PancakeSwap: Assessing if CAKE buyers have the firepower to push higher

- CAKE was at a critical juncture, with the current pattern as a barrier to further gains.

- A successful break above these levels could reaffirm a bullish trend, while a failure may expose CAKE to further downside risks.

PancakeSwap [CAKE] has been on a steady uptrend over the last two months after hitting a 10-month low in August.

The recent bullish momentum helped the coin climb higher, but can buyers capitalize on this momentum to overcome key resistances?

Recent price action and EMA overview

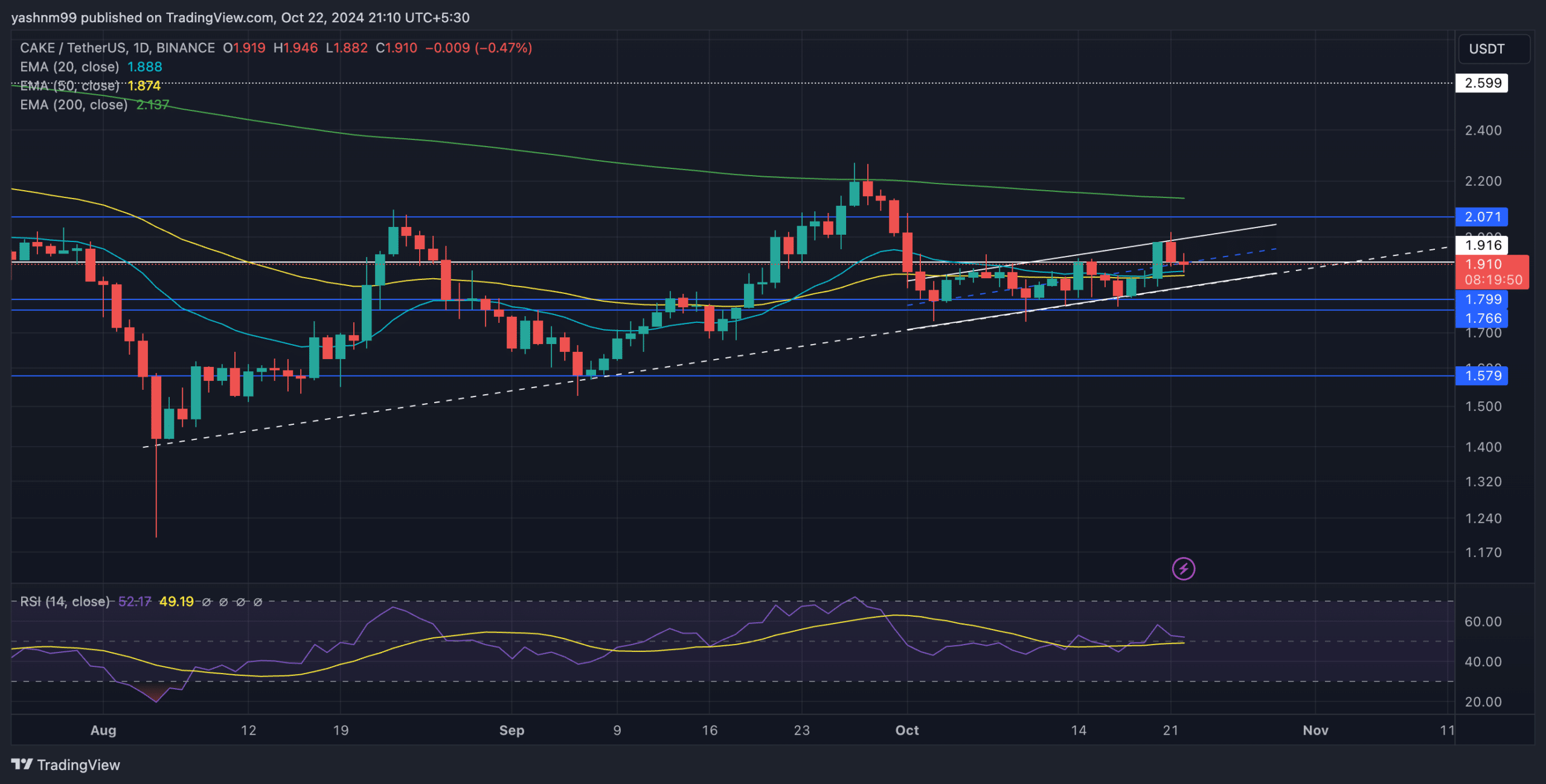

CAKE’s price action has hiked over the past two months, forming trendline support that has kept the coin’s momentum intact.

Despite this steady uptrend, CAKE has struggled to surpass the 200-day EMA, currently at $2.137.

At press time, CAKE was trading at $1.9, just above the 20-day EMA at $1.887 and 50-day EMA at $1.873. These EMAs were immediate support levels, with the price hovering along their boundaries.

The current up-channel on the daily chart resembled a classic bearish flag structure, potentially exposing CAKE to further losses if the price fails to sustain above the trendline support.

Any breakdown below the parallel lines and the $1.7 support could see the coin heading towards the $1.5 region.

Should the market witness a sudden spike in bullish edge, a decisive close above the current pattern could allow CAKE to test higher levels.

The Relative Strength Index (RSI) stood at around 50, indicating a neutral market sentiment with relatively equal buying and selling pressures. A decisive move below the 50 might suggest a renewed bearish stance.

The $1.7 level was a crucial support that aligned with the lower boundary of the up channel. A break below this level could expose CAKE to further losses.

A break above the current pattern could allow the coin to retest the $2.071 resistance and eventually challenge the 200-day EMA at $2.137.

CAKE’s derivatives data and market sentiment

Derivatives data pointed out a cautious sentiment among traders. Open Interest fell by 6.26% to $15.25 million, while the trading volume dropped by 43.37% to $15.28 million, reflecting reduced trader activity after recent volatility.

Interestingly, Binance’s Long/Short Ratio for CAKE/USDT was at 2.1095, showing a slight bullish bias among traders.

OKX’s Long/Short Ratio also stood at 2.4095, indicating that traders on these platforms were optimistic about the coin’s near-term prospects.

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Top traders on Binance have maintained a relatively bullish position, with a long/short ratio of 1.8477, suggesting that leading traders are positioning themselves for potential upward movement.

However, traders should monitor the broader market sentiment, as Bitcoin’s price movement can influence CAKE’s trajectory.