Pepe could be hit by another wave of selling, here’s why

- PEPE has a bearish market structure.

- A drop below the nearby support level could see prices recede 18%-40% in the coming weeks.

Pepe [PEPE] fell 35% from the 11th of January to the 24th. Its bearish market structure has been in place since the 3rd of January. At press time, it was trading at a support zone that PEPE bulls have defended since November 2023.

A drop below this zone would likely see the meme coin retrace all the gains it made in the second half of October 2023. An on-chain metric suggested that holders were gearing up to sell the token, which could see prices crater.

The momentum has been bearish over the past month

The RSI of PEPE on the one-day chart fell below the neutral 50 mark on 2nd January. It has stayed below it since then, apart from a brief foray beyond on the 11th of January.

The OBV has also slid lower in the past two weeks, but it has been in an uptrend over the past three months.

The market structure on the one-day chart was bearish. A move above $0.0000012 would be needed to flip the structure bullishly. The demand zone (cyan box) saw PEPE rally swiftly back in November.

Hence, it is expected that the buyers would be keen to re-enter the markets. However, a daily session close below the $0.000001 support would be an early sign of impending losses.

The weighted sentiment saw a brief spark but to no avail

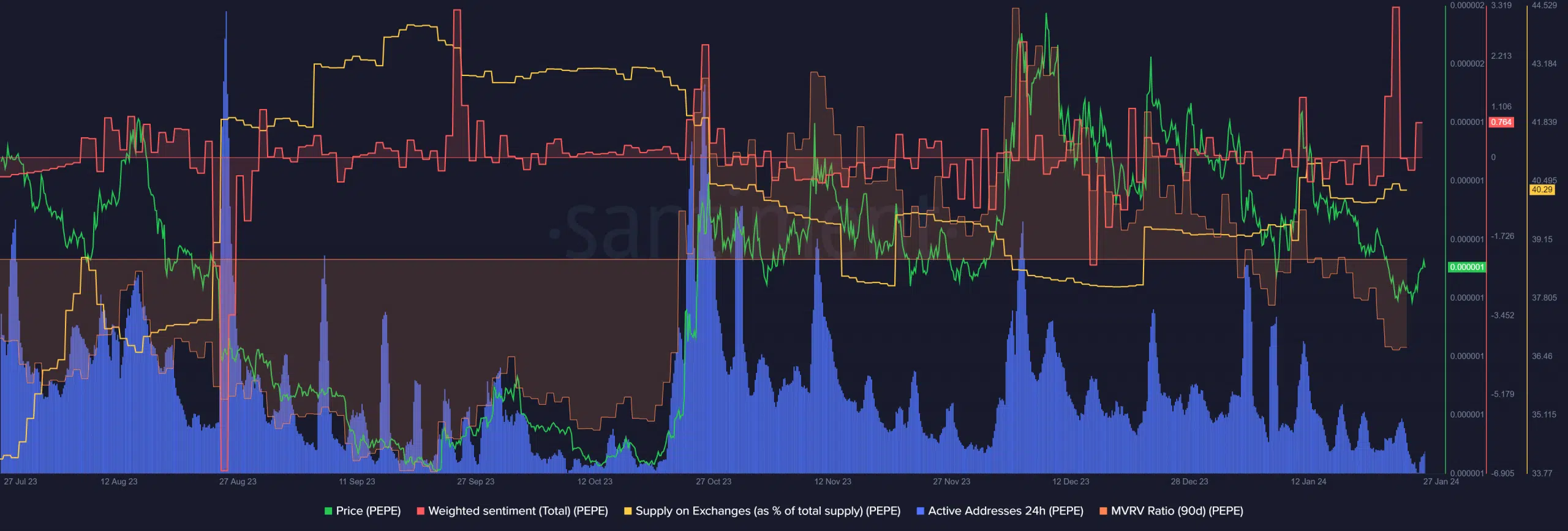

AMBCrypto analyzed data from Santiment to understand better how PEPE was faring. The active addresses metric has trended steadily downward in January.

Source: Santiment

The supply on exchanges has also jumped higher in the past month. Together they showed a lack of demand for PEPE and the possibility of another wave of selling.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

Even though the weighted social sentiment was positive over the past few days, it was not enough to stem the bearish tide.

The MVRV ratio noted that holders were at a loss and that the token could be undervalued. Yet, that might not be enough to initiate a rally either.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.