Optimism whales step up accumulation as they take advantage of the OP dip

- OP whales have accumulated $60 million in the last two months.

- The token has the potential to reach $.1.5 if buying pressure increases.

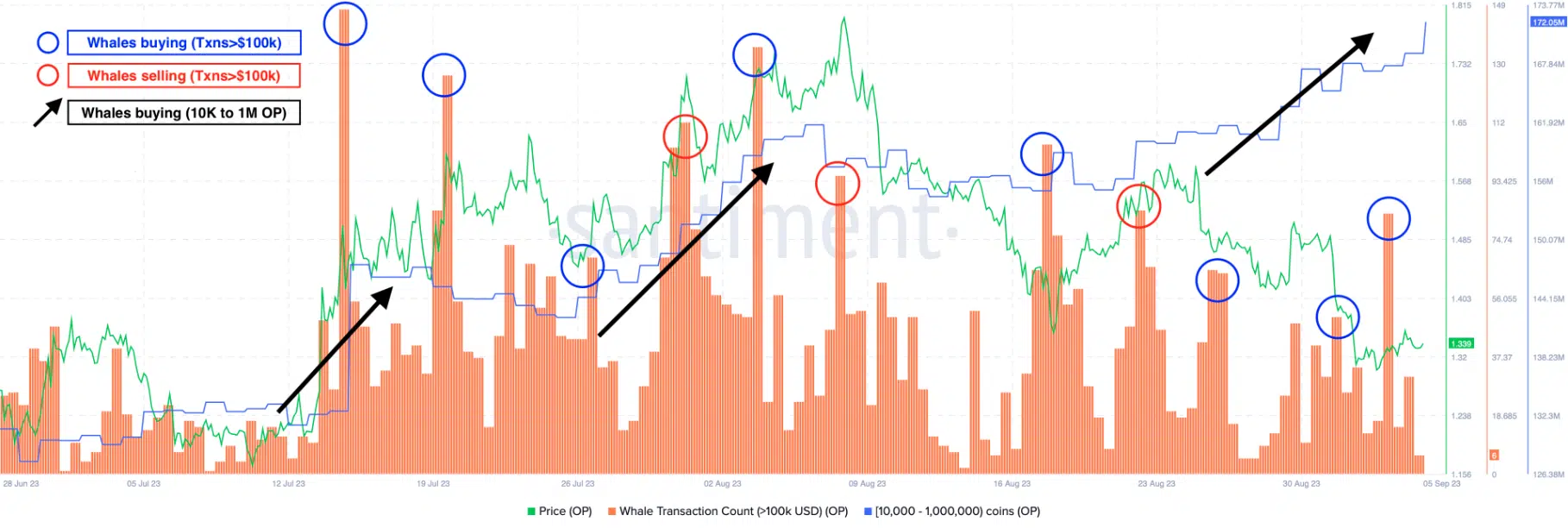

According to Santiment, Optimism [OP] whales holding 10,000 to 1 million tokens have been aggressively accumulating. The on-chain analytic platform, in its 6 September insight noted that these whales have bought about OPs worth nearly $60 million in the last 60 days.

How much are 1,10,100 OPs worth today?

Not waiting for greed season

Buying tokens this way can be associated with the sentiment that the cryptocurrency may be undervalued. Therefore, Santiment concluded that the whales were buying the dip as shown in the chart below.

From the image above, the black arrow denoted the accumulation phase of the aforementioned cohort. The blue circle represents transactions worth $100,000 while the red circle represents the selling phase.

So, the increase obtained from the blue circle and black arrow suggested that the transactions behind the accumulation were worth $100,000 or more at several intervals.

Although Optimism’s performance in the last year was a 9% hike, the cryptocurrency’s performance in the last 30 days was a 23.15% decline. As per the technical outlook, the 20-day EMA (blue) had crossed below the 50-day EMA (yellow).

The crossover indicates the short to intermediate trend is bearish. So, the likely action to take is to short/sell OP. For the long term, the 200 EMA (purple) gives an insight into the possible trajectory.

Eyes on the uptrend

At the time of writing, the 200 EMA was above both the 50 and 20 EMAs. This suggested that OP could turn bullish in the long term. Thus, whales’ buying the dip could be geared toward the long term rather than the token’s short-term performance.

However, the Moving Average Convergence Divergence (MACD) was 0.003. Positive values of the MACD suggest an increasing momentum. Also, the blue dynamic line was above the orange line, meaning buyers were attempting to neutralize the selling pressure.

If the MACD increases and the blue line jumps into the positive region, then it could be a good time to long OP, and the price could possibly rise to $1.4 or $1.5.

Furthermore, Optimism’s weighted sentiment had risen to 1.184. The weighted sentiment measures the unique social volume or positive/commentary about an asset.Negative values of the weighted sentiment mean the crypto community did not perceive the said asset to be profitable in the short term.

Read Optimism’s [OP] Price Prediction 2023-2024

So, Optimism’s weighted sentiment meant that market participants were optimistic about the OP price action. Active addresses on the Optimism network also increased to 17,700.

The hike in the metric is a good indicator of daily users on the Optimism blockchain, implying a rise in successful transactions.

![Optimism [OP] price action](https://ambcrypto.com/wp-content/uploads/2023/09/OPUSD_2023-09-06_12-57-45.png.webp)