Optimism [OP] at mercy of bears, will RetroPGF 2 save it

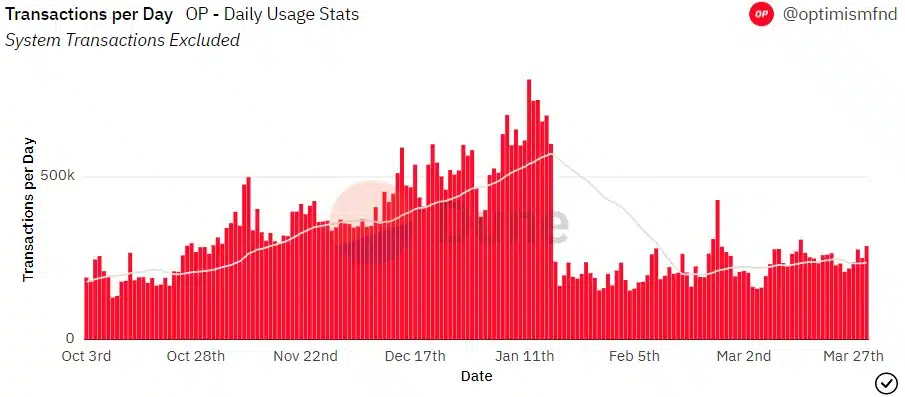

- OP’s number of transactions and gas usage were in a declining trend.

- The MVRV Ratio showed recovery, but market indicators were bearish.

Optimism’s [OP] network usage has been declining for quite some time. This was evident from Dune’s data, which pointed out a reduction in gas usage. The total number of transactions also fell, suggesting fewer users on the network.

How much are 1,10,100 OPs worth today

Because of this decline, the network’s revenue also got affected. As per Token Terminal’s data, OP’s revenue fell considerably over the last 30 days, which was concerning.

Can increased development save OP?

Optimism announced the results of its Retroactive Public Goods Funding (PGF) 2 on 30 March. For reference, RetroPGF is the engine that drives the growth of the Optimism ecosystem.

The project was launched with the aim of building some of the core infrastructure that Ethereum [ETH] and Optimism depend on, supporting developers in building decentralized applications and more.

Huge news: the results of RetroPGF 2 are in! ??

This experiment in retroactive public goods funding is driving growth of the Optimism ecosystem by allocating resources to the projects and people that have demonstrated positive impact.https://t.co/JSSapKhiDl

— Optimism (✨?_?✨) (@optimismFND) March 30, 2023

RetroPGF 2 saw 69 of the 71 selected badgeholders vote on how to allocate 10 million OP to projects and individuals who assisted in the use and development of the OP Stack. In its second edition, the median OP received by a project for RetroPGF 2 was 22,825; the top 10% of projects received over 140,000 OP.

Apart from this, another interesting development was that OP ranked second on the list of layer-2 rollups with the highest number of new accounts in the last 30 days, indicating that things might get better for the network.

Top #Layer2 rollups with highest new accounts last 30 days?

? $ARB @arbitrum

? $OP @optimismFND

? @zksync@Starknet$IMX @Immutable#ArbitrumNova$METIS @MetisDAO$DYDX @dYdX$LRC @loopringorg$ZKS @ZKSpaceOfficial$ARB #L2 $ETH #BTC #Moon #100x pic.twitter.com/r12RDWrlj2

— The Crypto Squad (@thecryptosquad_) March 31, 2023

But are the recent updates enough to help OP attract new users as the token’s price action continued to favor bears?

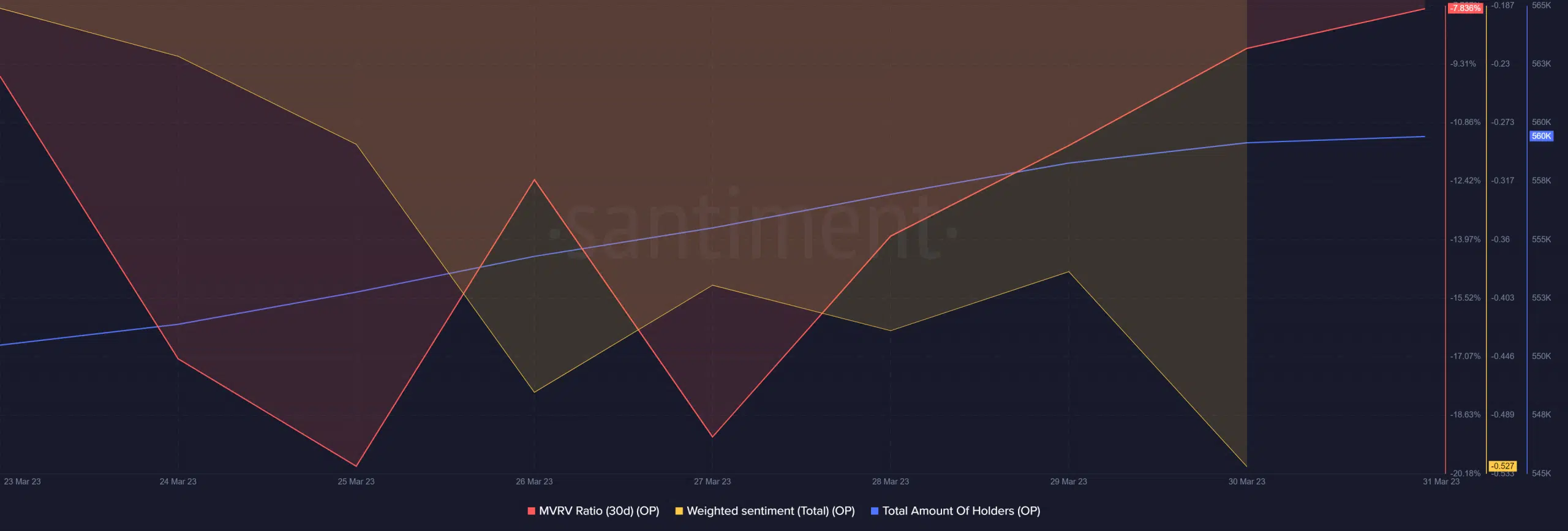

OP’s MVRV is recovering

OP’s price had declined by over 4% in the last seven days, and at press time, it was valued at $2.26 with a market capitalization of $711 million. Despite the drop in price, it was interesting to see OP’s MVRV Ratio go up over the last few days.

The hike in MVRV was not enough to increase investors’ confidence in OP, as its weighted sentiment continued to decline. Nonetheless, the total number of OP holders continued to rise, which looked promising for the token.

Read Optimism’s [OP] Price Prediction 2023-24

OP at bears’ mercy

OP’s daily chart revealed that the bears were far from letting the bulls take over the market. The Exponential Moving Average (EMA) Ribbon displayed the possibility of a bearish crossover, which can further push OP’s price down.

Moreover, OP’s Money Flow Index (MFI) registered a downtick. Besides that, the Relative Strength Index (RSI) was resting below the neutral zone, which was another red signal.