ORDI price prediction: What next for the crypto after a 20% surge

- ORDI bulls announce their presence with a strong 20% rally.

- Assessing ORDI’s potential upside in the event that the bulls maintain dominance.

ORDI is making headlines after kicking off the week with a 20% on Monday, the 2nd of September. An outcome that has analysts wondering whether this could be the start of a new massive rally.

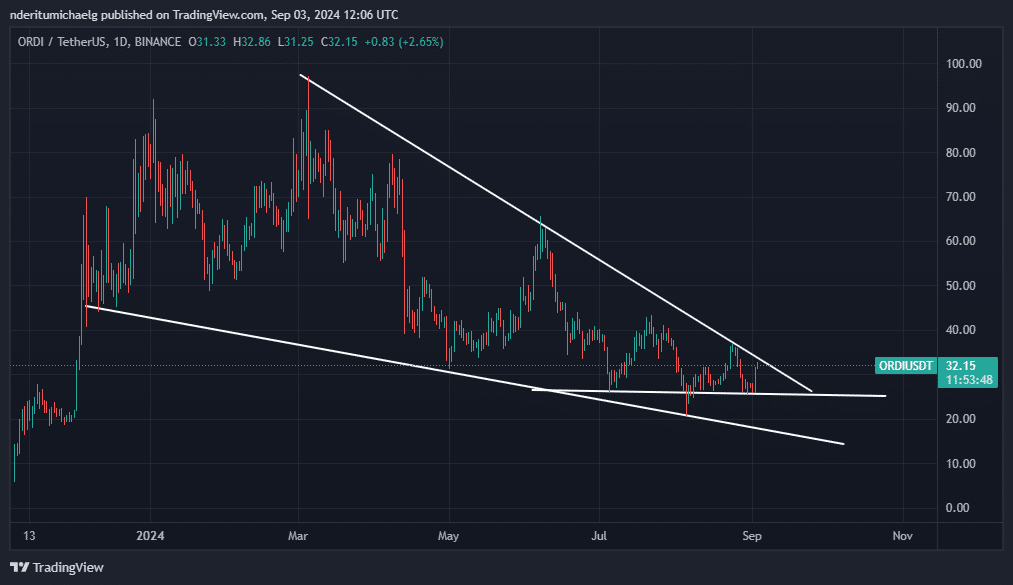

ORDI has been on an overall bearish trend since March. It traded at $32.05 at the time of writing, building on Monday’s bullish momentum during which it bounced up by 20.05%.

This is the first time that ORDI has achieved such a massive rally in a single day since May.

Upon closer inspection of its price action, we discovered that the rally occurred after bouncing from a key support level. The $25 price range which previously demonstrated resistance in July and August.

ORDI’s latest bullish attempt may also be the start of a bullish breakout. The cryptocurrency has been trading within a falling wedge pattern for many months and is now approaching the squeeze zone.

Its rally on Monday could may attract more demand. If that turns out to be the case, then ORDI might extend its upside.

ORDI price prediction

Is ORDI the next Bitcoin? That is the question especially considering that ORDI and Bitcoin have one major thing in common. They both have a maximum supply of 21 million coins. However, BTC’s current value is over 1,700X that of ORDI.

With a marketcap of $673.84 million which in the grand scheme of things can be considered as undervalued. On top of that, its volume spiked by over 180% in the last 24 hours, signaling robust investor interest.

But how far can it go in the short and long-term?

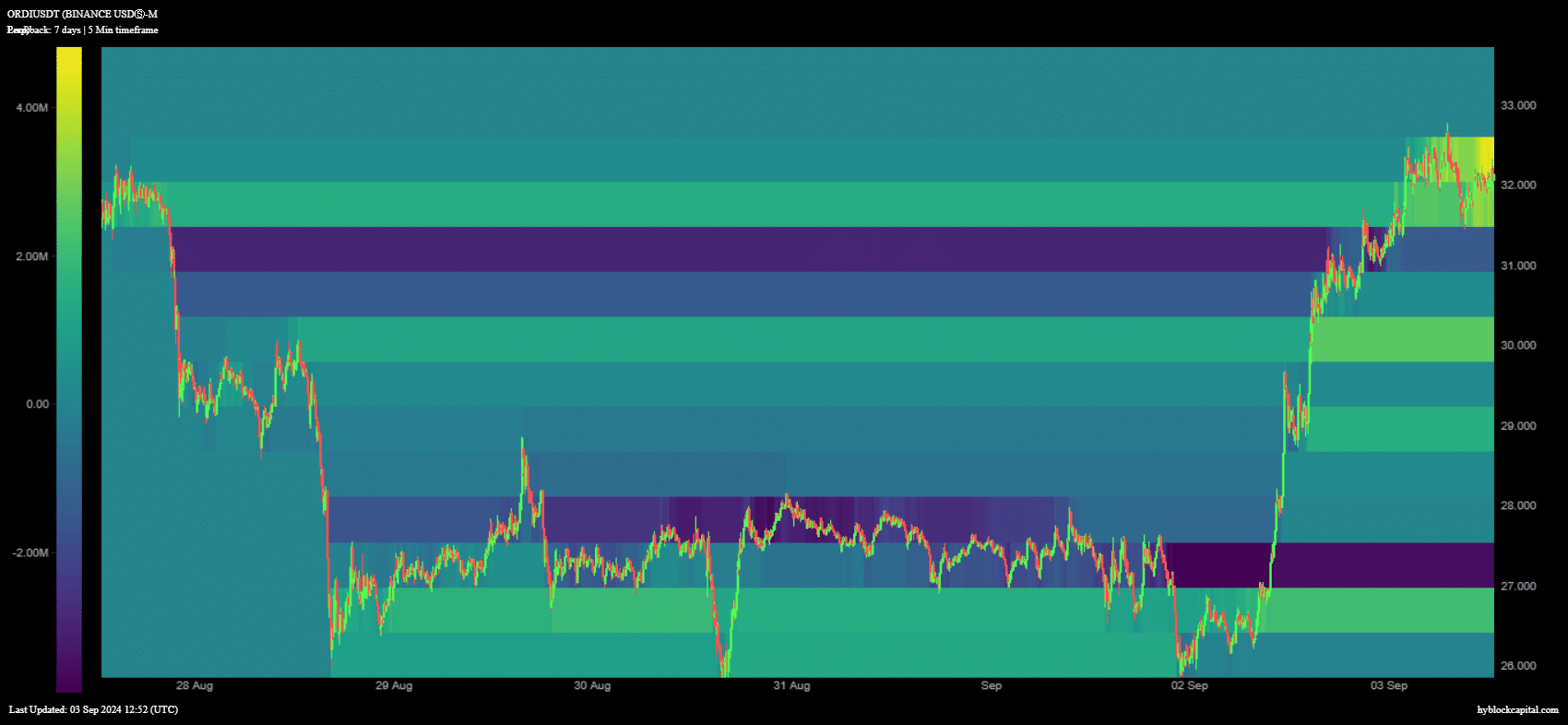

Perhaps a look at the current market sentiment may offer some insights into ORDI’s potential upside. Its net shorts peaked at 3.895 million positions in the last 24 hours at its recent highs.

This suggests that quite a significant number of traders anticipate a pullback. On the other hand, net longs were higher at 4.45 million.

The higher net longs suggest that there was more bullish optimism than the bearish expectations. Traders can expect ORDI to soar as high as $57 in the short-term If it can sustain the bullish momentum.

Is your portfolio green? Check out the ORDI Profit Calculator

It is the next major support/resistance zone. That would be equivalent to a 78% gain from its press time levels.

ORDI’s low circulating supply suggests that prices above $100 or more are attainable in the mid to long-term. Its current ATH is $97 and the best case scenario would be price levels above $200 in case of robust demand.