PEPE bides its time near key support: Can it reverse the losses since May?

- Pepe has a bearish market structure and is likely to retest recent lows once more.

- The eagerness in the futures market suggested a recovery, which once initiated, could be rapid.

Pepe [PEPE] was trading within a short-term range and saw a sell-off from the highs. One of the latest developments around the memecoin was the deposit of PEPE tokens worth $7.8 million into the Binance exchange. This pointed toward a potential spike in selling pressure.

Another AMBCrypto report noted that the momentum was bearish, and even a bounce in prices would likely be sold off by holders at a loss looking to break even. This scenario came to pass.

The 20% bounce earlier this weekend has begun to see a reversal

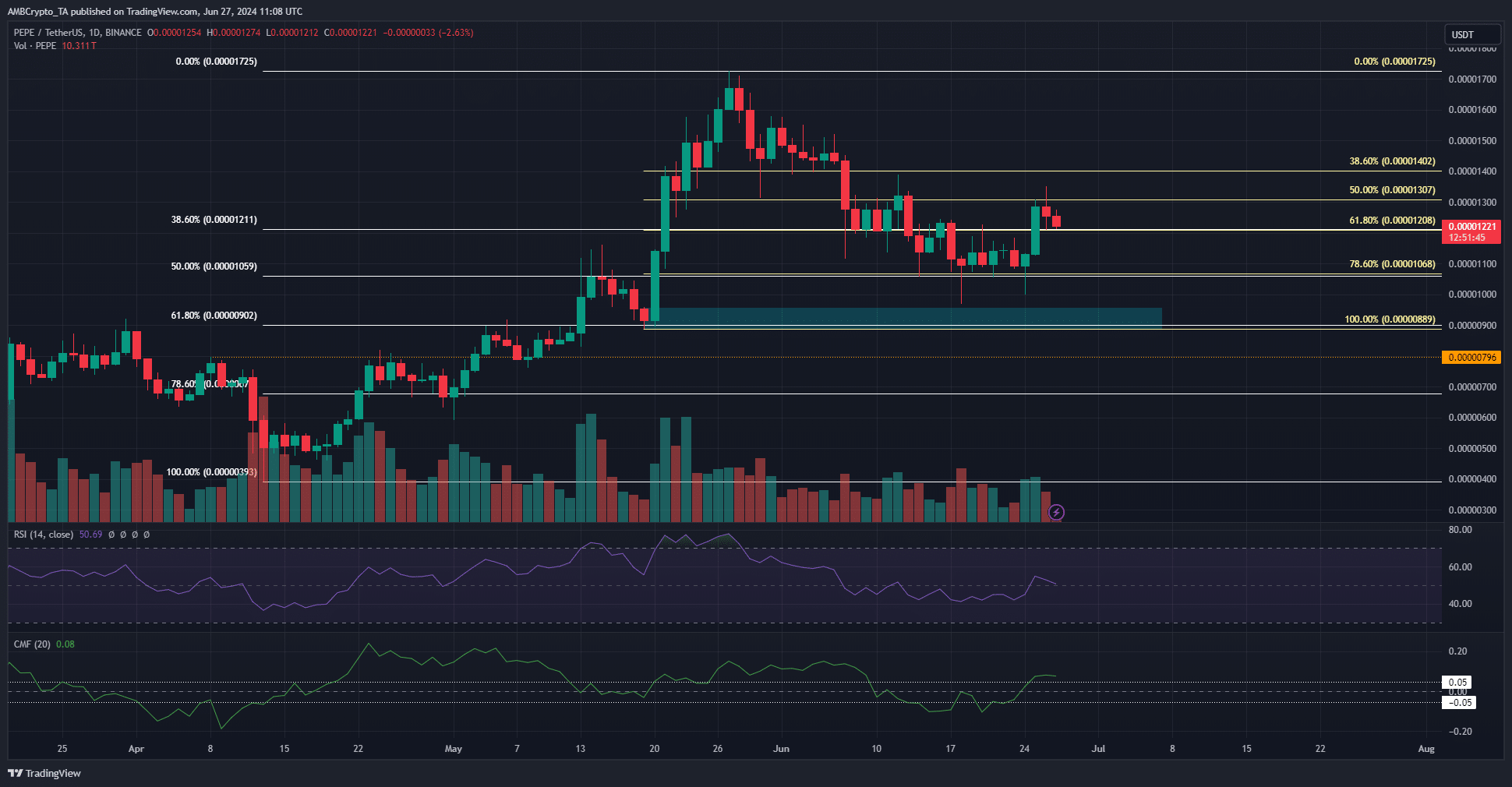

Two sets of Fibonacci retracement levels were plotted based on the impulse moves made in April and May.

The smaller move in the second half of May saw the 78.6% retracement level (pale yellow) defended as support, but the 50% level at $0.000013 served as resistance and rejected the bulls.

The bigger move was captured by the levels labeled in white. These levels showed that the $0.0000089, which was highlighted as a bullish order block, was the 61.8% retracement level. Hence, the price is likely to bounce from this region.

If it does not, a long-term bear trend might still not be established. The 78.6% level further south at $0.0000068 would be expected to reverse the deep correction. However, it would indicate bearish dominance in the short term.

The daily indicators showed some positivity after the 20% price bounce earlier this week. The RSI was at 50 and the bulls would seek to flip the neutral level to support to establish an uptrend.

Similarly, the CMF was at +0.08 to indicate notable capital inflows. This trend needs to continue for PEPE bulls to initiate a recovery.

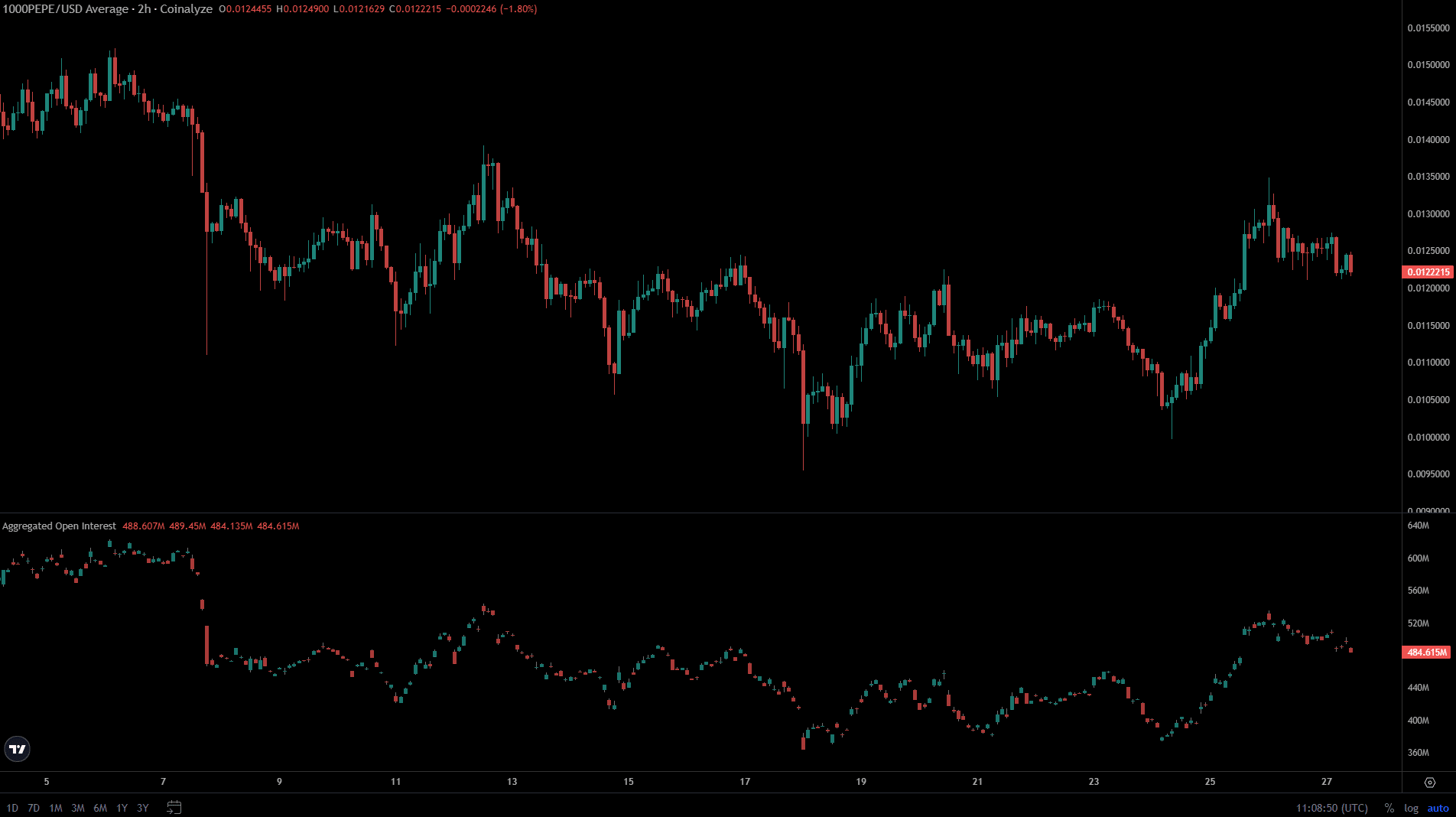

The Open Interest highlighted the ebbs and flows in market sentiment

Source: Coinalyze

While the price of PEPE has trended downward since late May, speculators in the futures market were not scared to go long when PEPE showed short-term bullishness. This was seen on the 25th when a 15% price bounce saw the OI surge from $400 million to $520 million.

Read Pepe’s [PEPE] Price Prediction 2024-25

In the past 36 hours, the OI has receded to $484 million. It showed some slump in bullish sentiment but this week highlighted that PEPE bulls were eagerly waiting for the trend to shift.

If and when Bitcoin [BTC] begins its recovery, Pepe might be one of the best-performing large-cap altcoins.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)