Optimism emerges as sole L2 network to gain this achievement, details here

- Optimism’s TVL rallied by 12% in the last month.

- OP token has seen an increase in accumulation since May.

Optimism [OP] witnessed a remarkable 12% increase in Total Value Locked (TVL) over the past month, according to data from DefiLlama. Notably, Optimism stands out as the sole Layer 2 (L2) platform in the top 10 ranking of blockchain networks to witness a substantial surge in asset value during this period.

Read Optimism’s [OP] Price Prediction 2023-24

At press time, Optimism’s TVL stood at $934.43 million. With increased adoption and growth in network activity on the L2’s OP Stack and the implementation of its Bedrock upgrade, Optimism’s TVL has grown by 80% on a year-to-date. As of 1 January, the chain’s TVL was $520.74 million.

Network activity on Optimism has grown

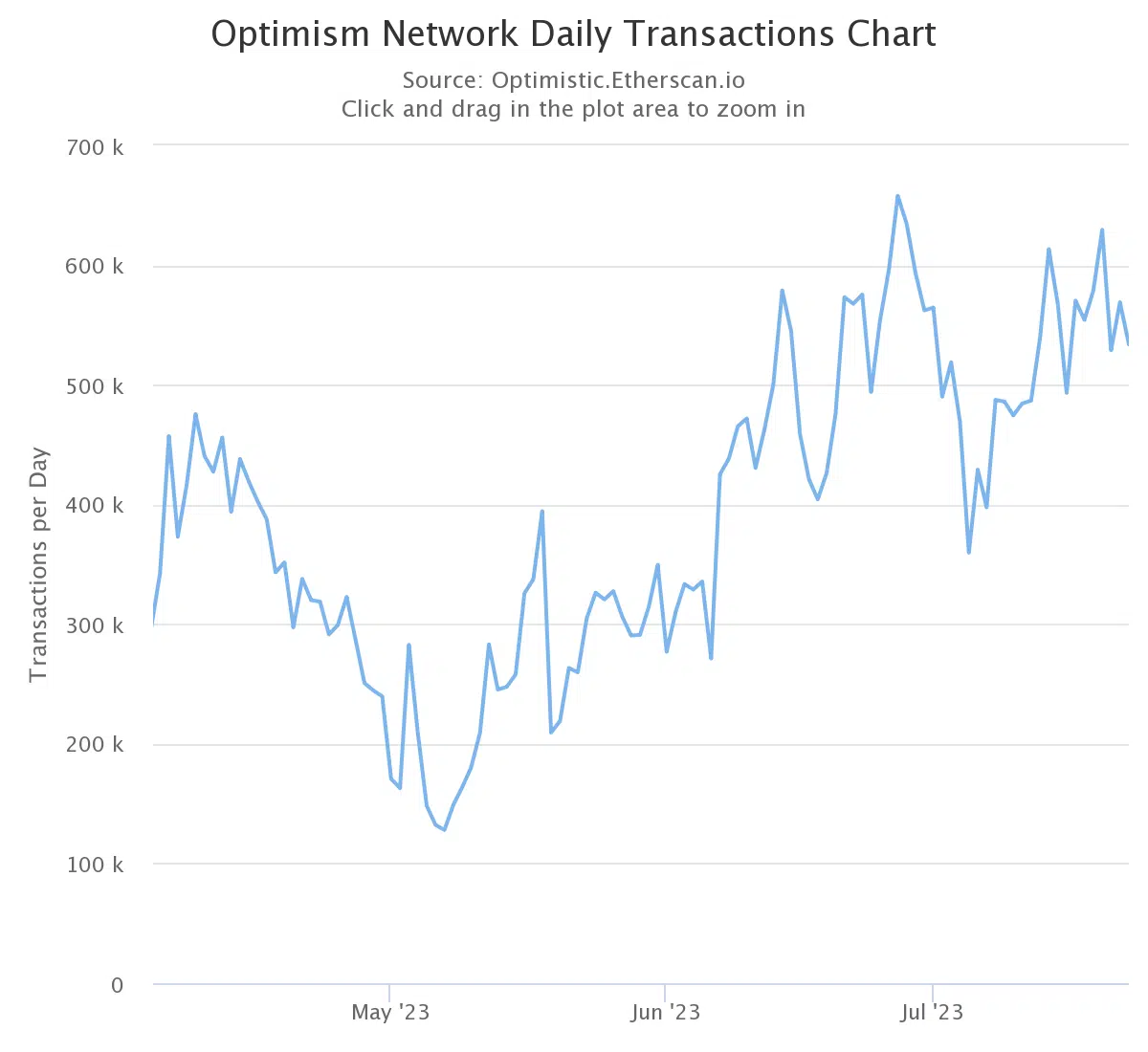

Following a momentary decline in Optimism’s daily transactions count between April and the beginning of May, the anticipation of the mainnet integration of the Bedrock Upgrade, which ended on 7 June, drove traffic to the chain.

According to data from Optimism Explorer, the network’s daily transactions climbed by over 300% since 8 May. Likewise, the daily count of new addresses on the L2 blockchain has increased by 247% within the same window period.

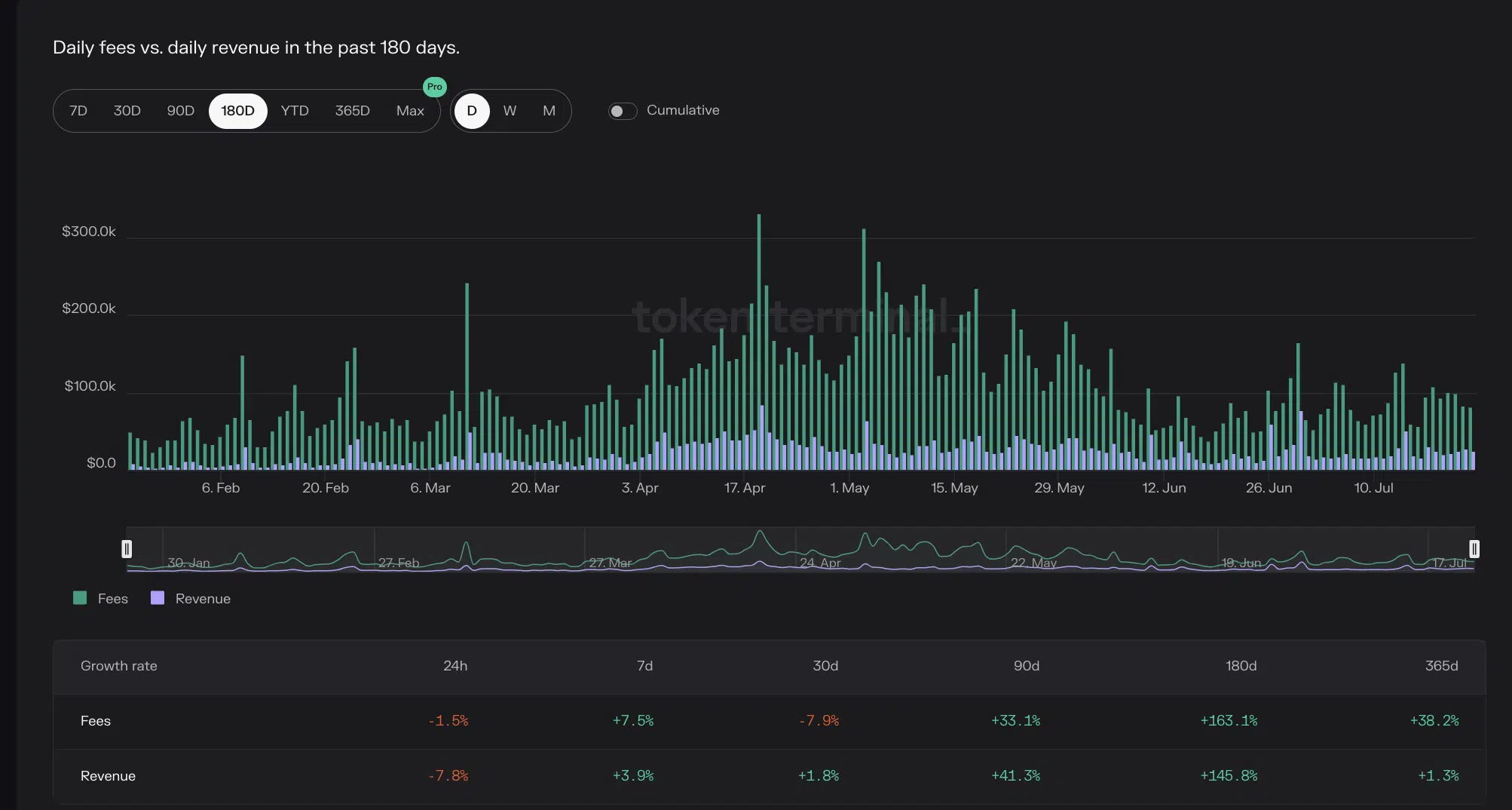

Interestingly, despite the uptick in network activity since May, network fees trickled downward in the last month. Data from Token Terminal revealed an 8% drop in fees paid by users to complete transactions on Optimism in the past 30 days.

However, on a broader window period, fees have indeed rallied. On a 90-day window, fees on OP mainnet have increased by 33%. On a 180-day window timeframe, fees have gone up by almost 200%.

As expected, there has been a corresponding rally in protocol revenue. In the last 90 days, Optimism’s revenue went up by 41%, and by 146% in the last 180 days.

How much are 1,10,100 OPs worth today

OP accumulation has increased since May

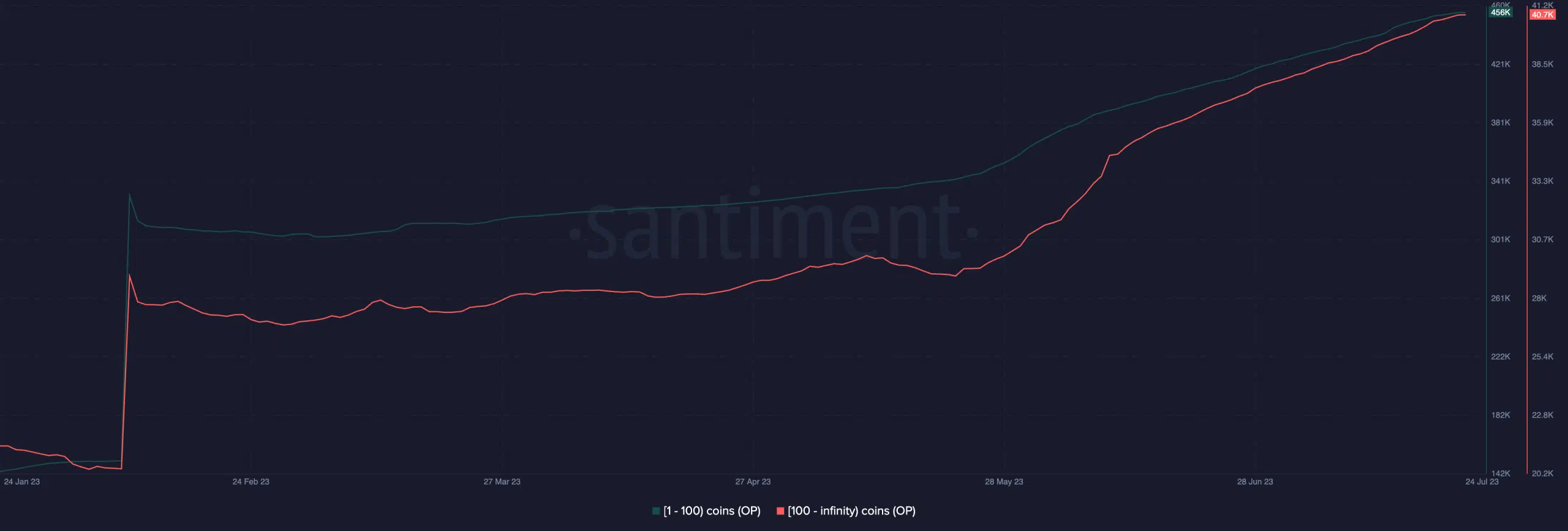

The growth in Optimism’s adoption has resulted in an uptick in demand for its native token OP, especially amongst major wallets. Per data from Santiment, holders with 100 or more OP tokens have increased their holdings significantly since 24 May. At 40,794 wallet addresses in this cohort, their count has risen by 40%.

On a daily chart, a new bull cycle which commenced in June, was spotted. The bull run was underway, with the MACD line resting above the trend line at press time. Lastly, momentum indicators were positioned above their respective neutral lines, signaling a steady growth in OP accumulation.