PEPE fights back even as Bitcoin wanes – But is it too late?

- PEPE has a strong short-term bearish bias based on momentum and price action.

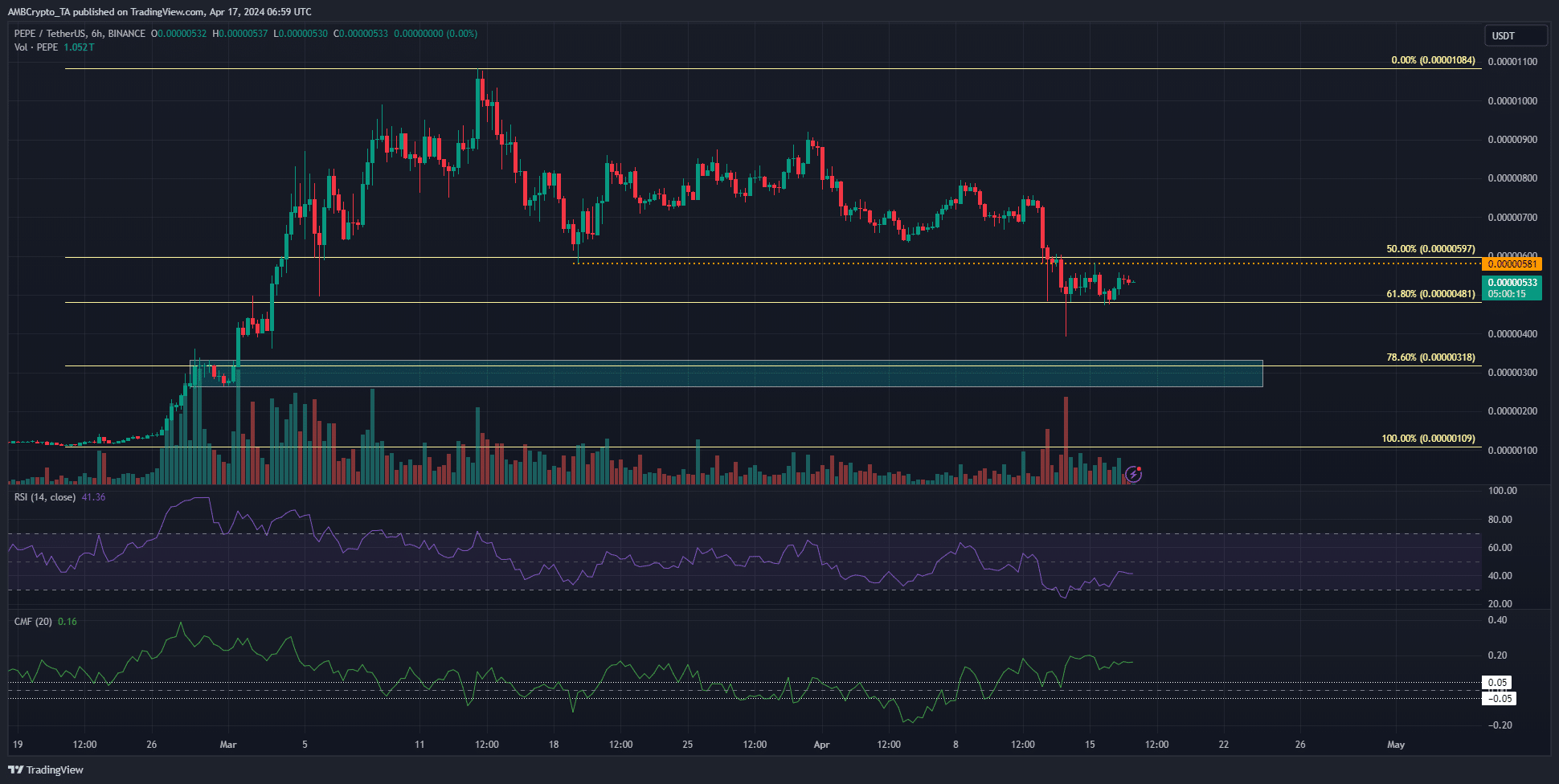

- The Fibonacci retracement levels would be pivotal for investors and swing traders.

Pepe [PEPE] traders likely benefited from the volatility of the past week, but this volatility has also been scarce over the past 24 hours. The momentum and volume indicators were at odds with one another.

The price action chart suggested more losses were likely. With Bitcoin [BTC] demand drying up, PEPE bulls might struggle to keep prices afloat.

The short-term range formation at the 61.8% level

PEPE has a bearish market structure on the 4-hour and 6-hour timeframes. The long-term trend was bullish, and the retracement we are witnessing now is part of the internal structure within that uptrend.

With that said, traders should anticipate further losses in the near term. The RSI was below neutral 50 and showed downward momentum was stronger.

Interestingly, the CMF was at +0.16, showing strong demand for the meme coin.

Despite the short-term demand in the past two days, the token was stuck within a small range that extended from $0.00000481 to $0.00000581.

The 78.6% Fibonacci retracement level is an area of interest. Just below it lay a demand zone from early March, where prices had consolidated before rallying six weeks ago.

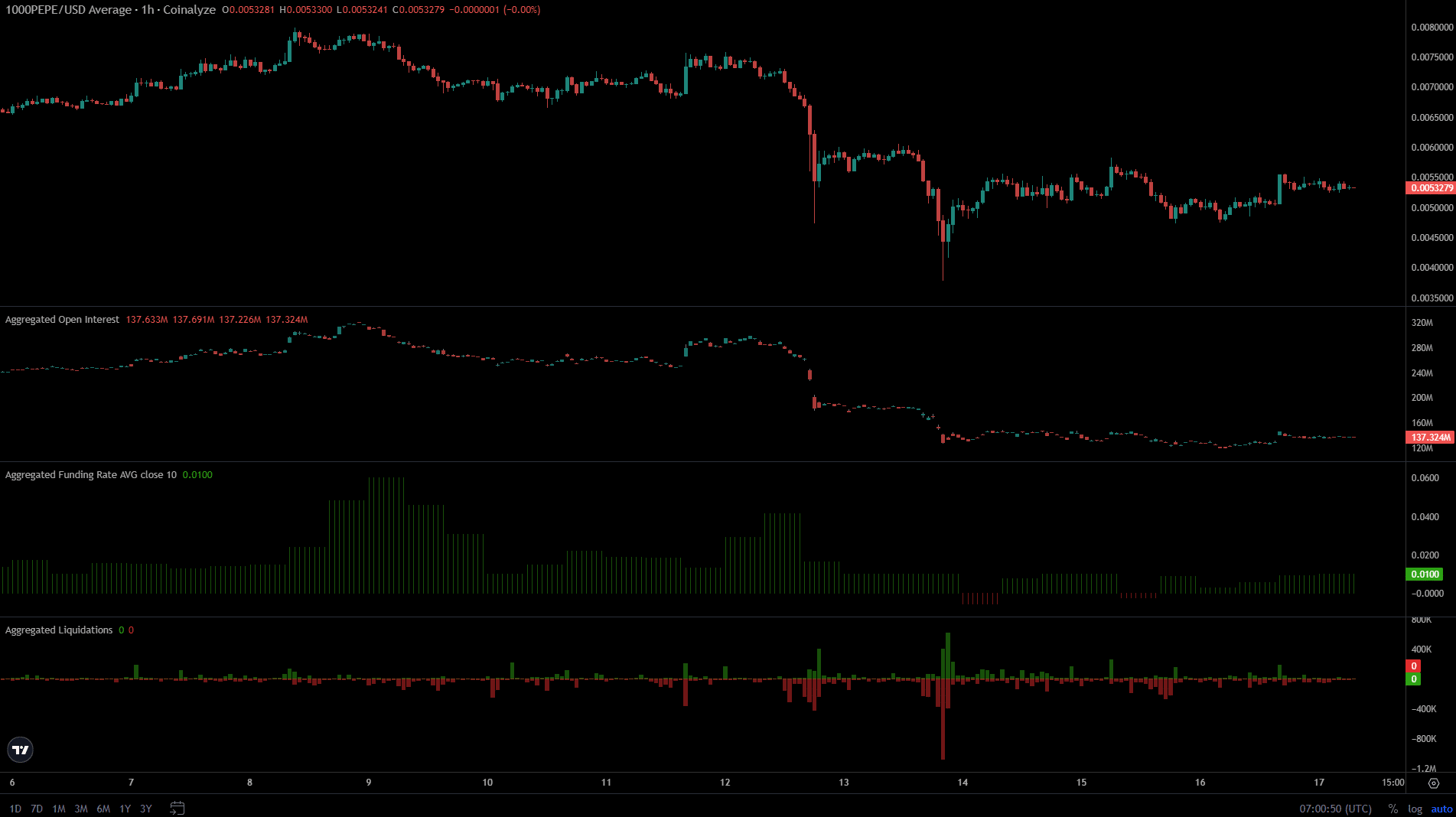

Speculators have been absent recently

Source: Coinalyze

The strong move downward recently saw many futures traders liquidated in both long and short positions. The swift drop on the 13th of April, followed by the quick bounce, has scared off speculators.

The Funding Rate was slightly positive, but this does not indicate long positions were favorable.

Read Pepe’s [PEPE] Price Prediction 2024-25

The Open Interest has been stagnant since the 14th, and the aggregated liquidations were still over the past 24 hours too.

Together they indicated bearish sentiment and feat in the market. Unless Bitcoin and PEPE can establish an uptrend, the speculators would likely remain sidelined.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.