PancakeSwap’s prospects improve, thanks to these latest integration

- PancakeSwap secures another liquidity win through 1Inch integration.

- CAKE’s prospects look a little promising as it flashes multiple oversold signs.

PancakeSwap is looking to leverage growth through integration with the Ethereum network and the BNB chain. A move that may potentially fuel more utility and thus demand for its native token CAKE.

Is your portfolio green? Check out the PancakeSwap Profit Calculator

According to PancakeSwap’s latest announcement, 1Inch just concluded the integration of PancakeSwap V3 liquidity pools with Ethereum and the BNB chain.

These two layer 1 networks currently control most of the DeFi volumes, hence the significance of the announcement.

The integration represents an important step forward for PancakeSwap as far as access is concerned.

? @1inch has integrated our V3 liquidity pools on both BNB Chain and Ethereum!

? PancakeSwap’s v2, v3, and Stableswap pools can all be sourced from 1inch

? Try it today: https://t.co/2z8YCsJIvs pic.twitter.com/LP5WLmK4M9

— PancakeSwap?Ev3ryone's Favourite D3X (@PancakeSwap) April 24, 2023

More access and utility for PancakeSwap pools have the potential to trigger higher demand for CAKE. However, the impact on the price is expected to take place over time and not necessarily immediately.

CAKE is on the menu for a sizable bounce

CAKE has been on a downward trajectory since the second week of February, and the selling pressure intensified within the last seven days. The token has tanked by 32% from its February peak to its $3.19 press time price.

CAKE’s price action is currently approaching a key support level within the $3.13 price range. A support retest may yield a sizable upside.

Also, the price just dipped into oversold territory according to the RSI. So, are there any signs that accumulation is already starting to build up?

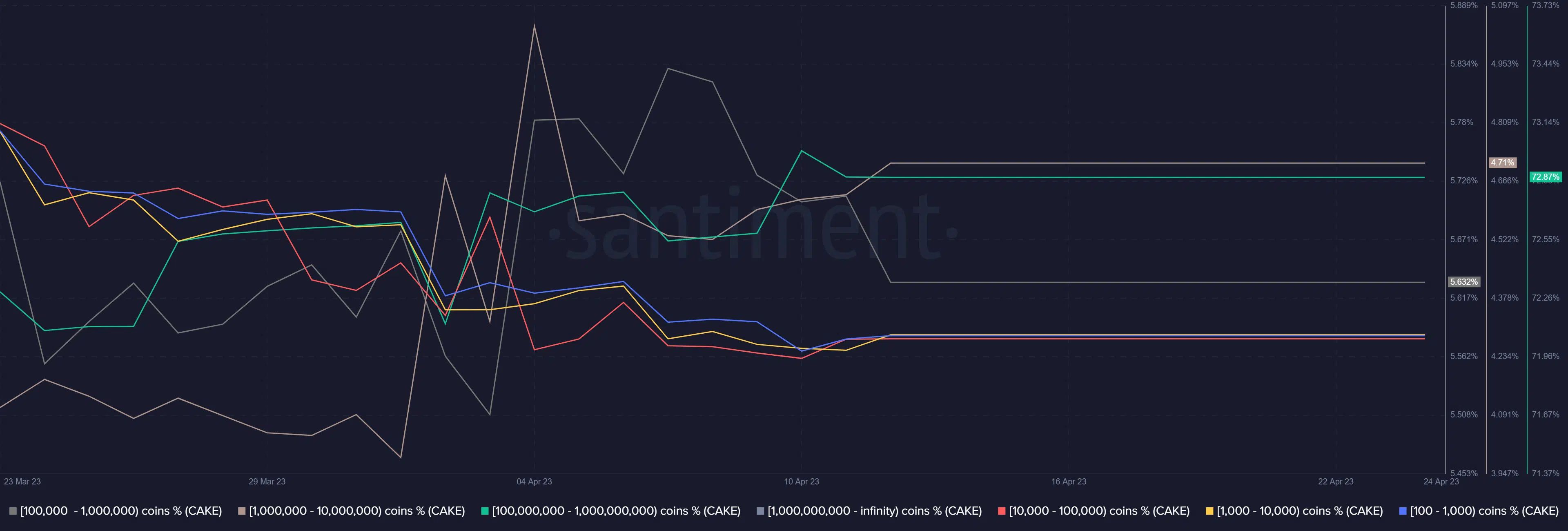

CAKE’s supply distribution metric reveals that whales have been relatively inactive since 12 April. Their on-chain activity has flat-lined since then but they are expected to come out of hibernation as the price retests the upcoming support line.

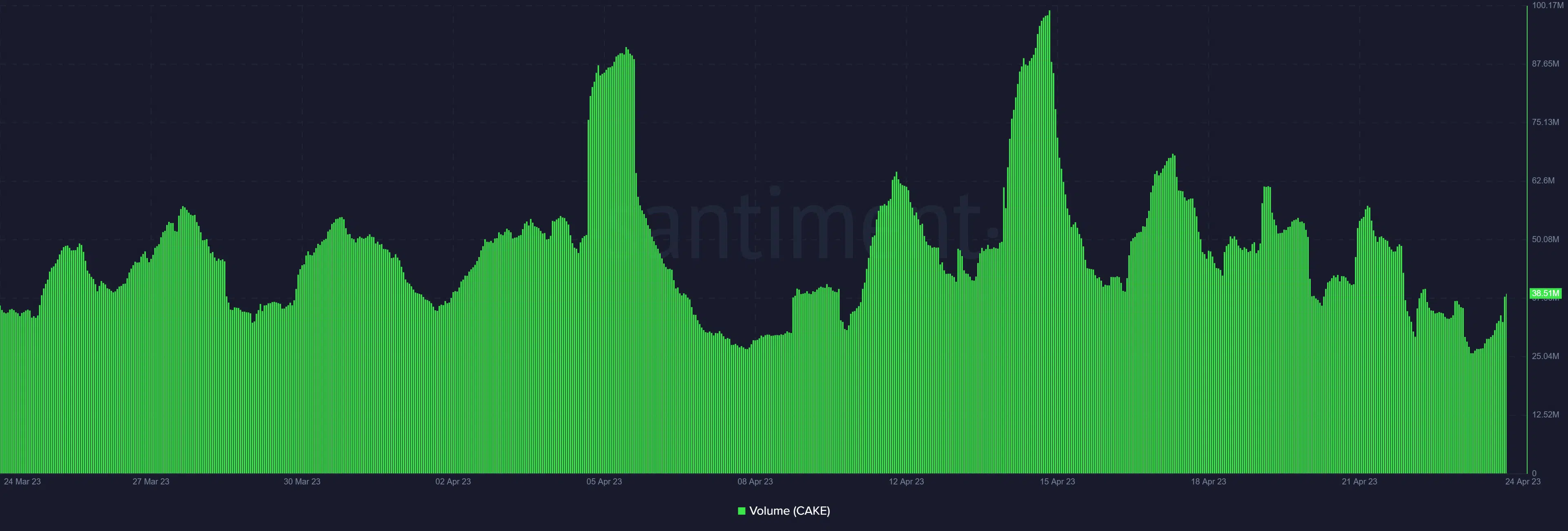

Meanwhile, CAKE’s volume declined since mid-April and even managed to drop to a new monthly low on 23 April. Explosive bullish volumes at the support line may fuel robust demand for CAKE in the next few days.

How many are 1,10,100 CAKEs worth today?

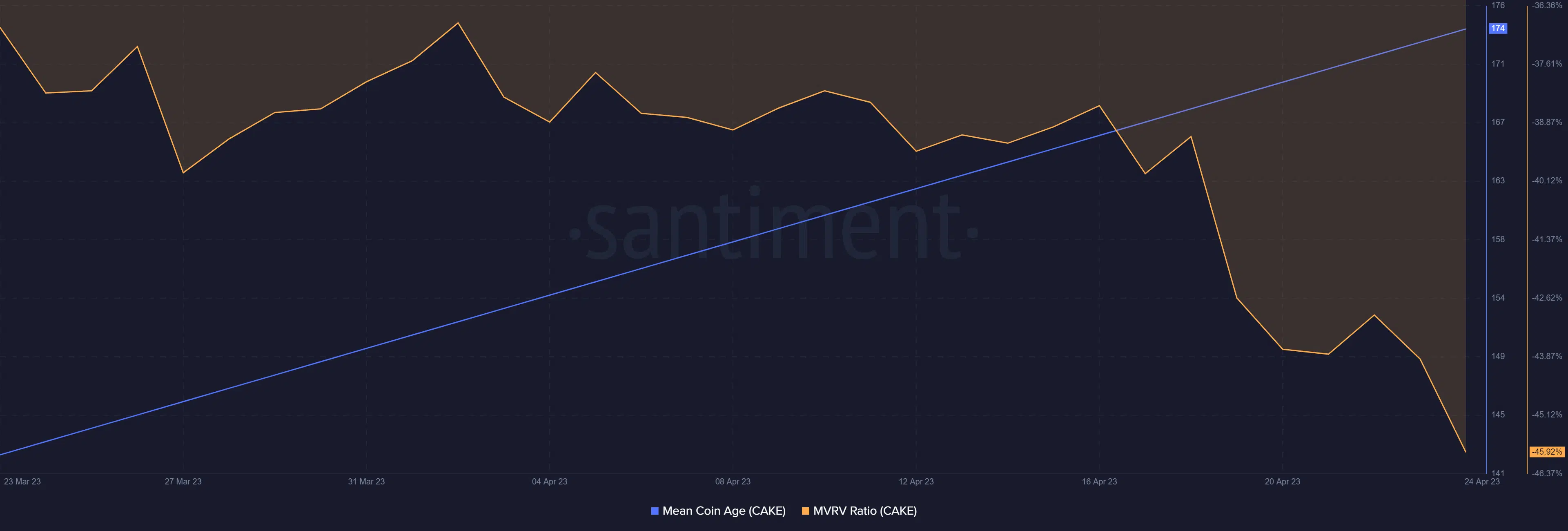

There are some signs that accumulation is building up. For example, the mean coin age maintained an upward trajectory in the last four weeks. This indicates that most CAKE holders are opting to HODL their coins despite the bearish price action.

Lastly, CAKE’s MVRV has been in free fall, especially in the last 7 days as the price dipped lower. Slight upsides here and there signal that there were individuals buying the dip all along but the falling prices ensured a drop in profitability.