PayPal USD’s [PYUSD] short-lived hype: Can it make a comeback soon?

- PayPal USD marketcap experienced roughly $300 million worth of liquidity outflows in September.

- A look at the stablecoin’s shift in dominance and address growth.

PayPal USD was on track to become one of the fastest growing stablecoins at the start of Q3 2024. However, it appears to have backtracked on its previous achievements judging by its performance in the last four weeks.

PayPalUSD more than doubled its marketcap between July and August. It soared above $1 billion for the first time in history towards the end of August, marking an important milestone.

That achievement was driven by a lot of hype and growing utility especially in the Solana ecosystem. However, that hype was short-lived judging by its performance in September.

Roughly $300 million was wiped out of PYUSD’s marketcap in the last four weeks. It recently dipped to a local low of $695 million, but has since recovered back above $700 million.

PayPal USD owes its previous surge to its deployment on Solana. We observed a surge in its dominance from the last week of July to the tail end of August.

PayPal USD dominance on Solana (blue) peaked at 65.79% on 28th August but has since then dropped to 47.68% as of 30th September. This means it reclaimed dominance on Ethereum (green) at 52.32%.

The declining dominance on Solana aligns with the dip in large transaction in the last 3 months.

Solana’s daily volume registered its highest peak at $342.24 million in July. The highest daily volume in August peaked at $252.58 million and more recently peaked at $170.67 million On 26 September.

The data above confirms that PayPal USD on-chain volume has been declining for the last 3 months. This suggests that there was a dip in demand during this period, which would explain the declining marketcap.

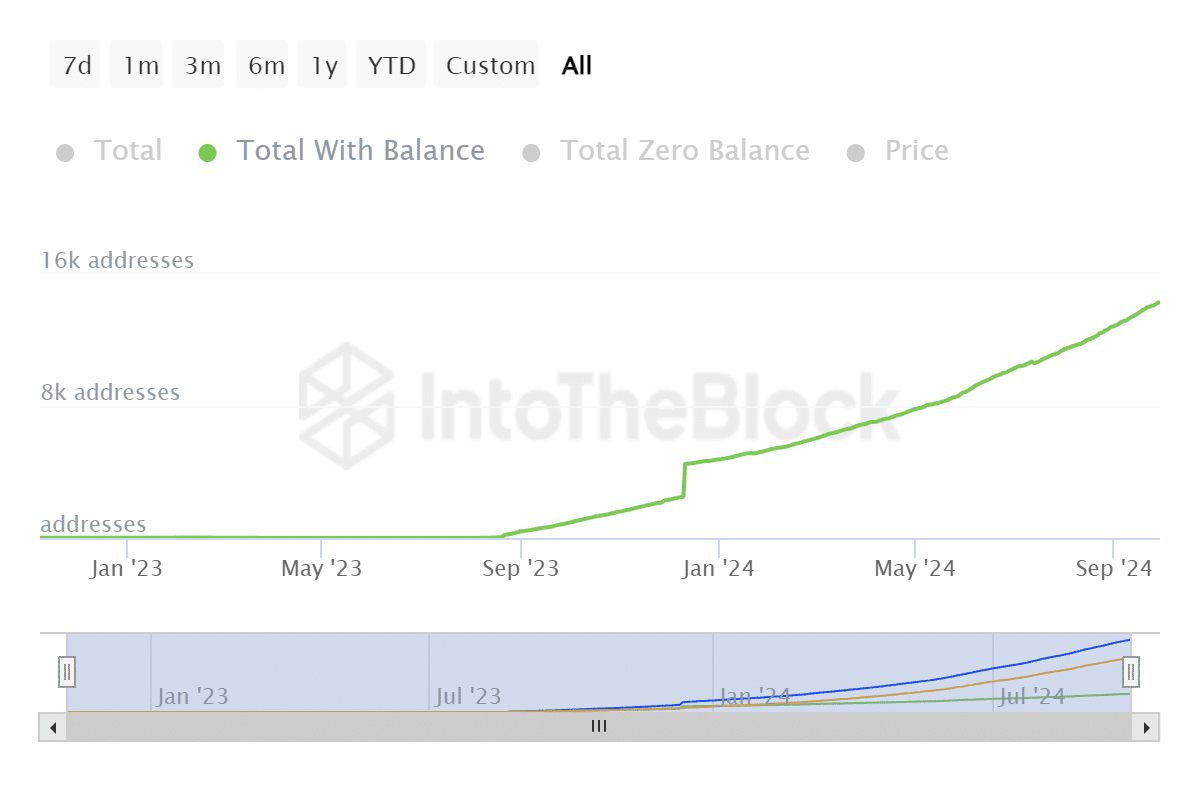

PayPal USD continues winning in address growth

Despite the impact on marketcap, PayPal USD continued to experience a net gain in the number of addresses. The total number of addresses with a PYUSD balance recently peaked at 14,290 addresses.

This is the highest number of addresses that the stablecoin has achieved so far.

Positive address growth confirms that there is a healthy level of adoption so far this year. This is despite the noteworthy slowdown in August and September.

Will PYUSD recover to previous marketcap highs? The stablecoin’s attractive incentives such as high yields especially on the Solana network contributed to its robust demand.

Such opportunities are likely to be available during a major bull run. In which case we might still witness more demand for PayPal USD sometime down the road.

![Solana's [SOL] high fee generation figures are misleading - Here's why!](https://ambcrypto.com/wp-content/uploads/2025/05/B6ACB721-6173-4255-91A4-FEE8D9DE21D1-400x240.webp)