PEPE could be on the verge of another rally, on one condition

- PEPE retested a short term ascending support after the latest pullback.

- Assessing whether demand is building up at this critical level.

Pepe [PEPE] is currently in a critical zone, which may determine its short term outlook. The memecoin’s performance in the last two weeks revealed a struggle to maintain the bullish momentum it achieved in September.

But what if the bulls could make a comeback that marks a continuation of that momentum?

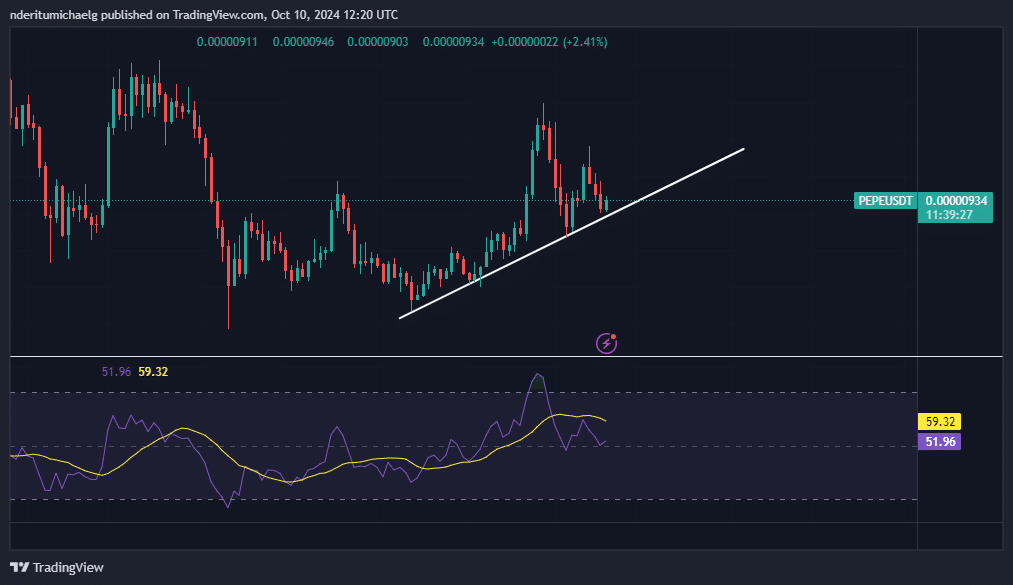

Although PEPE recently gave up its September gains, its short-term rally bullish bias may still be in play. The memecoin just retested its short-term ascending support line associated with its performance in September.

PEPE traded at $0.00000.935 at press time after a 2.63% upside in the last 24 hours. This suggested that the short term ascending trend line was still in play, hence the market’s bullish reaction to the retest.

The latest pullback pushed PEPE down to its 50% RSI level. So far, the RSI indicator has signaled a potential pivot and remained slightly above this zone.

Once again, this was confirmation that the bullish momentum was still at play.

The above observation underscores the importance of the memecoin’s current position. More upside is likely if it can sum up enough demand.

On the other hand, there was a significant probability of more price weakness if the bears launch a solid assault, coupled with low demand.

Assessing the state of PEPE’s demand

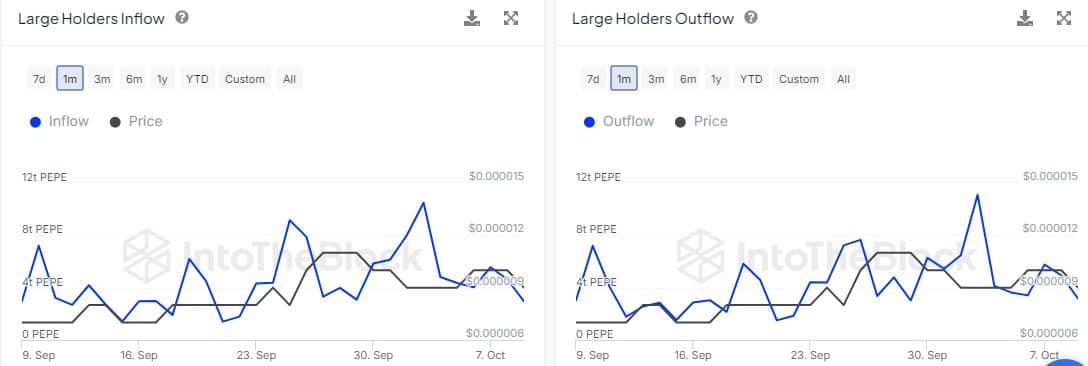

The first stop was an assessment of whale activity, since they tend to have the biggest impact on price action. Large holder flow data revealed declining whale activity since the start of October.

The latest data on the 9th of October revealed that large holder addresses received 2.96 trillion PEPE, while 3.17 trillion PEPE moved out.

The large holder flows data revealed that outflows were slightly higher. However, that may have changed in the last 24 hours, during which the price pulled off a bit of an uptick.

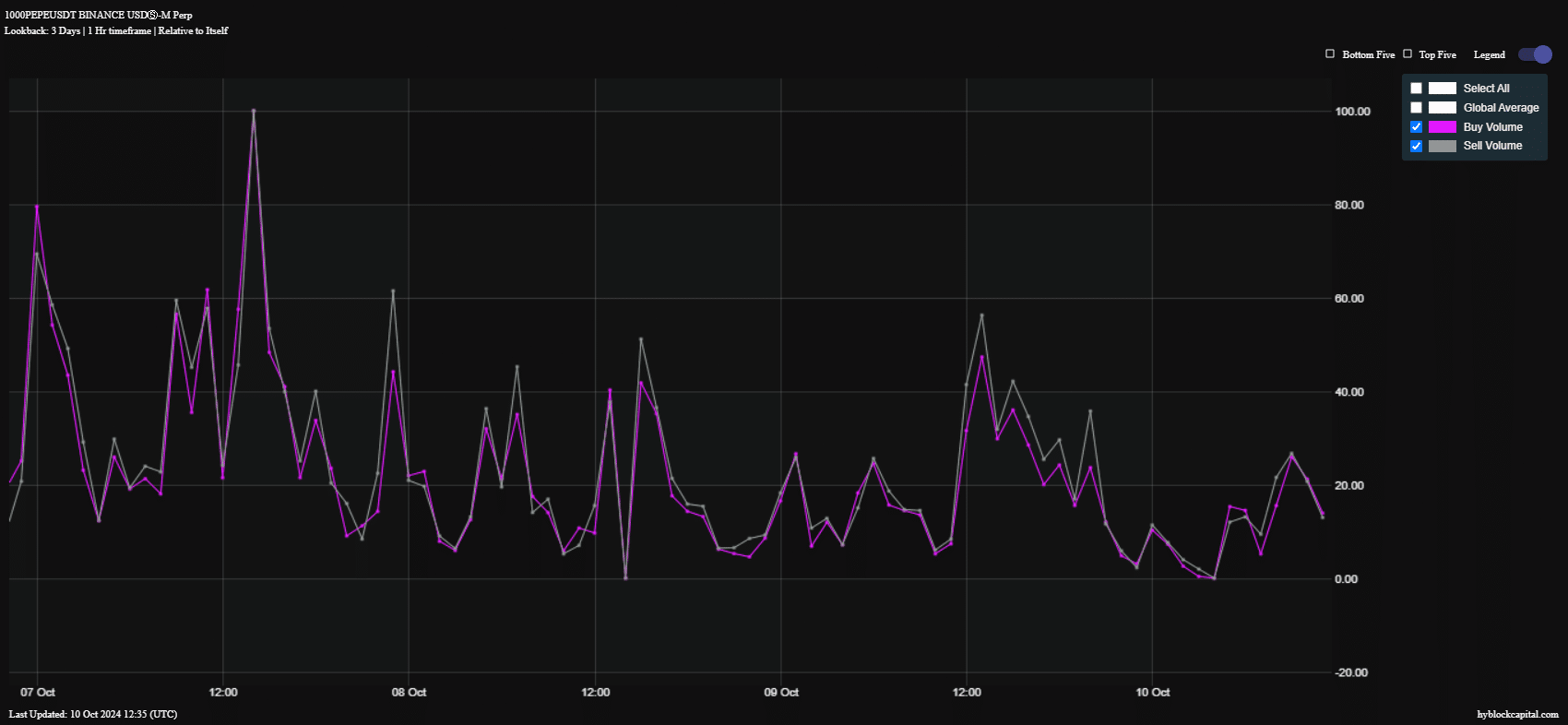

On-chain volume also demonstrated a slowdown in activity in the last three days. Sell volume was notably dominant, which was in line with the sell pressure observed during the same period.

However, the latest data revealed that PEPE buy volume was slightly higher than sell volume.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Despite the above observation, we did not observe a clear distinction to suggest which direction the price may swing.

Nevertheless, a shift in volumes, especially as the weekend approaches, may offer more directional clarity. A close eye on whale activity is thus recommended.