Pepe

PEPE: 2 reasons why the memecoin can rally 200%

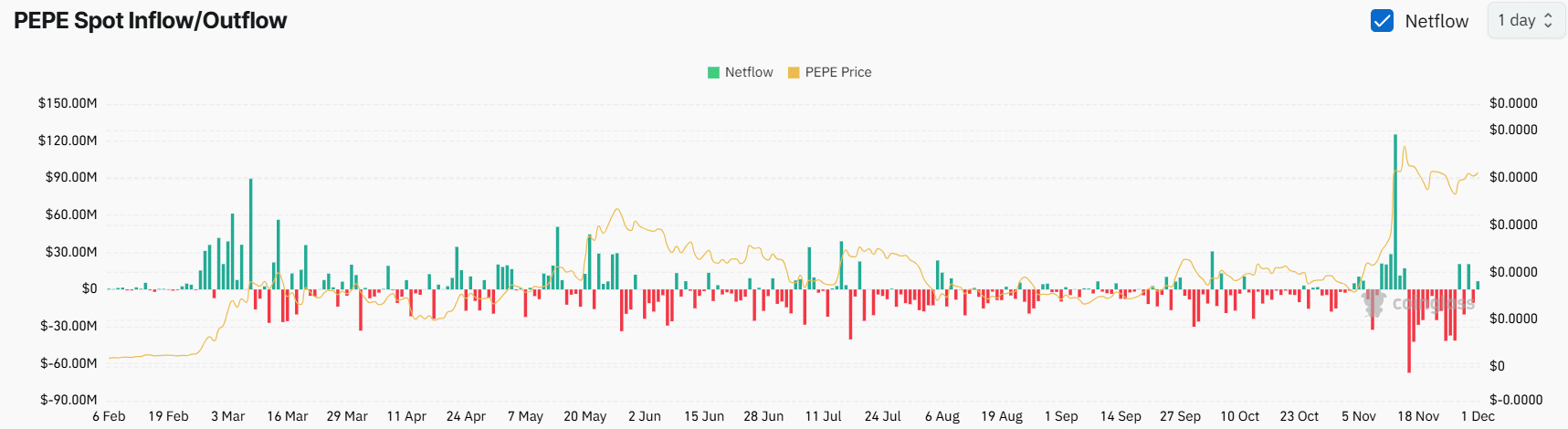

PEPE spot inflow/outflow data show outflows worth $341 million from exchanges.

- PEPE could surge by 200% to reach the $0.000060 level if it closes a daily candle above $0.0000216.

- Traders were overleveraged at $0.0000199 on the downside and at $0.00002143 lower side.

Pepe [PEPE], the popular Ethereum [ETH]-based memecoin, has been attracting whale and institution interest despite the ongoing price consolidation.

The overall market sentiment was bullish at press time, although the market was experiencing a correction following its significant upside momentum.

PEPE withdrawal from exchanges

Per AMBCrypto’s look at Coinglass data, PEPE’s Spot Inflow/Outflow data showed a significant $341 million in PEPE outflows from exchanges since the 13th of November.

This significant outflow indicated that tokens have been withdrawn from exchanges to wallets.

In the cryptocurrency landscape, such outflows typically indicate an ideal buying opportunity and potential upside momentum.

The primary reason for this significant participation from whales is the formation of a bullish price action pattern on the daily timeframe. It also reflects the community’s confidence and trust in the actions of whales.

PEPE technical analysis and upcoming levels

According to AMBCrypto’s technical analysis, PEPE appears bullish as it has broken out from a bullish flag and pole price action pattern on a daily time frame.

Based on recent price action and historical momentum, if the memecoin closes a daily candle above $0.0000216, there is a strong possibility it could surge by 200% to reach the $0.000060 level in the coming days.

As of press time, PEPE’s Relative Strength Index (RSI) was at 62, indicating that the memecoin still had room to rally in the coming days, as it was below the overbought zone.

Major liquidation levels

AMBCrypto’s look at Coinglass data also reported that traders have taken substantial positions on the long side.

The major liquidation levels were at $0.0000199 on the downside, with $7.40 million in long positions, and at $0.00002143 on the upside, with $5.05 million in short positions. Traders were overleveraged at these points.

Read Pepe’s [PEPE] Price Prediction 2024–2025

The combination of bullish on-chain metrics and technical analysis suggested that bulls were in control of the asset and could drive the memecoin’s upcoming upside momentum.

PEPE price analysis

At press time, PEPE was trading near $0.00002097 after a price decline of 1.10% in the past 24 hours. During the same period, its trading volume dropped by 15%, indicating lower participation from traders.