Optimism’s short-term targets – Is the $1.96 level next to fall for OP’s price?

- Large Optimism transactions spiked by 58%

- On-chain and technical indicators pointed to a bullish rally on the charts

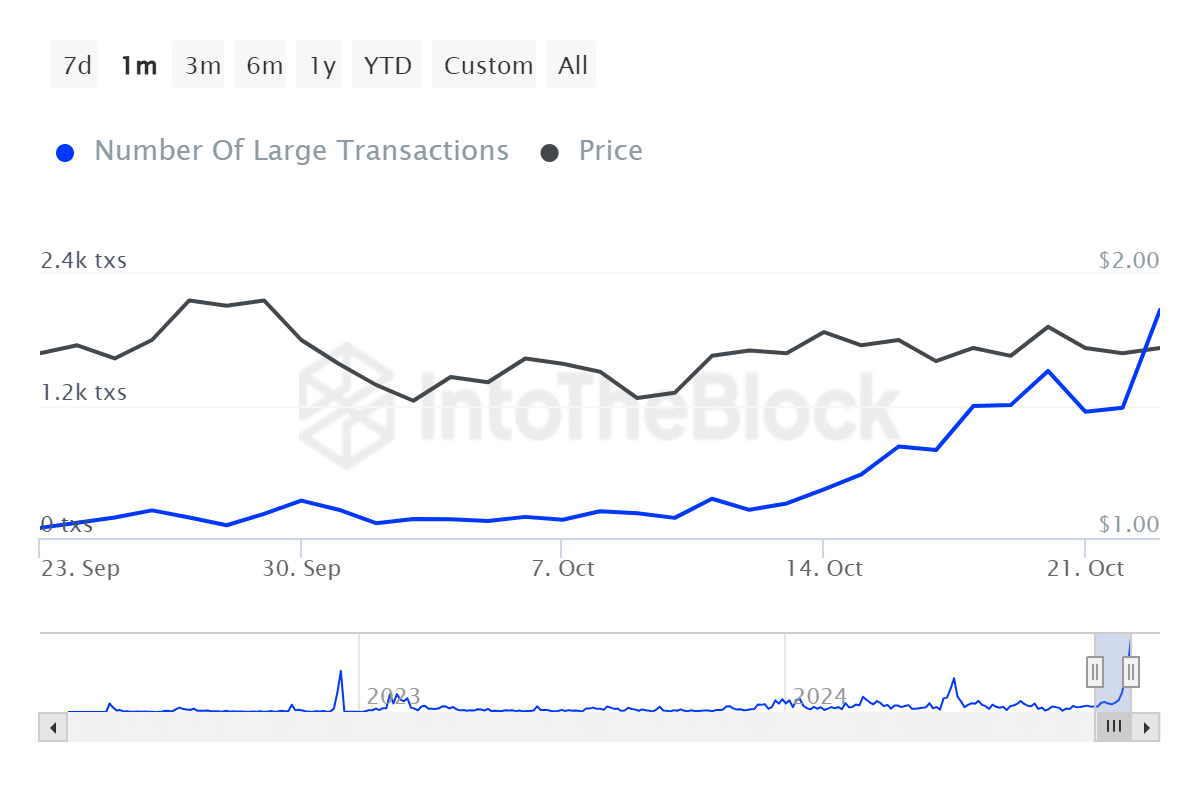

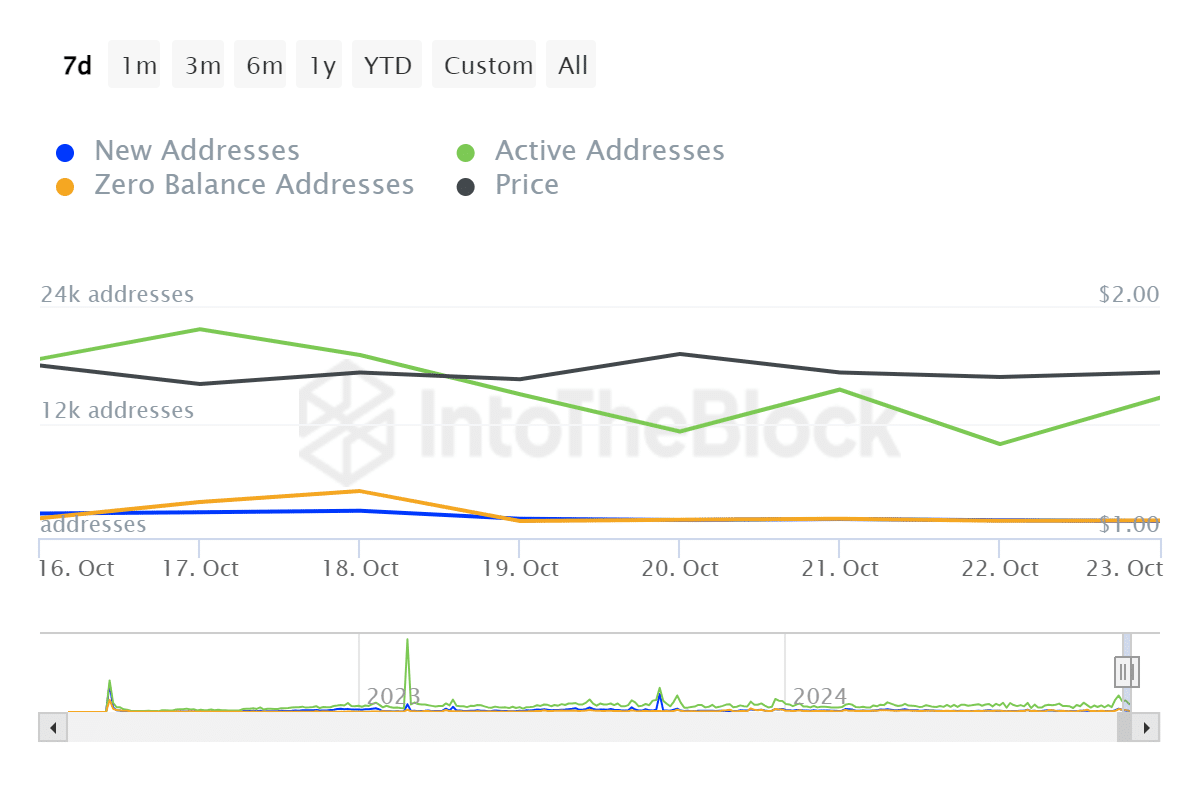

Optimism’s large transaction count surged as high as 58% to hit a total value of $766 million, according to IntoTheBlock data. Concurrently, active addresses on the Bitcoin network hiked by 48%, reflective of the action across key networks.

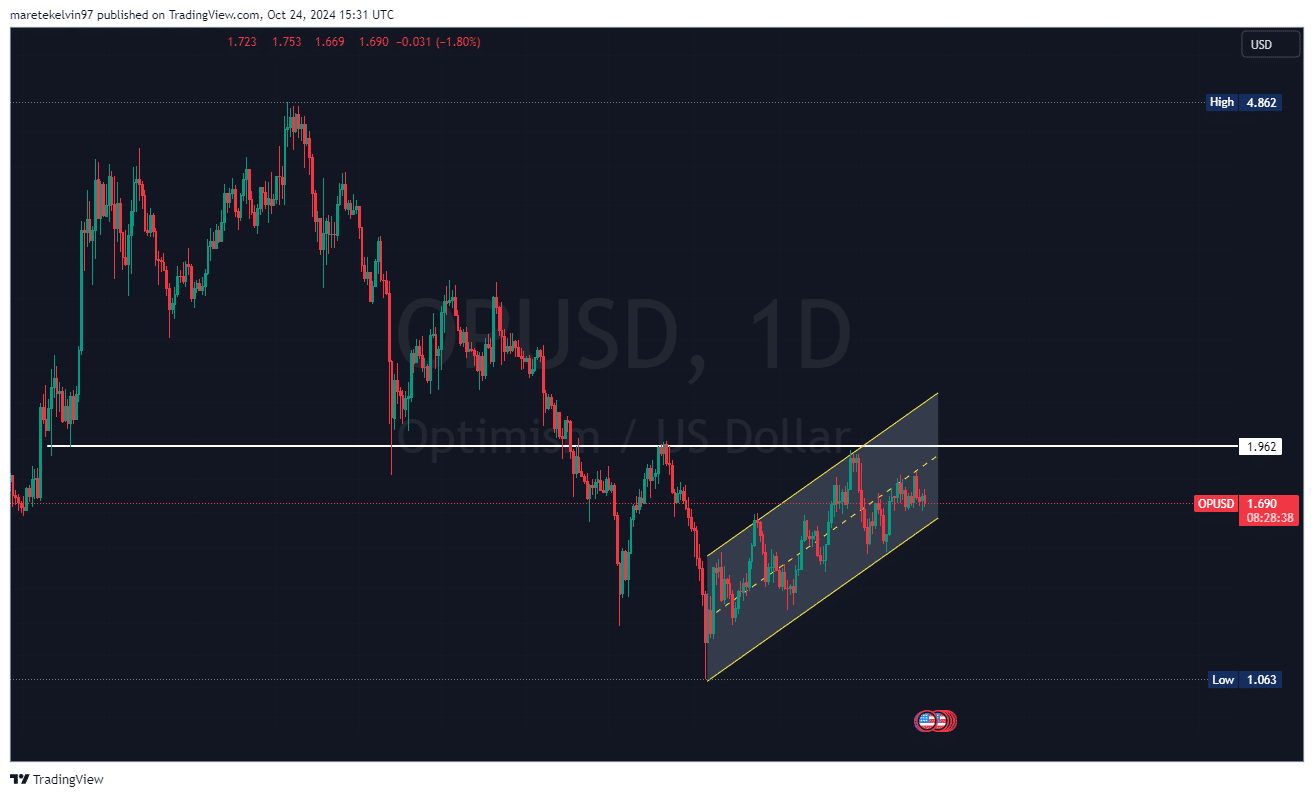

Additionally, the OPT bull flag consolidation implied that an uptrend continuation could happen.

Hence, the question – Will this consolidation, combined with the increasingly active whales, push OP’s price past the key resistance level of $1.96?

Whale activity sparks Optimism momentum

Optimism has been a hot topic, and whale investors have greatly increased their activity. In fact, according to IntoTheBlock, the number of large transactions on the network rose by 58% and accounted for a value of $766 million.

This is a sign of immense confidence among large participants – Usually a sign of bullishness in the crypto market.

In the meantime, BTC’s active addresses surged by 48%, showing that more and more movement is happening across the board. Source: IntoTheBlock

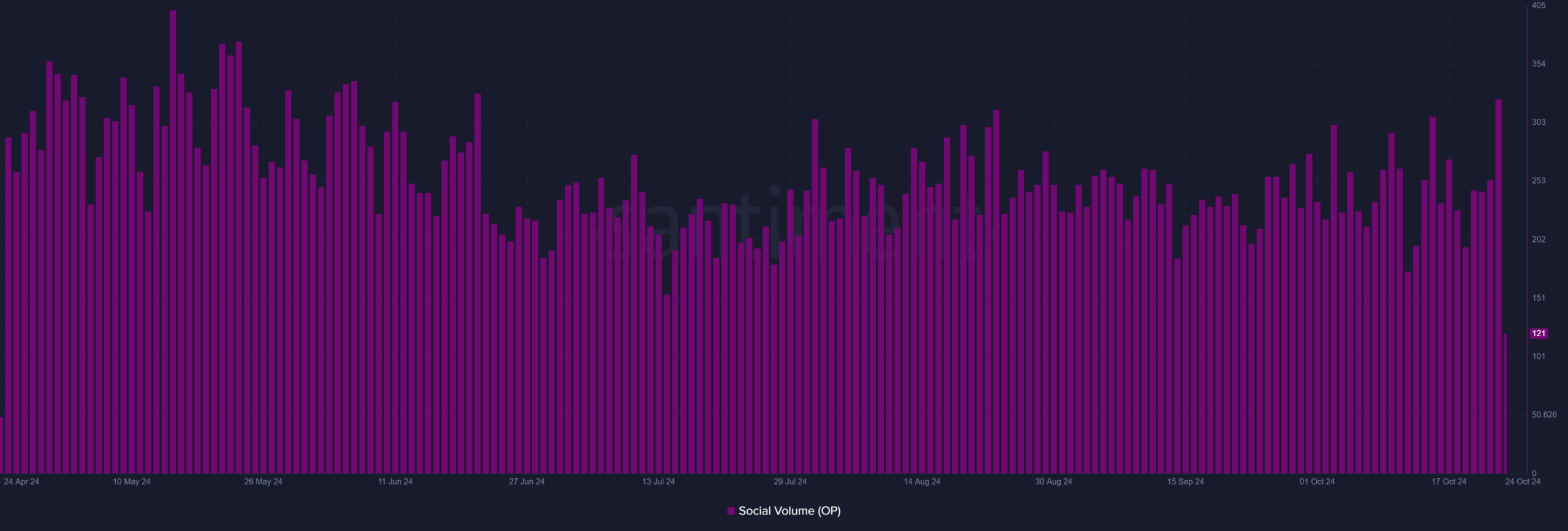

An uptick in social volume

In addition to the boom in large transactions, Optimism’s social volume has also been on the rise on the charts.

A hike in mentions on social media generally indicate wider interest and community activity. And, Optimism is not an exception to that rule.

The recent hike in social volume can further amplify the current bullish sentiment around Optimism, bringing in new investors and traders into the market.

Bullish flag pattern signals a potential breakout?

The uptick in large transactions, on top of the bullish consolidation, may indicate that whale activity could favor a push above OP’s $1.96 resistance.

A break above this level by Optimism might allow for an uptrend of a higher magnitude. This could eventually attract more investors to the network.

The aforementioned uptick in large transactions, combined with the bullish consolidation, suggested that whale activity could support a push beyond its $1.96 resistance.

If Optimism breaks through and closes above this level, it could trigger a larger uptrend to incite a bullish run.