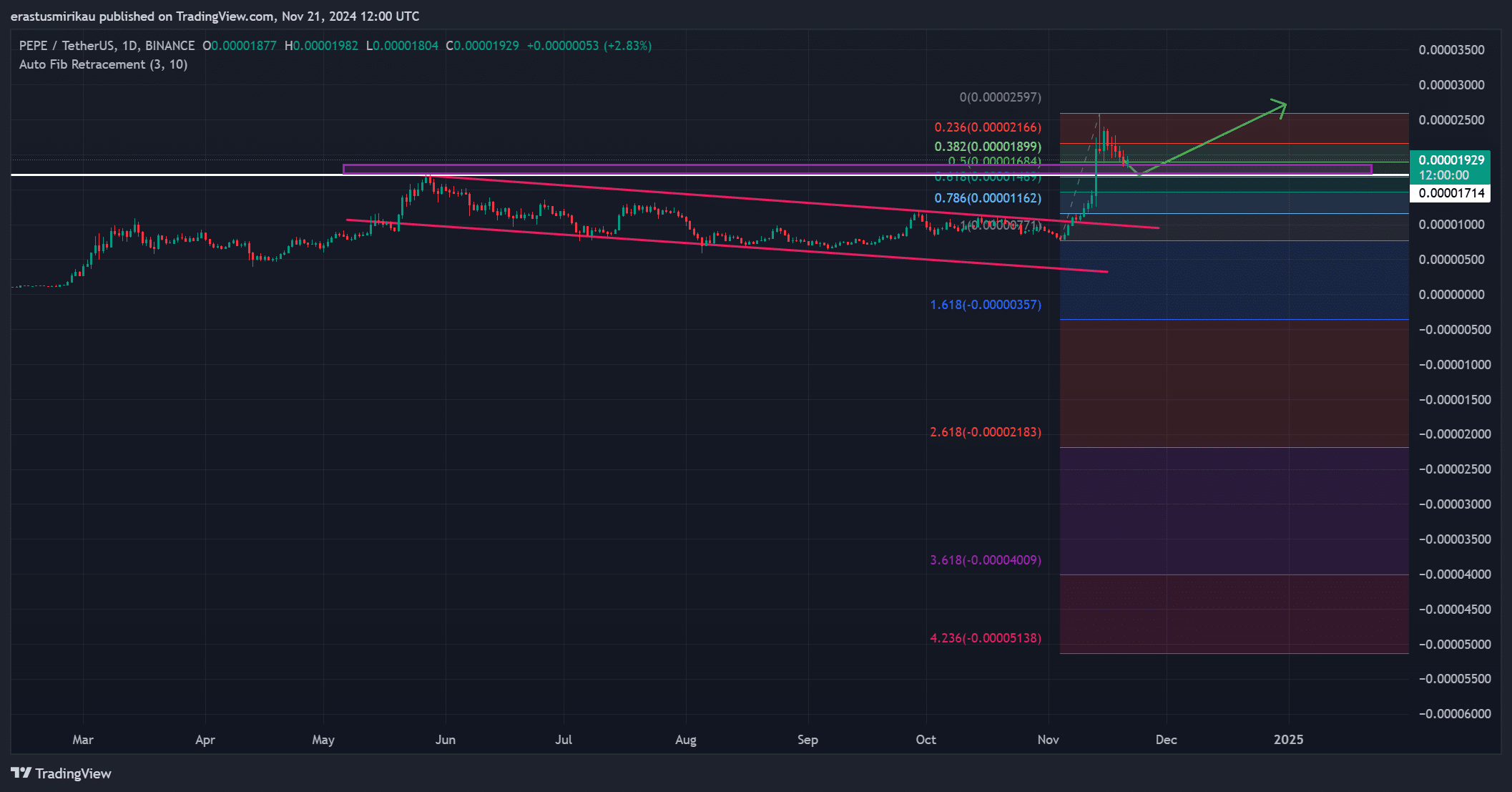

After breaking out of a prolonged falling wedge, a bullish reversal pattern, PEPE rallied to test the key resistance at $0.00002597.

However, it has since retraced to the critical support zone of $0.00001714, which also aligned with the 0.786 Fibonacci retracement level.

This pullback, though sharp, is a common occurrence after a major breakout and may serve as a setup for further gains.

Moreover, if PEPE holds above the support zone, it could reclaim $0.00002000 as a launchpad for another attempt at higher levels.

Conversely, a failure to sustain this level may expose the token to further downside toward $0.00001600.

A closer look at Fibonacci retracement levels suggested that PEPE’s immediate resistance lay at $0.00002200, followed by the major resistance at $0.00002597.

These levels have acted as pivot zones in recent weeks. Consequently, reclaiming them could signal a continuation of the bullish trend.

On the downside, a break below $0.00001714 may invalidate the bullish setup, triggering caution among traders.

Bullish signals keep optimism alive

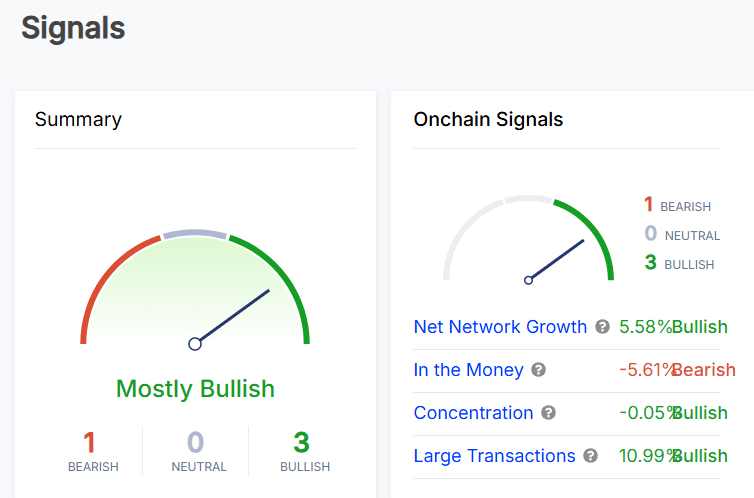

On-chain signals also revealed a positive outlook for PEPE. Net network growth has increased by 5.58%, and large transactions are up 10.99%, reflecting heightened interest from significant market participants.

While the “In the Money” metric showed a minor bearish reading of -5.61%, the overall sentiment remained “mostly bullish.” These signals provides optimism for a sustained rally if the technical structure holds.

Liquidations underscore bullish dominance

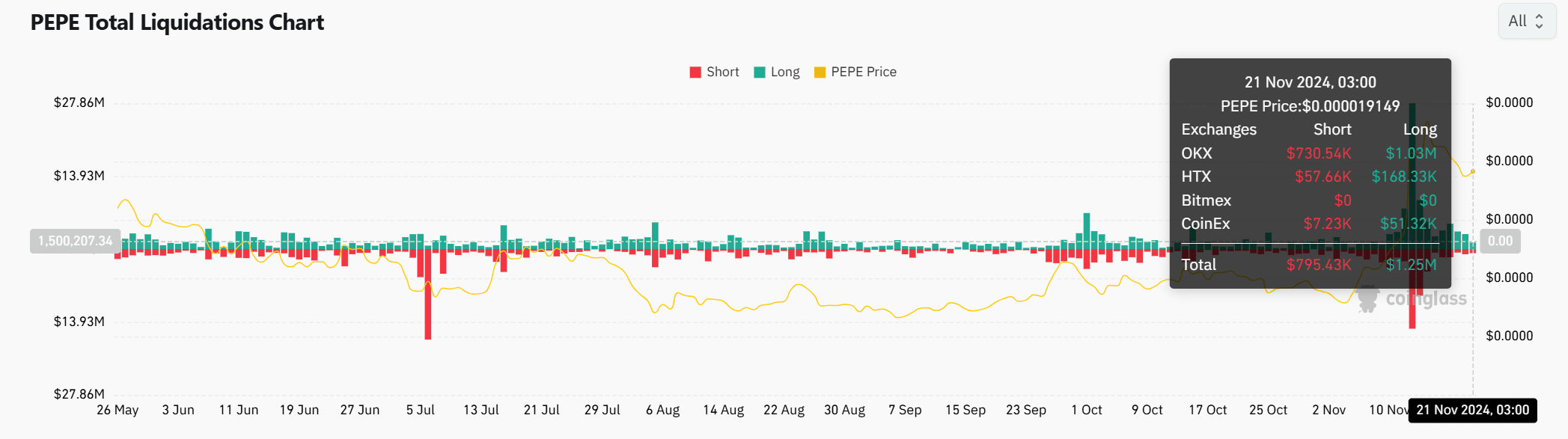

Liquidation data shows $1.25 million in long positions were liquidated compared to $795,000 in shorts, indicating bearish pressure is dominating for now.

However, the significant short positions liquidated earlier this week highlight the volatility and potential for rapid reversals in sentiment.

Therefore, traders are watching closely for any signs of renewed bullish dominance.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Can PEPE sustain its rally?

PEPE’s combination of whale accumulation, bullish onchain signals, and key technical levels suggests the token has the potential to resume its rally. However, holding above $0.00001714 remains critical.

If this support is sustained, PEPE is well-positioned to test $0.00002200 and potentially reclaim $0.00002597, setting the stage for new highs.