PancakeSwap’s exec reveals latest changes; will traders wake and CAKE?

- PancakeSwap lead releases statement explaining CAKE’s downward spiral.

- Resurgence of on-chain activity improves CAKE prospects.

It’s been a harsh three weeks for CAKE holders during which the value of cake plummeted to February 2021 levels. What started out as a seemingly innocent pullback manifested into a major drawdown, and more questions than answers.

How many are 1,10,100 CAKEs worth today

PancakeSwap’s lead executive just released a statement explaining the situation and it may offer insights into why CAKE lost flavor. According to the statement, CAKE’s recent performance is a reflection of changes to its tokenomics.

The PancakeSwap head chef revealed that changes to the platform’s inflation model were necessary for the CAKE Syrup pool to ensure sustainability.

1/12 As the Head Chef of PancakeSwap, I understand that changes in tokenomics can be a delicate topic for our community. However, I want to assure you that our recent changes were made with careful consideration and for the long-term benefit of PancakeSwap and our users in mind.

— chef mochi (@chef_mochi) May 9, 2023

PancakeSwap recently proposed a 3-5% CAKE inflation rate and also plans to introduce a new revenue-sharing model to generate value for users. The statement also confirmed that PancakeSwap will maintain the CAKE burn mechanism. While the recent changes spoofed investors and led to a massive downside, will this announcement mark a CAKE pivot?

Whales regain appetite for CAKE?

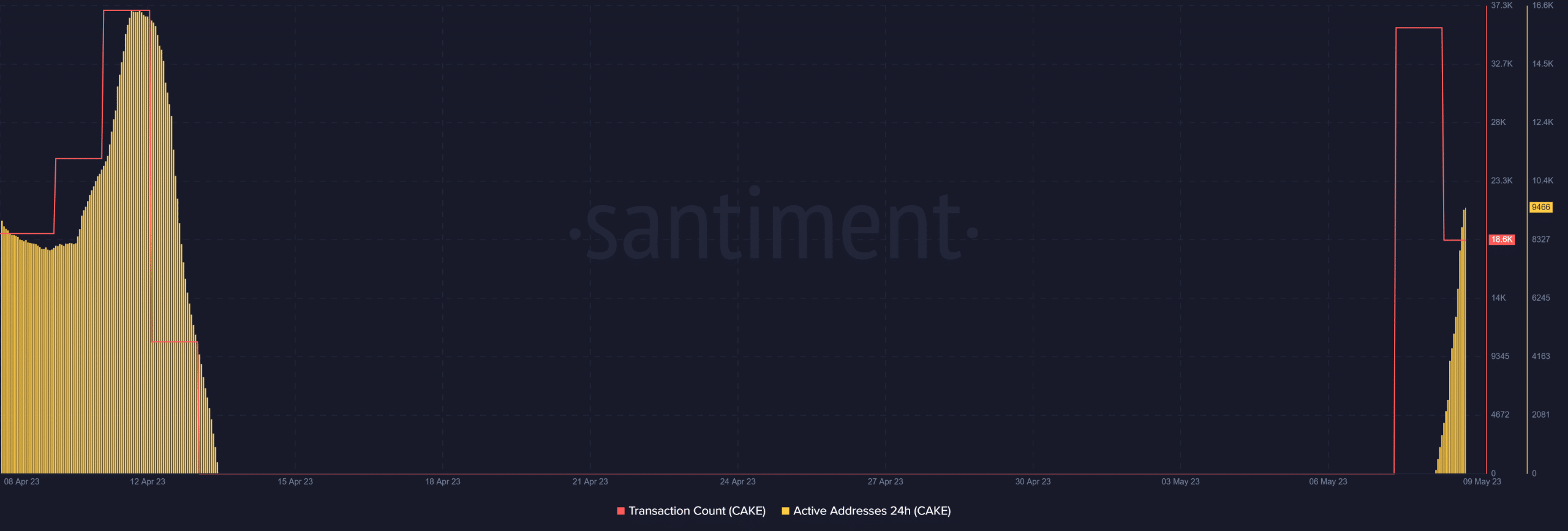

There stood a significant probability that CAKE may experience some bullish relief in the next few days as reflected across multiple metrics. For example, its transaction count has been relatively dormant for the last three weeks but it just registered a large spike during the trading session on 8 May.

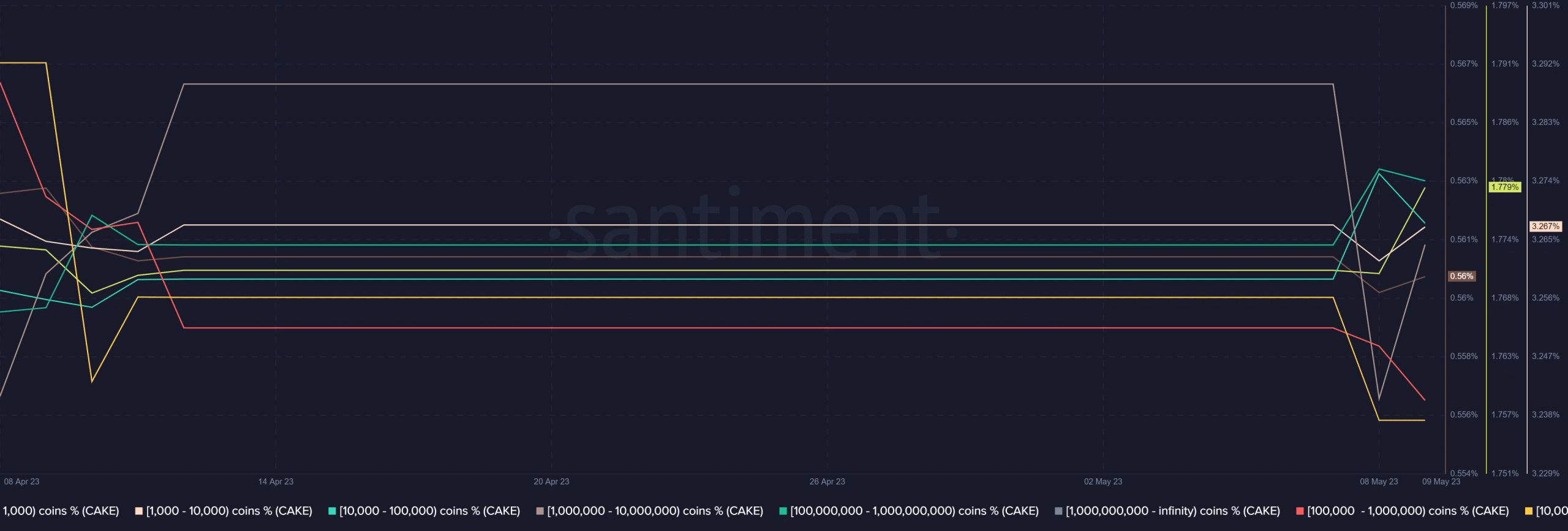

Address activity has been nonexistent during the same period, with signs of a revival in the last 24 hours. But that’s not all. Even the whales are back in action after a three-week hiatus. CAKE’s supply distribution metric confirmed the return of trading activity since 8 May after its previously flat performance.

Will these findings trigger a demand resurgence? CAKE managed to pull off a 3.61% gain in the last 24 hours at press time. However, it still stood down by over 50% compared to its value at its highest point in April.

The heavy discount may offer some incentive for buyers at the current price level especially now that CAKE was starting to regain some trading activity.

Is your portfolio green? Check out the CAKE Profit Calculator

At the time of writing, CAKE was still heavily oversold at its $1.91 price level. This means there was significant upside potential but its ability to achieve a strong bounce back will depend on whether it can secure robust demand.

It previously attempted a rally on 27 and 28 April but failed. This time it is backed by a return of activity especially from the whales, hence the improved bullish prospects.