PancakeSwap vs Uniswap: Of metrics, trends, and more

- PancakeSwap saw over 1 million active users in the last 30 days.

- CAKE and UNI continued their positive price trends.

A recent ranking revealed that PancakeSwap [CAKE] had a higher number of active users in the past 30 days when compared to Uniswap [UNI]. In addition to the number of active users, how do the two platforms compare in terms of other metrics?

PancakeSwap and Uniswap make the list

According to a Crypto Rank tweet on the 8th of November, which provided rankings of active users on decentralized finance (DeFi) platforms, PancakeSwap claimed the top spot.

Top 15 DeFi Projects by 30D Active Users

PancakeSwap $CAKE – 1.48M

Stargate $STG – 1.0M

SyncSwap $SYNC – 773K

Uniswap $UNI – 719K

rhinofi $DVF – 384K#Odos – 361K

Maverick Protocol $MAV – 344K

SpaceFi $SPACE – 322K

Mute $MUTE – 299K#1inch – 272K

WOOFi $WOO – 241K

Velocore $VC -… pic.twitter.com/Nv5UJ9bFK5— CryptoRank Platform (@CryptoRank_io) November 8, 2023

The rankings, based on the number of active users in the past 30 days, indicated that PancakeSwap had 1.48 million active users, while Uniswap secured the fourth position with 719,000 active users during the same time frame.

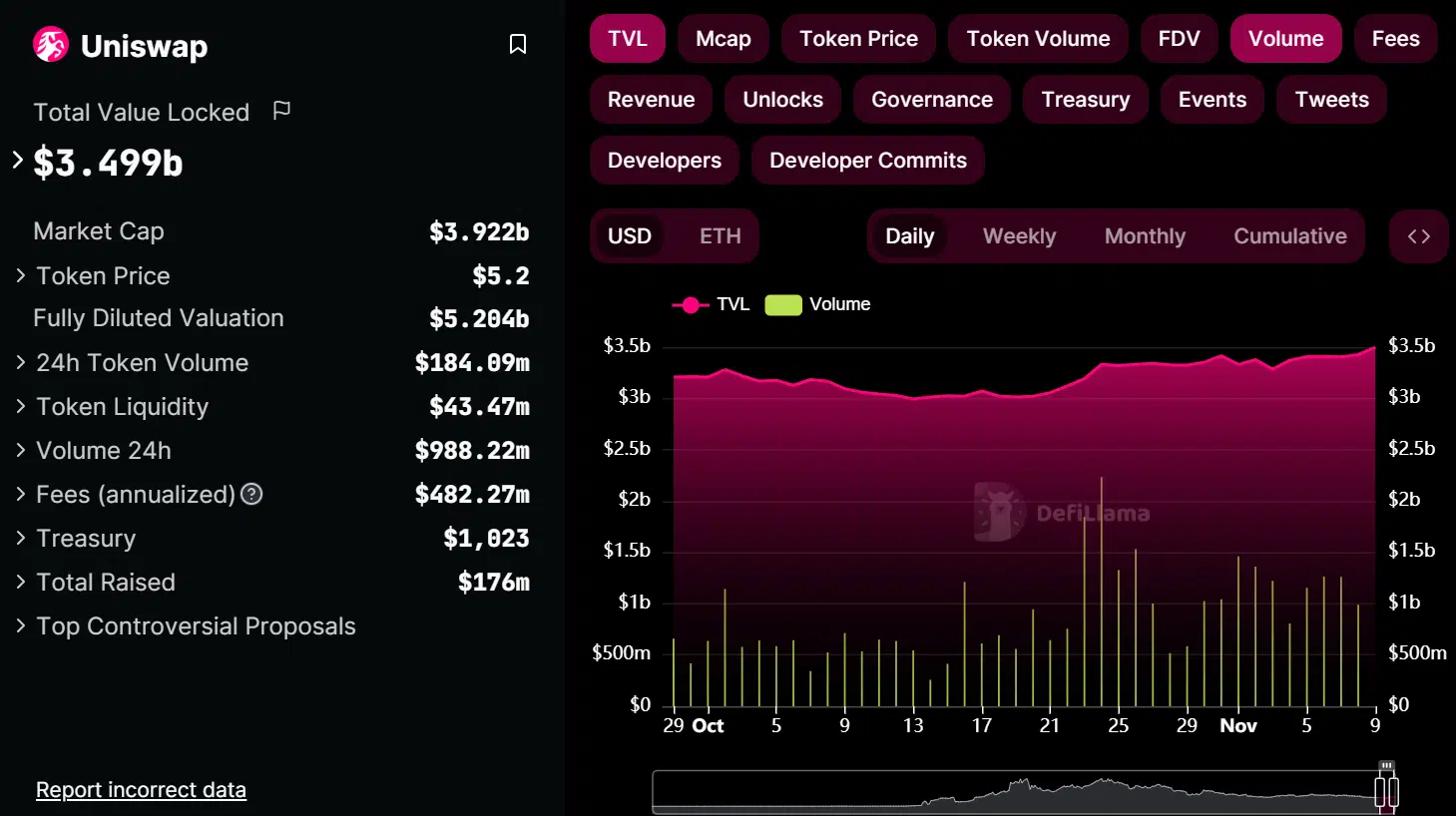

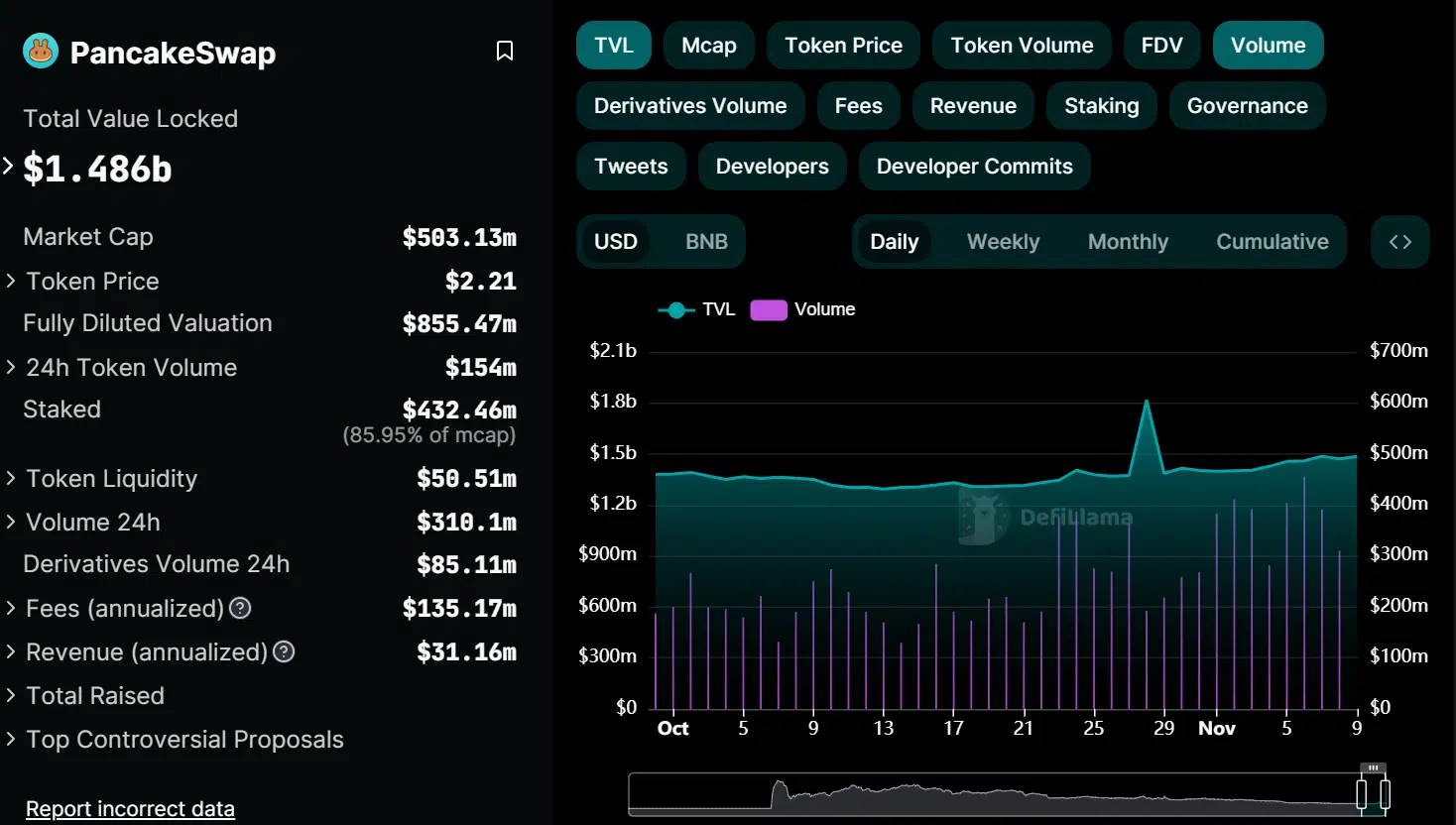

How TVL and volume ranks

AMBCrypto’s analysis of the Total Value Locked (TVL) and trading volume for both platforms revealed that Uniswap was leading in these metrics. According to data from DefiLlama, Uniswap consistently demonstrated higher daily trading volume compared to PancakeSwap.

For instance, an examination of the chart indicated that the lowest daily trading volume Uniswap recorded in the last 30 days was around $259 million. Interestingly, this figure represented PancakeSwap’s average daily volume.

Also, its highest daily trading volume in the last 30 days was approximately $455 million.

In contrast, UNI’s highest daily volume exceeded $2.2 billion. Furthermore, as of this report, UNI’s daily trading volume was over $988 million, while CAKE was around $310 million.

Additionally, in terms of TVL, Uniswap held a clear advantage. As of this report, Uniswap’s TVL was approximately $3.5 billion, signifying a substantial amount of value locked within the platform.

In contrast, PancakeSwap’s TVL was around $1.5 billion, indicating a lower amount of value locked within their ecosystem.

PancakeSwap and Uniswap’s price trend

AMBCrypto’s examination of CAKE’s price trend on a daily timeframe chart revealed recent spikes. This might provide an explanation for the increase in active addresses it experienced. The chart indicated that CAKE’s price surged by more than 50% in just two days.

This price increase moved the price from around $0.8 to the $2 price range.

While there were some minor price declines observed, it has generally maintained the $2 price range. At the time of writing, it was trading with an increase of over 1% at around $2.2.

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Additionally, Uniswap has also been on a positive price run in recent days, albeit at a more gradual pace. On the 8th of November, it gained over 5% in value, closing the day’s trading at around $5.1.

As of press time, it was trading at approximately $5.2, registering a modest increase of less than 1% in value.