An ‘Optimism’ outperformance – Will OP join in?

- Optimism does better than other layer 2 chains in terms of net flow. Protocol manages to retain a higher number of users.

- OP’s price continues to decline, however, whales show sudden interest.

Optimism has been having a tough time competing in the L2 space as competitors such as Arbitrum and Polygon have been dominating the market over the last few months. However, it appears that Optimism started to gain its footing in the L2 space yet again and has been outperforming other L2 solutions in some areas.

Realistic or not, here’s OP’s market cap in BTC’s terms

On the brighter side

According to data provided by analyst Dynamo Patrick, Optimism ranked number 1 in terms of net bridge flow. For context, net bridge flow in crypto refers to the movement of digital assets between different blockchain networks or bridges.

In the last week, Optimism’s net flow reached a total of $57.1 million.

Top 5 chains by 7 day net bridge flow ? pic.twitter.com/JJnVeTLkY9

— Patrick | Dynamo DeFi (@Dynamo_Patrick) May 24, 2023

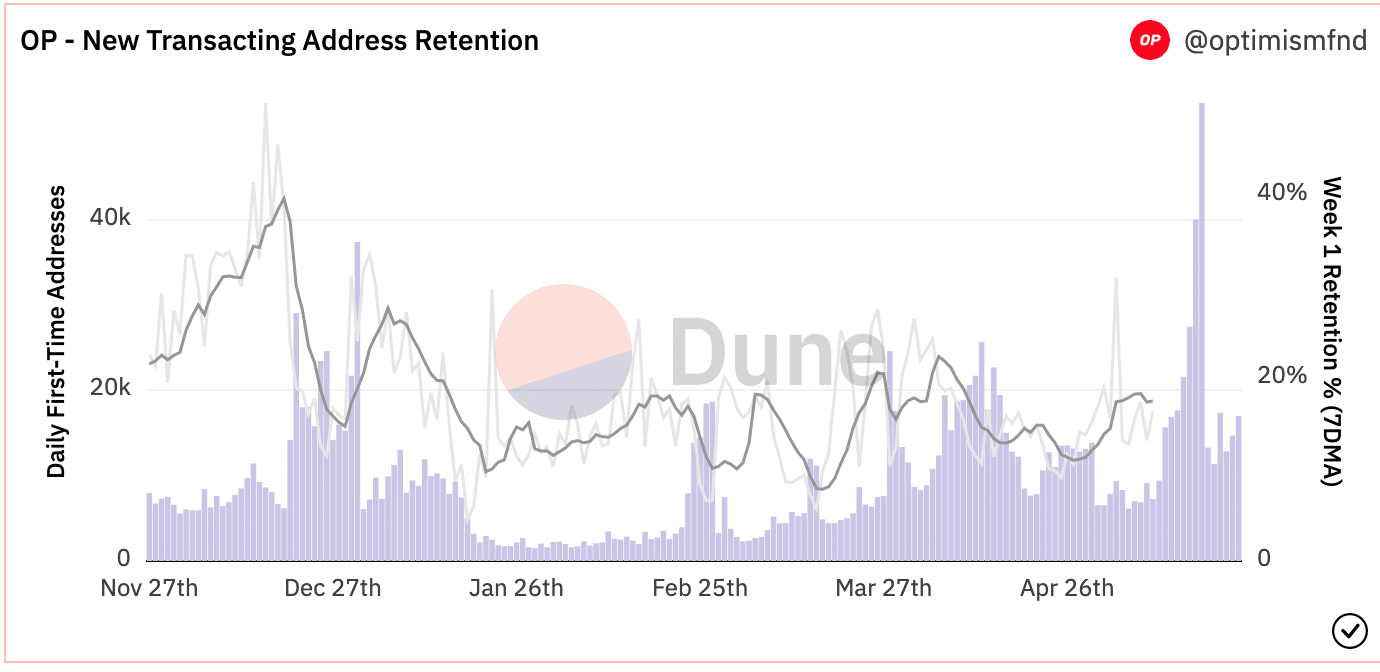

The spike in net flow on the Optimism protocol could be attributed to the growing number of users on the network. Not only were new users being onboarded to Optimism, but they were choosing to stay as well.

This was showcased by Dune Analytics’ data which indicated that Optimism’s user retention began to surge over the last few days. At press time, the weekly retention for new users on Optimism was around 17.3%.

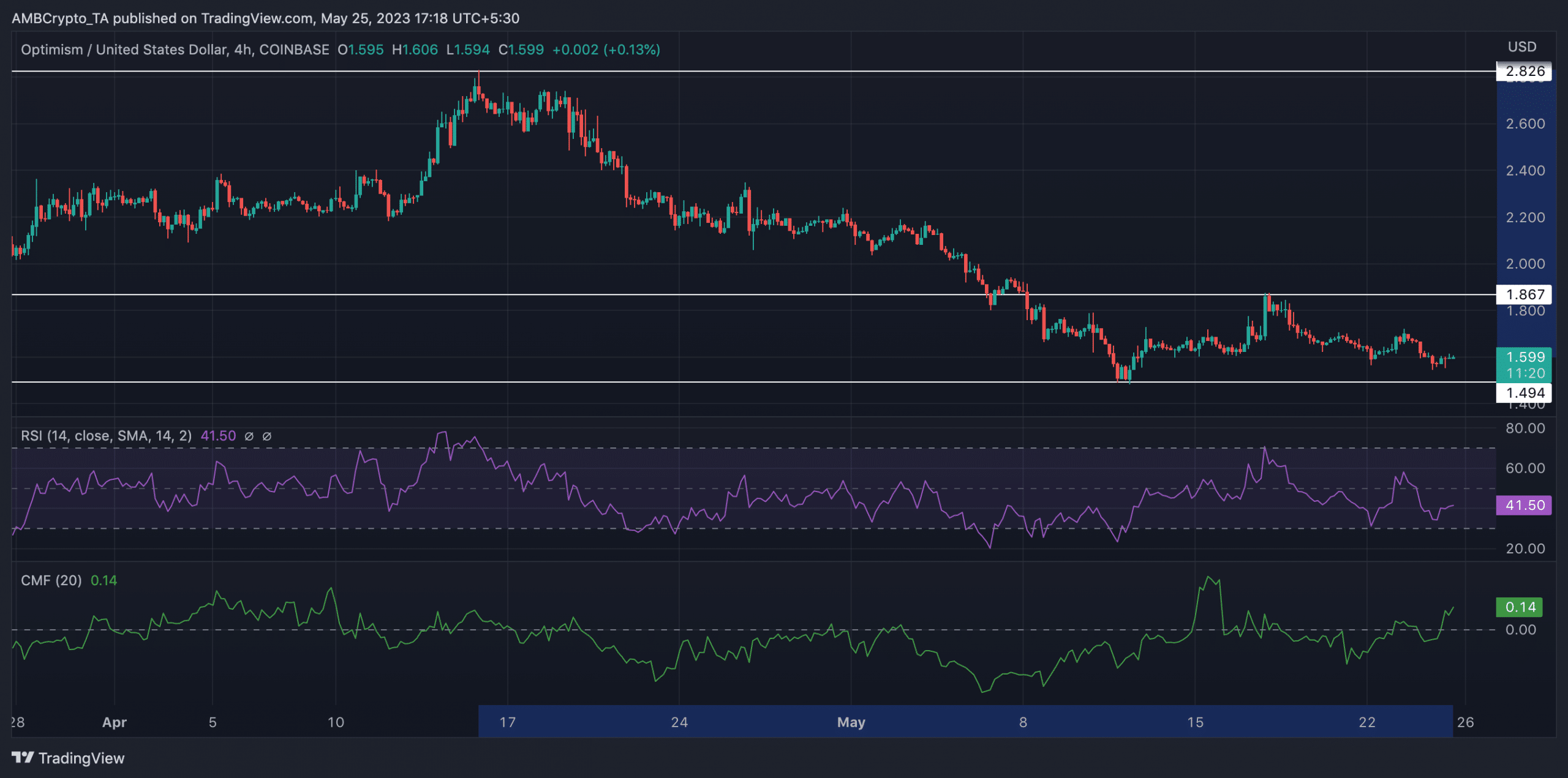

However, the OP token didn’t see the same growth as its protocol. Since 15 April, the price of OP declined by 43.64%. At press time, OP was trading at $1.596 after fluctuating between the $1.867 and $.494 resistance and support.

The Relative Strength Index (RSI) of OP experienced a significant and consistent decline over the past few days. It reached a value of 40.72 at the time of writing. Conversely, the Chaikin Money Flow (CMF) displayed a contrasting pattern by continuously increasing, with a recorded value of 0.13.

This suggested that despite the weakening momentum indicated by the RSI, there was still a demand for OP, possibly from new buyers or institutional investors.

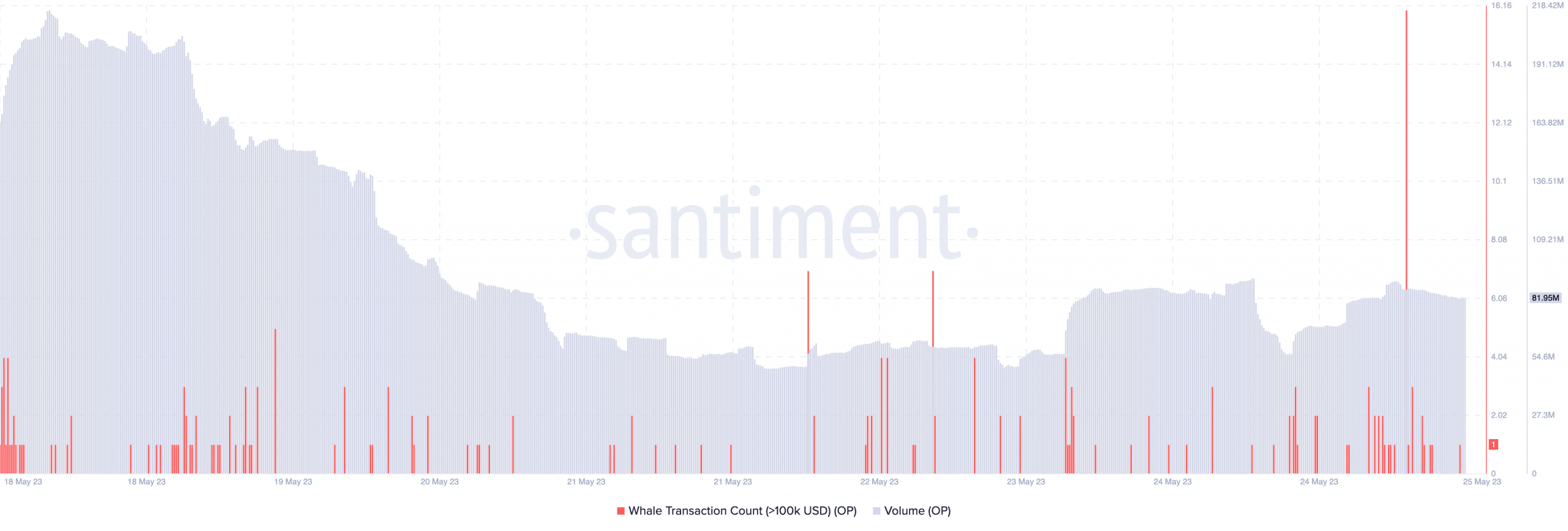

The volume with which OP was being traded, also declined during this month. However, there was a spike in the number of whale transactions for the OP token. If whales continue to show interest and accumulate more OP, it could have a positive impact on the OP token going forward.

Read Optimism’s Price Prediction 2023-2024

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)