Optimism: Bulls can extend rally, but only on this condition

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Optimism maintained its uptrend despite a pullback at key price level.

- Market sentiment stayed bullish on the positive funding rate.

Optimism’s [OP] bullish rally faltered at a key price level with the general crypto market continuing to flash mixed signals. Earlier, Optimism embarked on a remarkable 72% rally from its June low of $1 to reach the $1.8 price level.

Read Optimism’s [OP] Price Prediction 2023-24

Despite the price rejection for Optimism, total crypto market volume grew by 43% over the past 24 hours, per CoinMarketCap. This could provide an added boost for OP bulls to break past this price hurdle.

Bullish rally aims to hit $2 psychological price level

A look at Optimism’s uptrend on the four-hour timeframe showed the altcoin making a series of higher lows as prices surged. July brought further gains as buyers cleared the $1.4 resistance level.

Optimism’s uptrend was accompanied by a surge in trading volume, as evidenced by the OBV (On Balance Volume). Similarly, the RSI (Relative Strength Index) remained above neutral 50 despite a sharp decline occasioned by the recent price dip.

Both indicators hinted that significant buying power was still available for bulls.

Zooming out to the higher timeframe (12H) showed a bearish order block at the $1.8 price level. Bulls will need to clear this hurdle to reach the short-term goal of $2. This could be supported by Bitcoin [BTC] breaking out of its narrow price range ($28.8K – $29.3k).

A failure to clear this level at the first attempt would see bulls find support at the $1.4 to $1.5 price level. If bears break below this near-term support, this could flip Optimism bearish on the lower timeframes.

Bullish conviction remains strong in futures market

How much are 1,10,100 OPs worth today?

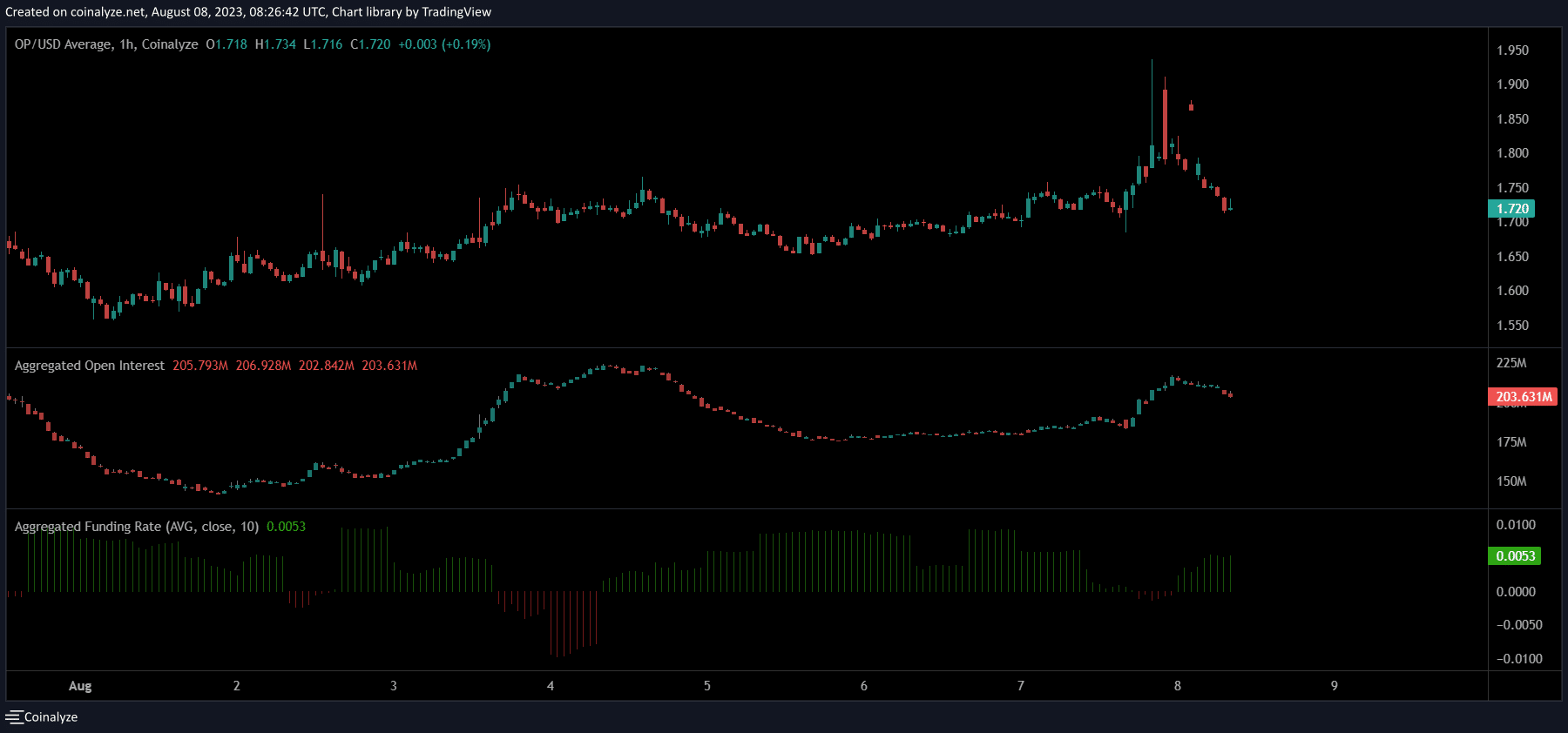

Optimism’s Open Interest maintained its uptrend on the one-hour timeframe, despite the price pullback. This highlighted the prevalent bullish sentiment. Per Coinalyze, the OI registered a positive 10.6% change over the past 24 hours to show continued bullish backing.

Likewise, the Funding Rate was positive. Together, it signaled that the press time pullback was just a temporary setback and Optimism could see more gains in the near term.