Pepe

Pepe coin price prediction: Can bulls reverse Q2’s 30% price drop?

What’s next for PEPE after defending 61.8% Fib level amidst BTC fluctuations?

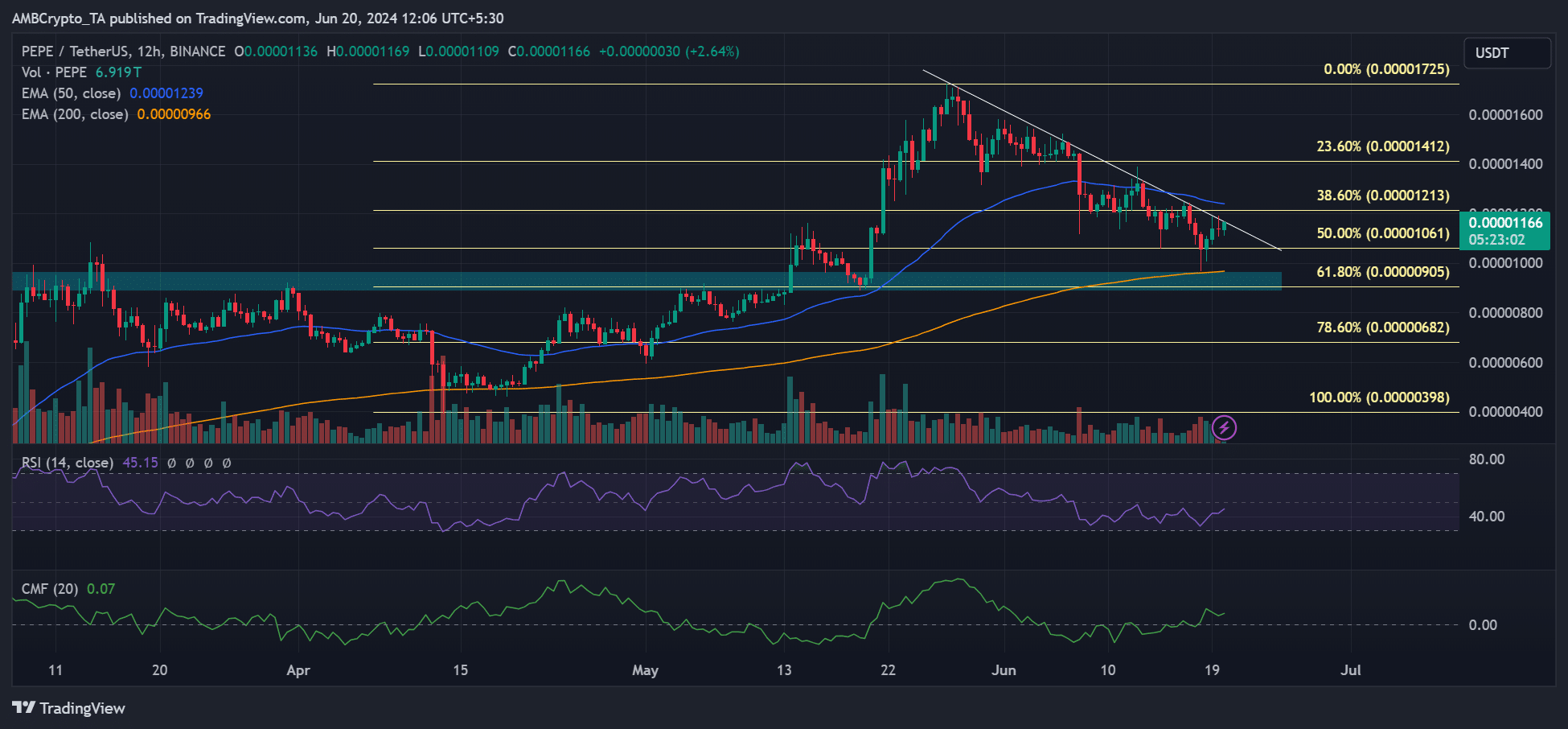

- PEPE saw relief above 61.8% and attempted a recovery.

- However, a strong recovery could be delayed as BTC fluctuations persist.

In the second half of Q2, crypto markets saw broader retracement, dragging most altcoins in double-digit losses. Pepe Coin [PEPE], one of the memecoins that had a massive rally in May, shed over 30% of its value.

However, PEPE saw slight relief after retesting a key demand zone and the 200-day EMA (Exponential Moving Average) near $0.000009.

The meme coin was up 4% in the past 24 hours but was yet to flip the market structure bullish as of press time.

PEPE coin price prediction: Can bulls reclaim 50-EMA?

Key technical indicators on the higher timeframe charts, 12-hour, showed strengthening buying pressure.

Notably, the CMF (Chaikin Money Flow), which tracks money flows into the PEPE markets, climbed above the average level, demonstrating substantial liquidity pumped into the memecoin.

Similarly, the RSI (Relative Strength Index) rebounded from the lower range indicating increasing buying pressure for the meme.

However, in June, the indicator has been range-bound below the mid-range, indicating demand was still muted.

Further rally could be confirmed if PEPE flipped bullish by moving above trendline resistance (white) and the 50-EMA ($0.0000012).

So, despite a relief bounce at the golden ratio (50% Fib level), bulls could only have leverage if PEPE reclaimed the 50-EMA.

Otherwise, in the short-term, a drop to 200 EMA couldn’t be overruled as Bitcoin [BTC] struggled to move beyond $66K.

More headwinds for PEPE

Besides, another data point from CryptoQuant suggested that the dominance of memecoins in the bull run has weakened considerably in the past few weeks.

If mindshare shifts elsewhere from memes, this could add headwinds to PEPE’s strong recovery.

Additionally, daily active addresses remained low despite a recent positive uptick in Weighted Sentiment for PEPE. It meant that the positive sentiment might not be enough to push PEPE forward as user activity remained low.

However, the slow traction could change when Ethereum [ETH] ETFs launch, reportedly before July 4th.