PancakeSwap’s continuing attempts fail to resurrect CAKE, here’s why

- CAKE tumbled more than 16% in the last 24 hours to its press time value of $2.72.

- The total staked value on PancakeSwap fell 17% in the last 24 hours.

To add deflationary pressure on its native token, PancakeSwap removed more than seven million CAKE tokens out of circulation in the latest burning round.

The tokens burned were worth $23 million in value. According to CoinMarketCap, CAKE’s circulating supply stood at 193.69 million. This meant that 3.7% of the circulating supply was burnt in the latest round.

However, this development was not cheered on by investors as CAKE tumbled more than 16% in the last 24 hours to its press time value of $2.72.

? 7,176,570 $CAKE just burned – that’s $23M!

? Trading fees (Swap and Perpetual): 157k CAKE ($505k) +26%

? Prediction: 65k CAKE ($210k) -3%

?️ Lottery: 23k CAKE ($73k) -36%

? NFT Market, Profile & Factory: 441 CAKE ($1k) +6%*% change from last week is in CAKE

??? Proof… pic.twitter.com/jQ2c2Y46Zp

— PancakeSwap?Ev3ryone's Favourite D3X (@PancakeSwap) April 24, 2023

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

CAKE’s not yummy?

CAKE has been witnessing a steady decline in value in recent weeks. Even the much-hyped launch of PancakeSwap V3 earlier this month failed to resurrect CAKE, as the token has recorded losses of more than 26% since the launch.

While the alt was feeling the pinch of a wider market slump triggered by Bitcoin’s [BTC] steep descent, some of the internal factors could also be at play.

About a year ago, PancakeSwap launched its fixed-term staking program, allowing users to lock their CAKE for optimum rewards.

The maximum locking duration was 52 weeks (1 year). Hence, there was a possibility that users who deposited their tokens were now unlocking and dumping in the market.

This idea was supported by PancakeSwap’s staking data from DeFiLlama, which showed that the total staked value dropped from $926 million to $763 million in the last 24 hours, a fall of 17%.

Moreover, due to unstaking of the token, overall liquidity on the DEX declined as the total value locked (TVL) dropped 6% in the 24-hour period. On a weekly basis, the TVL fell as much as 12%.

CAKE in the grip of bears

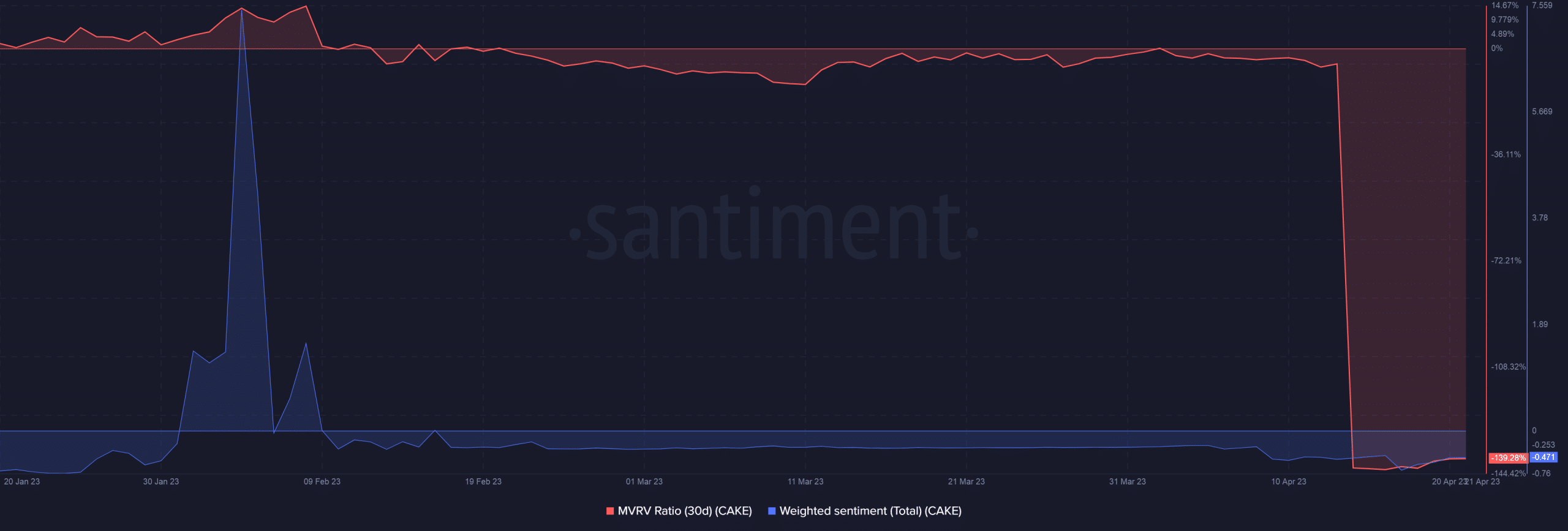

As per data from Santiment, the 30-day MVRV Ratio plunged deep into the negative territory, implying that most holders would incur losses if they decide to sell their holdings.

The lack of profitability deterred investors from betting big on CAKE as the weighted sentiment declined sharply.

How much are 1,10,100 CAKEs worth today?

Last week, PancakeSwap proposed changes to its tokenomics to move CAKE towards a deflationary model. In a blog post, the DEX put forward a plan to target an annual inflation rate of 3%-5% for CAKE, a significant reduction from the current rate of 21%-23%, by reducing the incentives given to traders and stakers.

However, more than 56% of the stakeholders voted against the proposal, demanding to continue with the existing emission rate of 6.65 CAKE per block for Syrup Pool.