Optimism faces key test at $1.90 – Analyst predicts ATH in January

- OP’s $1.80-$1.90 resistance could trigger a rally to $2.50 if broken.

- On-chain data shows rising new addresses and $1.47M net outflows, signaling potential bullish accumulation.

Optimism [OP] has recently faced challenges at a critical resistance zone between $1.80 and $1.90, identified as a pivotal breakout level. OP tested this area but failed to break above it, resulting in a pullback of over 20% in recent days.

Crypto analyst Michaël van de Poppe remarked,

“OP has tested the crucial resistance but dropped more than 20% in the past few days.”

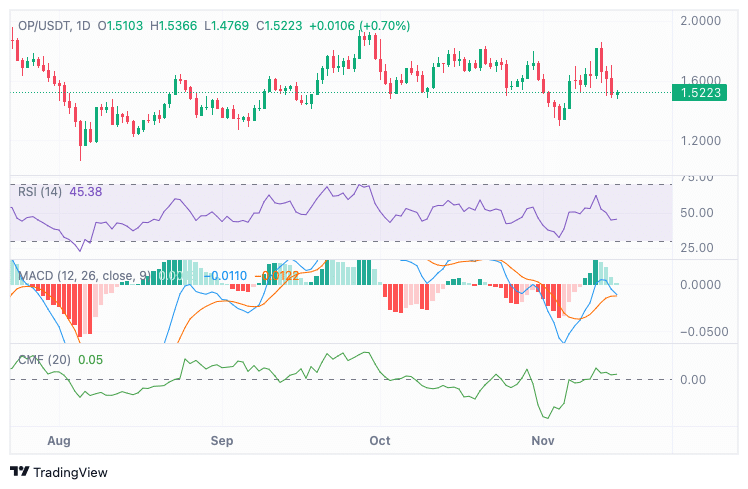

At press time, OP traded at $1.52, with a 24-hour trading volume of $614.9 million. The market cap is approximately $1.9 billion, based on a circulating supply of 1.3 billion tokens.

Support and consolidation levels

OP’s price movement indicates consolidation, with support around $1.50 and resistance near $1.60. These levels are critical in maintaining short-term stability. If support at $1.50 holds, it could provide a foundation for the next breakout attempt.

The analyst added,

“If there’s another test at $1.80-$1.90, then I expect we’ll break upwards and have an ATH test in January.”

This outlook positions the resistance zone as a potential springboard for higher price levels, with targets around $2.50-$2.60.

Technical indicators show mixed signals

The Relative Strength Index (RSI) was at 45.38 at the time of writing, reflecting neutral momentum. This indicates that while the price may lean bearish, there is room for a potential reversal if buying pressure increases.

The RSI will need to move above 50 to confirm a stronger bullish trend.

The MACD histogram shows early signs of bullish divergence, although momentum remains weak.

Meanwhile, the Chaikin Money Flow (CMF) at 0.05 indicates mild inflows of capital, suggesting limited but positive investor activity.

On-chain metrics reflect bullish accumulation

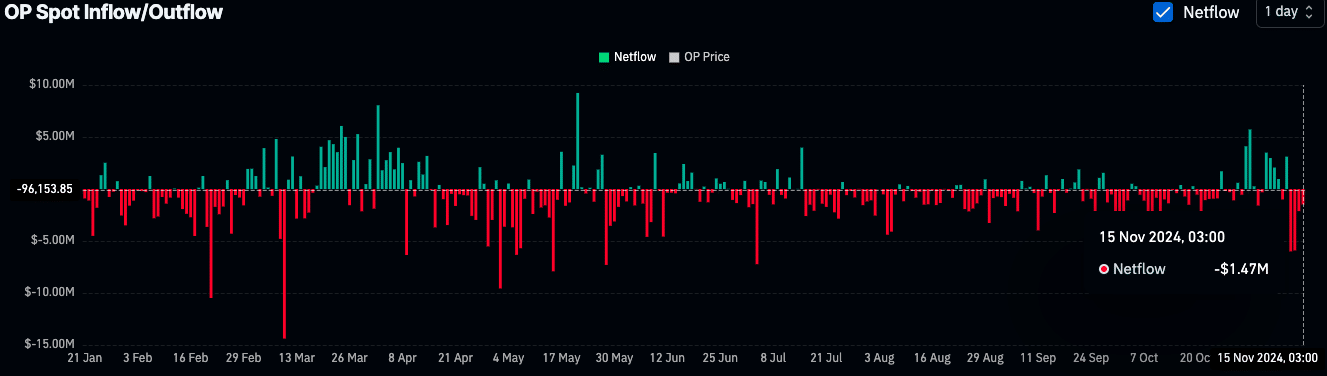

Recent on-chain data from Coinglass shows consistent net outflows, with the latest figure on 15th November reaching $1.47 million.

This trend suggests OP tokens are being moved off exchanges, a behavior often associated with long-term accumulation or storage in private wallets.

Additionally, IntoTheBlock data reveals a 21.03% increase in new addresses over the past seven days, reflecting growing interest in the token.

Read Optimism’s [OP] Price Prediction 2024–2025

However, OP active addresses have decreased by 27.79%, indicating lower transactional activity despite the influx of new participants.

Source: IntoTheBlock

Zero balance addresses also rose slightly by 1.77%, showing a minor increase in dormant accounts.